As Americans continue to grapple with economic uncertainty, rising living costs, and increasing life expectancy, the importance of retirement planning has never been more pressing. One of the biggest debates among financial experts and everyday workers alike is this: Is it better to start saving early, or can a late start still lead to a secure retirement?

The Power of Starting Early

Financial advisors almost universally agree—when it comes to retirement, time is your greatest asset. Starting in your 20s or early 30s allows compound interest to work its magic.

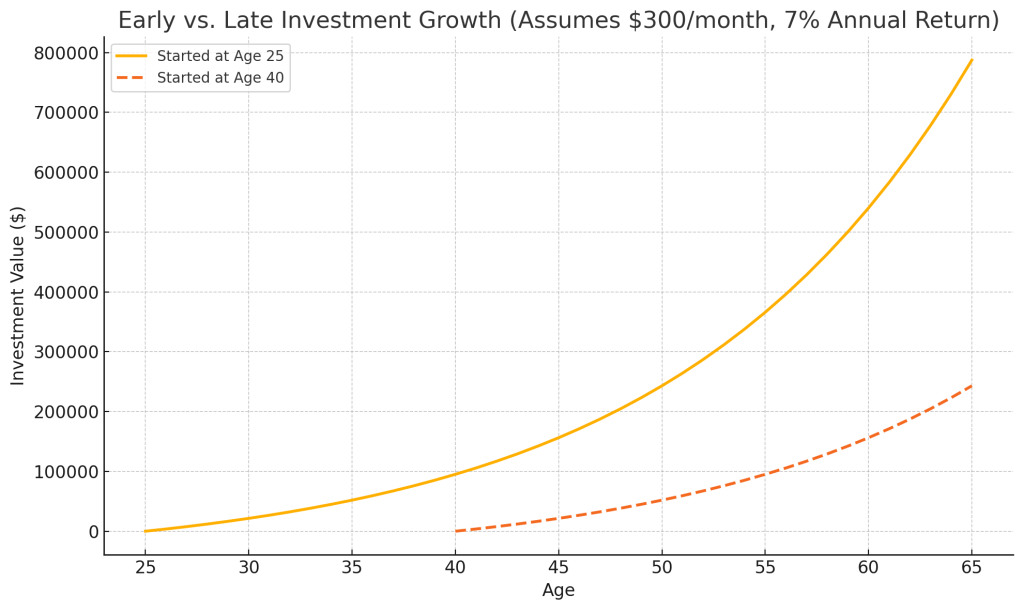

Take, for example, a 25-year-old who invests $300 a month in a retirement account with an average annual return of 7%. By the time they turn 65, they could accumulate nearly $725,000. On the other hand, someone who begins investing the same amount at age 40 would end up with just over $225,000 at retirement.

“Starting early doesn’t just mean you’ll have more saved—it also means you can afford to take less risk, contribute less monthly, and still enjoy financial freedom later,” says Michelle Harris, a certified financial planner in Chicago.

Early starters also have the advantage of weathering market volatility. They have decades to recover from downturns, allowing for a more aggressive, growth-oriented investment approach early on.

The Challenges—and Hope—of Starting Late

Still, not everyone has the means or knowledge to begin saving in their 20s. Life events such as student debt, low-paying jobs, or unexpected medical expenses can push retirement planning to the back burner.

“If you’re starting in your 40s or even 50s, the hill is steeper, but it’s not insurmountable,” says Tony Kim, a retirement strategist based in San Diego. “The key is discipline, increased contributions, and possibly working a bit longer.”

Late starters are often advised to max out retirement accounts like 401(k)s and IRAs, take advantage of catch-up contributions (available to those 50 and older), and consider delaying Social Security benefits to increase monthly payouts.

Financial experts also emphasize the importance of budgeting, eliminating debt, and making intentional lifestyle choices to accelerate savings.

A Matter of Mindset

Whether you start at 25 or 55, the most important step is simply to start. Procrastination is often the biggest enemy of retirement planning.

“Too many people think they have time or that it’s too late,” says Harris. “Both beliefs are harmful. The sooner you face your financial future, the better your options will be.”

Retirement planning is not a one-size-fits-all journey. Starting early gives investors more flexibility and freedom, but starting late doesn’t mean the game is over. With the right strategy, discipline, and mindset, it’s possible to secure a comfortable retirement at any age.

About the Author:

David Dandaneau is a insurance agent that covers the insurance and financial services industry. He is known for his insightful analysis and comprehensive coverage of market trends and regulatory developments.