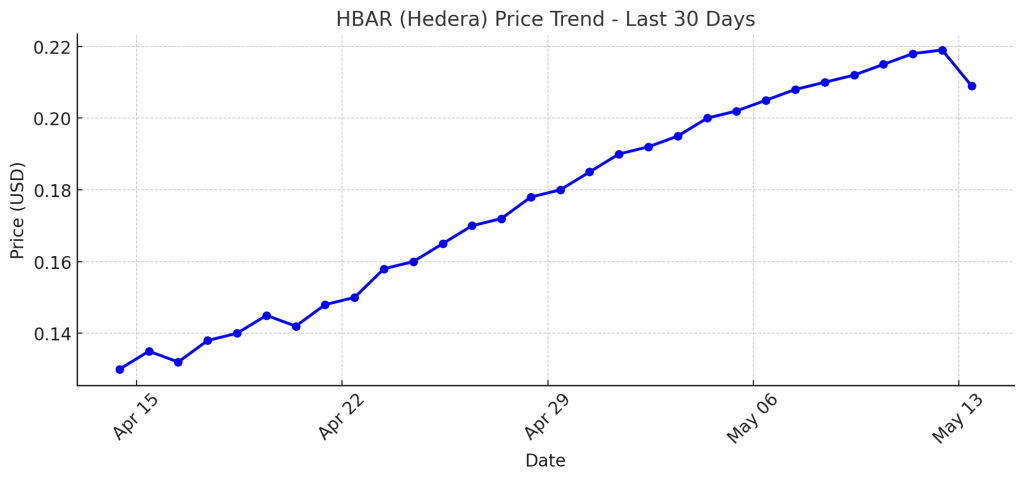

May 13, 2025 — Hedera Hashgraph ($HBAR), the native cryptocurrency of the Hedera network, is drawing renewed attention as it experiences a resurgence in price and market confidence. As of today, HBAR is trading at $0.2098, down slightly by 1.88% over the last 24 hours. This comes after a strong performance earlier in the week, where the token climbed over 24%, breaking the psychological barrier of $0.20 and signaling potential bullish momentum.

Current Market Snapshot

- Price: $0.2098

- 24H Change: -1.88%

- Day High / Low: $0.2266 / $0.2015

- Market Sentiment: Cautiously optimistic

HBAR has been trading within a broad range but recently found support near the $0.20 level, which analysts say could serve as a foundation for further gains—assuming favorable market conditions persist.

Bullish Outlook & Price Predictions

Several crypto analysts and financial platforms forecast a promising future for HBAR in the ongoing bull cycle. According to analysts at Crypto News and Bankless Times, Hedera could surge toward $1, particularly if it breaks key resistance levels near $0.30 and $0.58—the latter being its all-time high.

One analyst noted: “If the current upward momentum sustains, and with growing enterprise adoption—including partnerships with tech giants like Google and IBM—HBAR could challenge the $1 mark by late 2025.” (Crypto News, 2025)

Others remain more conservative, citing continued challenges in breaking out of the long-term descending channel as a key risk. Technical indicators such as the Relative Strength Index (RSI) and Chaikin Money Flow show strong market inflows, but overbought conditions may spark a short-term pullback.

Fundamentals Supporting Growth

Several factors bolster HBAR’s long-term appeal:

- Enterprise Integrations: Use by Fortune 500 companies.

- Sustainability: Hedera’s consensus mechanism is significantly energy-efficient compared to traditional blockchains.

- Tokenization and DeFi Growth: Hedera’s total value locked (TVL) in stablecoins has recently surged to $130 million, up from just $37 million at the start of the year (Crypto News, 2025).

Hedera’s price trajectory appears increasingly bullish, but market watchers remain wary of resistance zones and macroeconomic headwinds. Whether HBAR reaches $1 this year depends largely on continued investor sentiment, enterprise adoption, and overall crypto market dynamics.

Disclaimer: The author holds a position in HBAR Hedera Hashgraph and this article should not be considered financial advice. Always conduct your own research before making any investment decisions.

References

BeInCrypto. (2025, May 12). Hedera HBAR price secures $0.20 support as funding rate hits 5-month high. https://beincrypto.com/hedera-hbar-price-secures-support-funding-rate-rises/

Bankless Times. (2025, January 29). Top 3 reasons the Hedera HBAR price may surge to $2.50 in 2025. https://www.banklesstimes.com/articles/2025/01/29/top-3-reasons-the-hedera-hbar-price-may-surge-to-2-50-in-2025/

CCN. (2025, May). Hedera HBAR price prediction. https://www.ccn.com/analysis/crypto/hedera-hbar-price-prediction/

CoinMarketCap. (2025, May). HBAR price forecast by Cheeky Crypto. https://coinmarketcap.com/academy/article/9b874a2f-5038-49e0-aee8-a75b150d6b99

Crypto News. (2025, May). HBAR price prediction: Can Hedera hit $1 in this bull market? https://crypto.news/hbar-price-prediction-can-hedera-hit-in-this-bull-market/

Crypto News. (2025, May). HBAR stablecoin market cap surges. https://crypto.news/hbar-crypto-price-prediction-as-hedera-stablecoin-market-cap-surges/

The Crypto Basic. (2025, January 20). Hedera price prediction: Analysts forecast $5 HBAR by 2025. https://thecryptobasic.com/2025/01/20/hedera-price-prediction-analysts-forecast-5-hbar-by-2025/