Your credit profile is more than a borrowing tool, it is a core risk-rating variable in property and casualty insurance. Before adjusting your homeowners or auto policy whether increasing limits, changing carriers, adding vehicles, or bundling coverage, it is strategically prudent to review your credit report. The impact can be material.

The Role of Credit in Insurance Underwriting

Most insurers use a credit-based insurance score when pricing home and auto policies. While distinct from a traditional FICO score, it is derived from similar data points contained in your credit report, payment history, outstanding balances, credit utilization, length of credit history, and types of accounts.

Insurers view credit behavior as a predictive indicator of claims frequency and severity. Statistically, lower insurance scores correlate with higher loss ratios. As a result, your credit profile can influence:

- Premium pricing

- Eligibility for preferred tiers

- Qualification for discounts

- Payment plan options

- Even carrier acceptance in certain markets

If you are preparing to modify coverage such as raising dwelling limits, adding an umbrella policy, financing a new vehicle, or switching companies your credit profile may directly affect the quoted rate.

Why Timing Matters

Policy changes often trigger underwriting review. For example:

- Switching carriers typically requires a fresh credit-based insurance score pull.

- Adding a newly financed vehicle may prompt re-rating.

- Rewriting a homeowners policy due to renovations can initiate updated underwriting.

If your credit report contains errors, late payments that were paid, accounts that are not yours, inflated balances, or identity discrepancies those inaccuracies can raise your insurance score risk tier and increase your premium unnecessarily.

Reviewing your credit report beforehand gives you an opportunity to correct discrepancies before they influence underwriting outcomes.

Common Credit Report Issues That Impact Insurance Rates

Consumers are frequently surprised at how minor inaccuracies affect pricing. Common issues include:

- Incorrect delinquency reporting

- Duplicate accounts

- High reported credit utilization due to statement timing

- Accounts that should reflect paid-in-full status

- Fraudulent activity or identity theft

Correcting these errors before making policy changes can prevent avoidable premium increases.

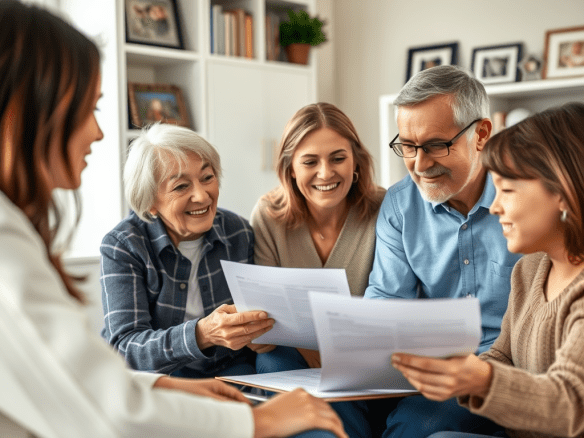

Financial Planning Perspective

Insurance adjustments are often part of broader financial decisions buying a home, refinancing, purchasing a vehicle, consolidating debt, or upgrading property. In these scenarios, credit optimization creates compounding benefits:

- Lower interest rates on loans

- More favorable insurance premiums

- Stronger negotiating leverage

- Access to top-tier carriers

From a risk management standpoint, insurance is not just about coverage it is about capital efficiency. Paying more in premium due to preventable credit issues erodes financial optimization.

Strategic Steps Before Adjusting Coverage

- Obtain a current copy of your credit report from all three major bureaus.

- Review for inaccuracies, disputes, or outdated negative information.

- Address any discrepancies prior to requesting quotes or making policy changes.

- Consult with your insurance professional to understand how credit factors into your state’s rating structure.

It is important to note that some states restrict or limit the use of credit in insurance underwriting, but in most jurisdictions it remains a key rating component.

Long and Short

Before modifying your home or auto insurance policy, conduct a financial due diligence review of your credit report. In the insurance marketplace, pricing precision is data-driven. Ensuring that your credit file accurately reflects your financial behavior can protect you from overpaying and position you for optimal underwriting classification.

Insurance is a risk transfer mechanism but your credit profile is part of the risk equation. Reviewing it is not optional diligence; it is strategic financial management.

About the Author:

David Dandaneau is a client relations analyst that covers the insurance and financial services industry. He is known for his insightful analysis and comprehensive coverage of market trends and regulatory developments.