After years of discussing auto insurance with customers, I’ve learned that one of the most common points of confusion is what actually counts as a “property claim” after a car accident. Many people assume that if property is damaged in an accident, it automatically falls under the property portion of their policy. In reality, auto insurance breaks these situations into different categories.

Understanding the difference can help drivers avoid surprises when they file a claim.

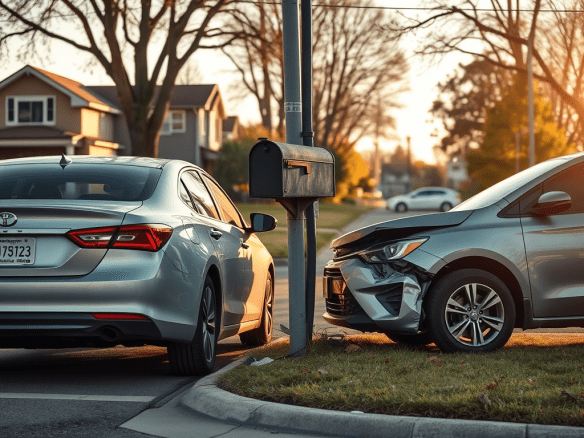

The Scenario: A Simple Car Accident

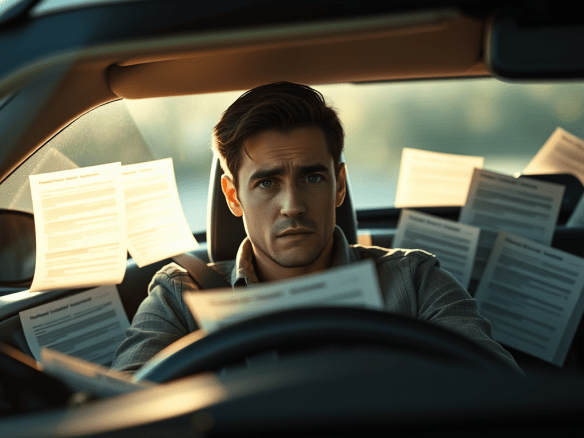

Imagine this situation.

You’re driving through your neighborhood on a Saturday afternoon. As you approach a stop sign, you look down for a moment to adjust the radio. When you look back up, it’s too late you roll into the intersection and collide with another vehicle. The impact pushes the other car into a nearby mailbox and damages both vehicles.

Now there are three different types of damage involved:

- Damage to the other driver’s car

- Damage to the mailbox

- Damage to your own car

At this point, many people ask the same question:

“Is this a property claim?”

The answer is yes and no, depending on which property was damaged.

Property Damage Liability: Damage to Other People’s Property

In the scenario above, your Property Damage Liability coverage would apply to the damage you caused to someone else’s property.

This includes:

- The other driver’s vehicle

- The mailbox you knocked over

Property Damage Liability is designed to pay for repairs or replacement of property that you damage in an accident when you are at fault.

In other words, it protects other people’s property… not your own.

Collision Coverage: Damage to Your Own Car

Your vehicle, however, is handled differently.

Damage to your car would typically fall under Collision Coverage, which helps pay to repair or replace your vehicle after an accident, regardless of who caused it.

If you don’t carry collision coverage, you may have to pay out of pocket for repairs to your own vehicle.

Why This Confuses Drivers

The confusion comes from the wording.

Many drivers hear the term “property damage” and assume it refers to any property involved in an accident, including their own car.

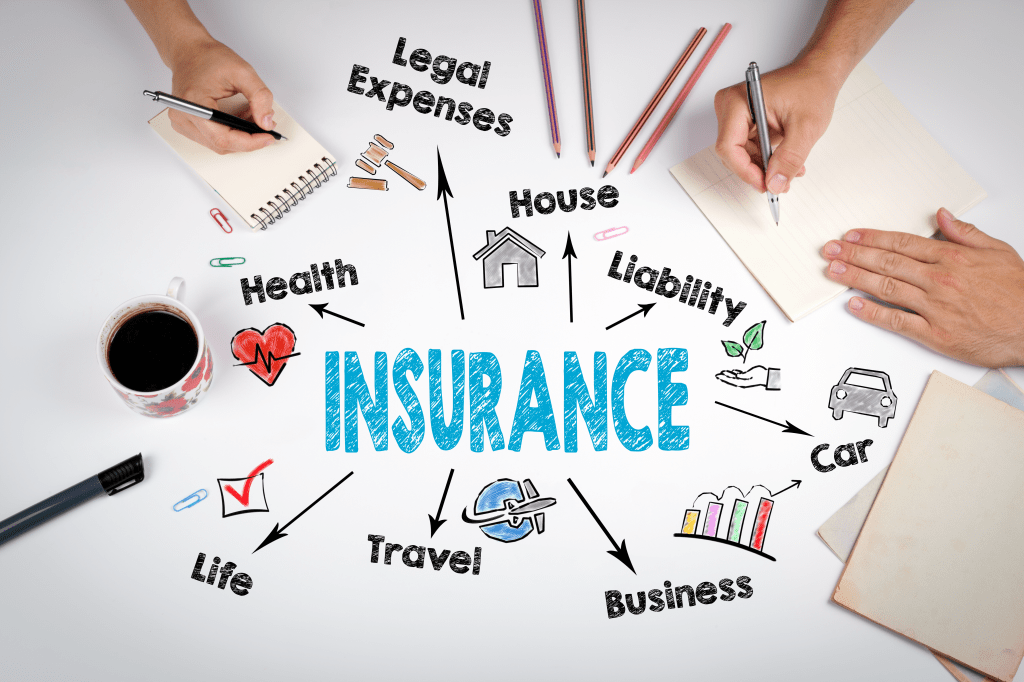

But in auto insurance terminology:

- Property Damage Liability = damage you cause to someone else’s property

- Collision Coverage = damage to your own vehicle

Understanding that distinction can make the claims process much clearer.

Why It Matters

Knowing how your policy works before an accident occurs can save both time and stress.

Drivers who understand their coverage are better prepared to answer questions like:

- Who pays for the other car?

- Who pays for my car?

- What happens if property like a fence, building, or mailbox is damaged?

Insurance is ultimately about managing risk and protecting both your finances and the property around you.

And sometimes, the most important protection comes from simply understanding what your policy actually covers.

About the Author:

David Dandaneau is a client relations analyst that covers the insurance and financial services industry. He is known for his insightful analysis and comprehensive coverage of market trends and regulatory developments.