|

| [Image Credit: VineTwitter Account] |

Well hello again and long time no talk fellow socialites! Needless to say, hope all is well and you are continuing to grow and prosper this New Year. As with most years that pass there are many new instruments, ideas, and strategies that are continuing to transform the way we communicate and if you have been a reader here for any amount of time you already know that! With that said, recently I decided to upgrade my old iPhone 3GS to the new iPhone 5, which to my surprise if extremely AWESOME. As with any upgrade (personal or professional), of course, my initial thinking was to get used to my new device (mentally) and discover some new apps to help make my life and business more organized, which I always love to share with all you. So far and just a couple weeks in with the new iPhone 5, I have discovered a new platform known as

Vine(perhaps you have already discovered this application) to continue growing online via social media? Regardless if you are familiar or not with this particular application you’ll want to check it out and/or revisit it after you read the next few paragraphs.

From my research

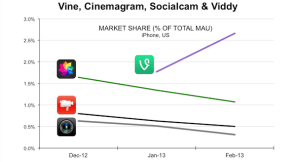

Vine for Twitter was just introduced in January of this year, which means many (perhaps you again) have discovered how valuable this new platform can be for increases in search, marketing, and sales purposes for yourself or business? Yes/No? Okay I know what you’re thinking and that’s… great now another social media site to manage? Well contrary to your thinking (open your mind already) this application is not just another app to fill up your Twitter stream but instead this app is a new way to create interesting stories using short video (i.e. 6 seconds or less) so you/your business can share your thoughts, ideas, and life changing personal or business stories. Just like many of the other social applications such as

Facebook,

YouTube,

Twitter,

LinkedIn,

FourSquare, etc. all the items (in this case videos) that you create can be publically or privately posted to your Vine followers and/or shared among your existing networks via

Facebook or

Twitter by recording a video with the push of a button on your iPhone, iPod, iPad or other device that may run this type of mobile application. Okay, so what does this all mean to me? Even though I am also still new to this app, here are three easy steps to take in order to find the who, what, when, and how to simply use this application to benefit you or company while staying ahead of the social media madness we often refer to in our postings.

1) Showcase what you have to offer

Have you or your company created a unique way to showcase your competences or unique qualifications yet? If not, use

Vine to create a small one or multiple set of online videos (again 6 seconds or less) for others to see what EXACTLY you have to offer. This is especially important if you have decided to look for that new job (creating an online resume) or looking to bring a new product or service to market (give everyone a sneak peek into your old or new offering(s).

2) Take other people behind the curtain of your life or business

What if you don’t have anything to showcase? Well that’s okay because behind everyone showcase is a story of how you or your business was born, started, or operates right? Use

Vine to create a picture of what everyday life is like for yourself or business by showing off your daily routines, friends, office, or other interesting things others in your life or place of work do on daily, weekly, or monthly basis. Give your audience a firsthand encounter of events that will get you found and/or noticed in the social cloud, or in other words, pull back the curtain on your life or business!

3) Let others help you succeed

If you are familiar with networking or use other social media sites, which have you already engaged with many of your followers, friends, and acquaintances let them know about your new personal or business plans with

Vine. Once others become familiar with this new application ask them to help you achieve what it is you are looking to achieve. In fact, if you use other platforms such as

Twitter or

Instagram get a little more creative and create a NEW hashtag dedicated to your cause and ask other people in your network to share or use this hashtag to create additional push or buzz about yourself, company, and/or brand. The old help others and they will help you back approach to Marketing.

|

|

|

Obviously, these three things are not the only things you can use

Vinefor but they are a good way to start or retool your account if you have already started down this road. Regardless of how you use this platform, I sure would like to hear from others (if you have already set up an account) about your successes or other techniques that you are considering if you haven’t already started. As always thanks for stopping by and don’t forget to wear that smile like you mean it today ((>>:-))

David Dandaneau is a Consultant at [SevenTimesSeven] and a Contractor at [FedEx]. He specializes in helping business owners “manage their business and not their processes!” For more connect with him via his About.Me Page or any of his other social platforms.

way everyone communicates, then I ask you to think about all the people you and/or your company reach daily, weekly, or yearly to create awareness, while maintaining one-on-one contact. Do you see how or perhaps create some of the most important relationships that you or your company has/can develop online? Have you or your company closed any accounts or sales online without actually even talking to another person? If you are like most others the answer to this question should be YES (even in the lowest form you surely have purchased from EBay or Amazon)and if not then you really need to get or build your online presence immediately. If you are in sales and also answered NO to this question, you also need to start building your own online presence as well as your companies since you cannot or will not be able to rely on in person or personality only to seal more deals moving into the future.

way everyone communicates, then I ask you to think about all the people you and/or your company reach daily, weekly, or yearly to create awareness, while maintaining one-on-one contact. Do you see how or perhaps create some of the most important relationships that you or your company has/can develop online? Have you or your company closed any accounts or sales online without actually even talking to another person? If you are like most others the answer to this question should be YES (even in the lowest form you surely have purchased from EBay or Amazon)and if not then you really need to get or build your online presence immediately. If you are in sales and also answered NO to this question, you also need to start building your own online presence as well as your companies since you cannot or will not be able to rely on in person or personality only to seal more deals moving into the future.