Pfizer Inc. ($PFE), one of the world’s largest pharmaceutical companies, continues to make a strong case for long-term investors seeking both stability and income. While the stock has faced recent volatility due to a decline in COVID-19 vaccine sales, its solid fundamentals, diversified pipeline, and consistent dividend payouts remain key reasons why investors may want to hold shares for the long haul.

Pfizer currently offers an attractive dividend yield—well above the S&P 500 average—making it a compelling choice for income-focused portfolios. The company has a long track record of reliable dividend payments and has shown commitment to rewarding shareholders even during periods of industry and market uncertainty. With a payout ratio supported by its robust cash flow, Pfizer’s dividend looks sustainable in the years ahead.

Beyond dividends, Pfizer’s pipeline of treatments in oncology, immunology, and rare diseases provides investors with growth opportunities outside of its COVID-19 products. Recent strategic acquisitions, such as the purchase of Seagen to bolster its oncology portfolio, reinforce the company’s long-term vision. These moves are designed to balance near-term headwinds with future revenue expansion.

Financial Snapshot: Strengths and Weaknesses

Strengths

- Dividend Yield & Stability: Pfizer’s dividend yield is significantly higher than the S&P 500 average, appealing to income-focused investors.

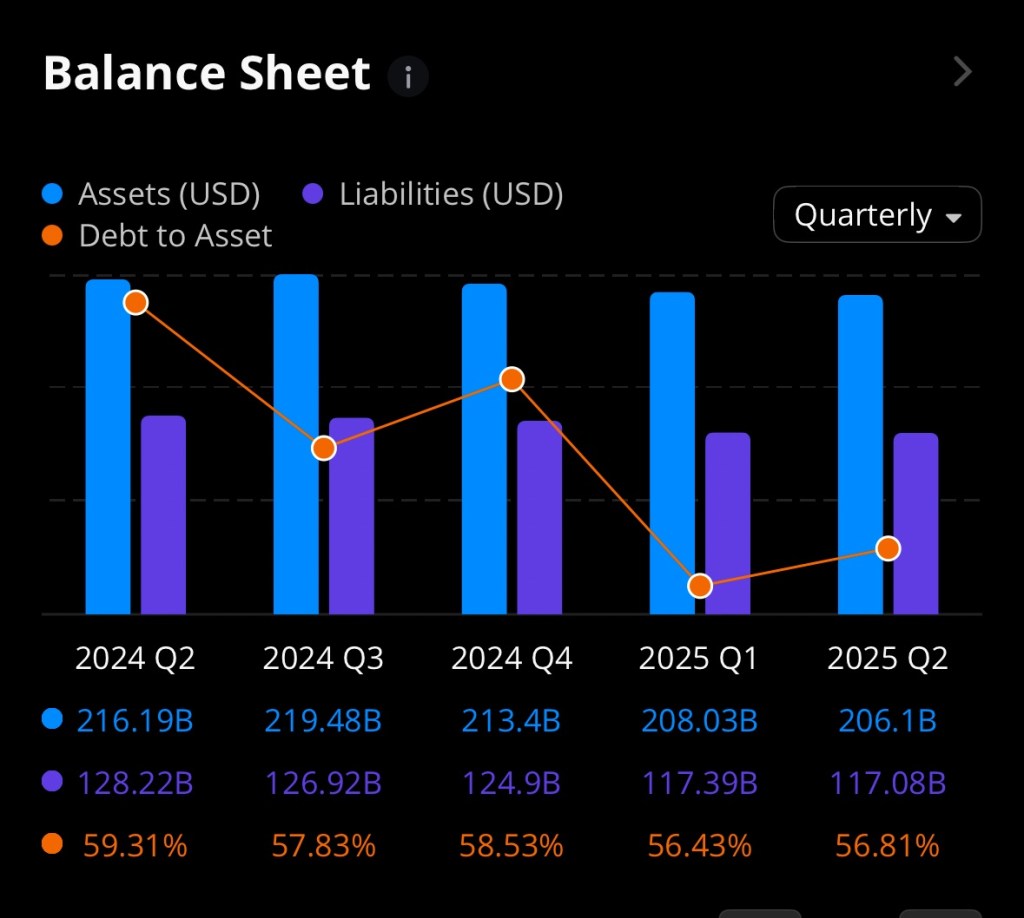

- Strong Balance Sheet: Despite recent revenue declines, Pfizer maintains healthy cash reserves and strong operating cash flow, supporting its dividend and acquisition strategy.

- Attractive Valuation: Shares are trading at a discount compared to peers in the pharmaceutical sector, offering a margin of safety for value investors.

- Diversified Revenue Base: Expansion in oncology, vaccines, and rare diseases provides multiple future growth drivers beyond COVID-19.

Weaknesses

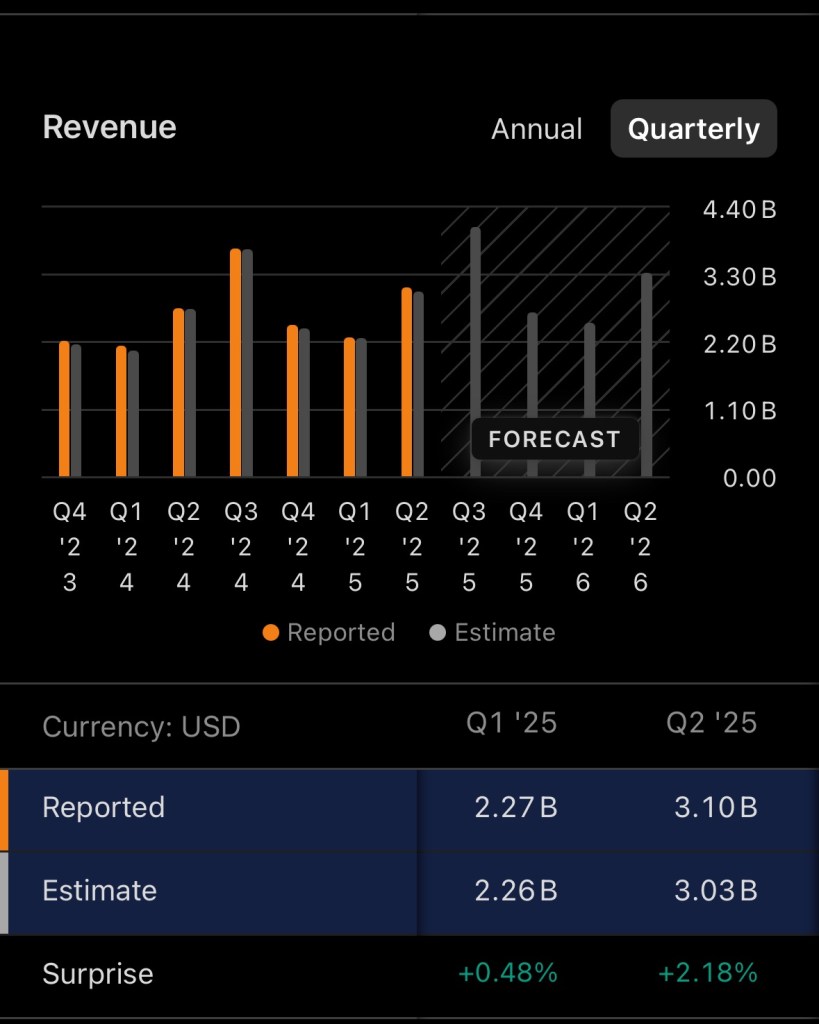

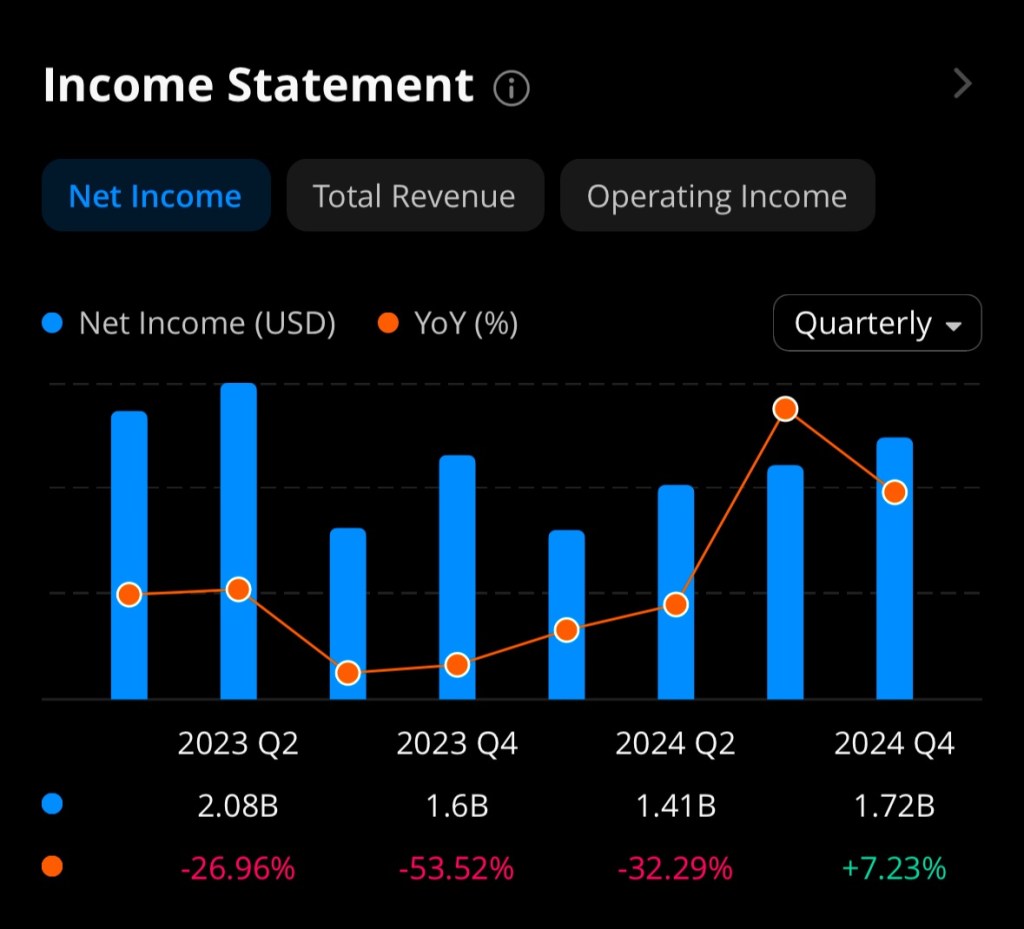

- COVID-19 Dependency Hangover: A sharp decline in vaccine and antiviral demand has pressured revenue, highlighting reliance on pandemic-era products.

- R&D Risk: Heavy investment in research and development may not always lead to successful approvals, leaving earnings vulnerable.

- Debt from Acquisitions: The Seagen deal adds to Pfizer’s debt load, which, while manageable, could strain resources if integration challenges arise.

- Patent Expirations: Like many pharmaceutical giants, Pfizer faces long-term risks from patent cliffs that could erode future revenue streams.

Stock Price Outlook: 1 to 5 Years

Pfizer’s current share price reflects market concerns over post-COVID revenue declines, but its fundamentals suggest room for recovery.

- 12-Month View (2025–2026): Analysts see potential for modest gains, with shares trading in the $32–$38 range as the market digests lower vaccine revenues but begins to price in oncology and pipeline growth. The dividend will continue to anchor returns even if share price growth is muted.

- 3-Year View (2027): As new oncology therapies, rare-disease drugs, and vaccine innovations mature, Pfizer could see revenue stabilize and return to growth. A reasonable target range could be $40–$48 per share, supported by mid-single-digit revenue growth and steady dividends.

- 5-Year View (2029–2030): If Pfizer successfully integrates Seagen, brings key drugs to market, and manages upcoming patent expirations, long-term investors could see shares trading in the $50–$60 range. Dividend reinvestment along the way would enhance total returns, making Pfizer a solid long-term hold for income plus growth.

While uncertainty remains in the short term, Pfizer’s combination of a reliable dividend, undervaluation relative to peers, and a promising pipeline suggests patient investors may be rewarded over a 5-year horizon.

Disclosure: I currently hold a position in Pifzer (NASDAQ: $PFE). This article reflects my personal opinions and analysis, and is not intended as financial advice. Please conduct your own research or consult a financial advisor before making any investment decisions.