Conduent Incorporated, the business-process-services company spun out from Xerox, reported mixed results through early 2025 as it works to convert cost cuts and restructuring into sustainable profit. The shares trade at a low single-digit price level, making the company a high-beta, speculative play for investors who believe management can consistently deliver margin improvement and free cash flow growth. (Conduent Investor)

Key headlines (what just happened)

- Conduent reported second-quarter 2025 results in early August with revenue of roughly $754 million and GAAP net loss on a standalone basis (but continued improvements in adjusted metrics were highlighted by management). (Conduent Investor)

- The company’s market capitalization sits in the hundreds of millions (Yahoo Finance shows market cap in the ~$440–460M range around current quotes), while enterprise value is notably higher because of net debt on the balance sheet. The stock price is trading near $2.80–$3.00 per share as of this writing. (Yahoo Finance)

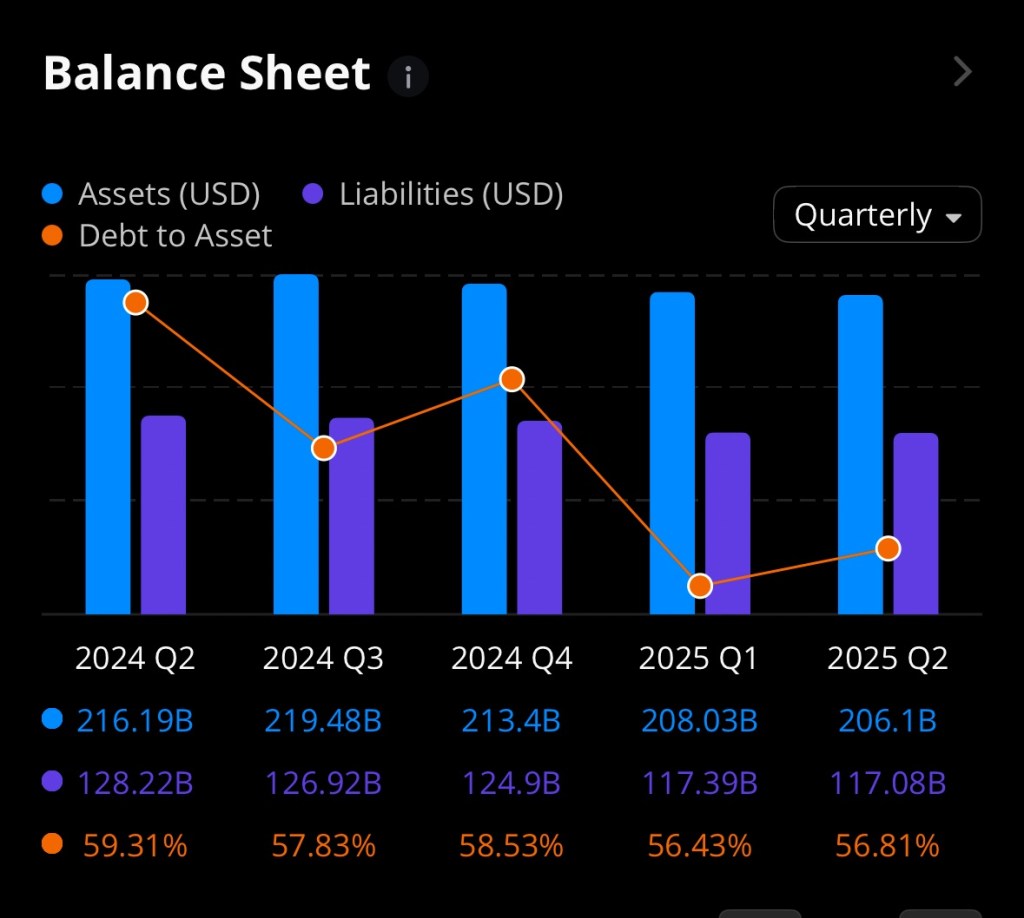

Balance-sheet and financial-position analysis

Using the company filings and aggregated financial data, the balance-sheet picture for Conduent in the most recent filings shows several important characteristics:

- Total assets / liabilities: Conduent’s total assets in recent annual/quarterly filings have been in the low-to-mid billions (annual totals around $2.6B–$3.2B), with total liabilities making up a substantial portion of that base. That translates to relatively thin shareholder equity compared with larger peers. (Yahoo Finance+1)

- Leverage / net debt: Total long-term debt has historically been material — recent snapshots put total debt roughly in the high hundreds of millions to over $1B (enterprise value and total debt differ by source and date) — and net cash/(debt) has been negative (i.e., net debt). StockAnalysis and other aggregators show net debt in the several-hundred-million range. That means Conduent’s EV is meaningfully larger than its market cap. (StockAnalysis+1)

- Liquidity: Management has emphasized cash on hand and the revolving credit facility as sources of near-term liquidity in SEC filings and the latest 10-Q/earnings commentary; operating cash flow is a key metric to watch as the company seeks to deleverage. The company stated it believes its cash, projected operating cash flow and its revolving credit line support near-term needs. (Conduent Investor+1)

Interpretation: Conduent is a balance-sheet–constrained turnaround: not insolvent, but carrying leverage that raises the bar for operational execution. If revenue growth stalls or free cash flow fails to materialize, debt servicing and refinancing risk become real constraints.

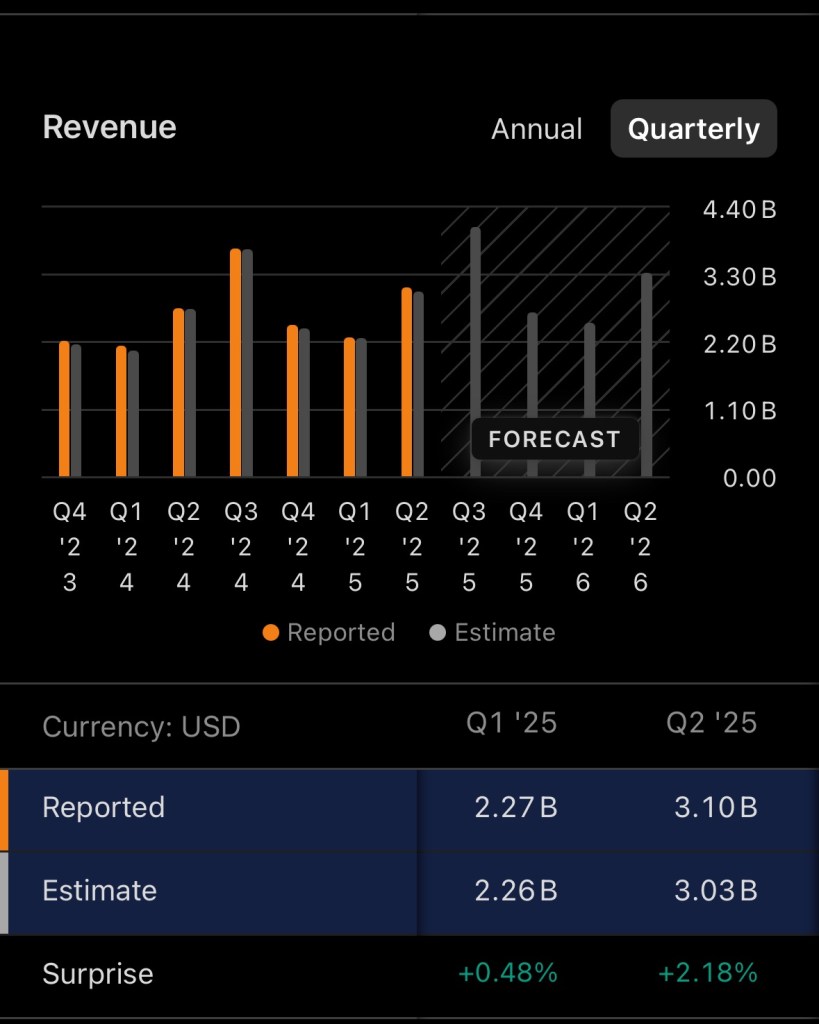

Income-statement & cash-flow highlights

- Revenue trend: Revenues have been in the ~$3.3B range on an annual basis (2023–2024 levels per public filings and financial aggregators), with sequential quarter fluctuations due to contract timing and divestitures. Recent quarters in 2025 showed revenue in the mid-$700M range per quarter. (Yahoo Finance+1)

- Profitability: GAAP results have cycled between losses and small profits in recent years; management prefers adjusted EBITDA/adjusted metrics that show margin improvement after restructuring. For investors, the question is whether adjusted profit improvement converts to consistent GAAP profitability and positive operating cash flow. (Conduent Investor+1)

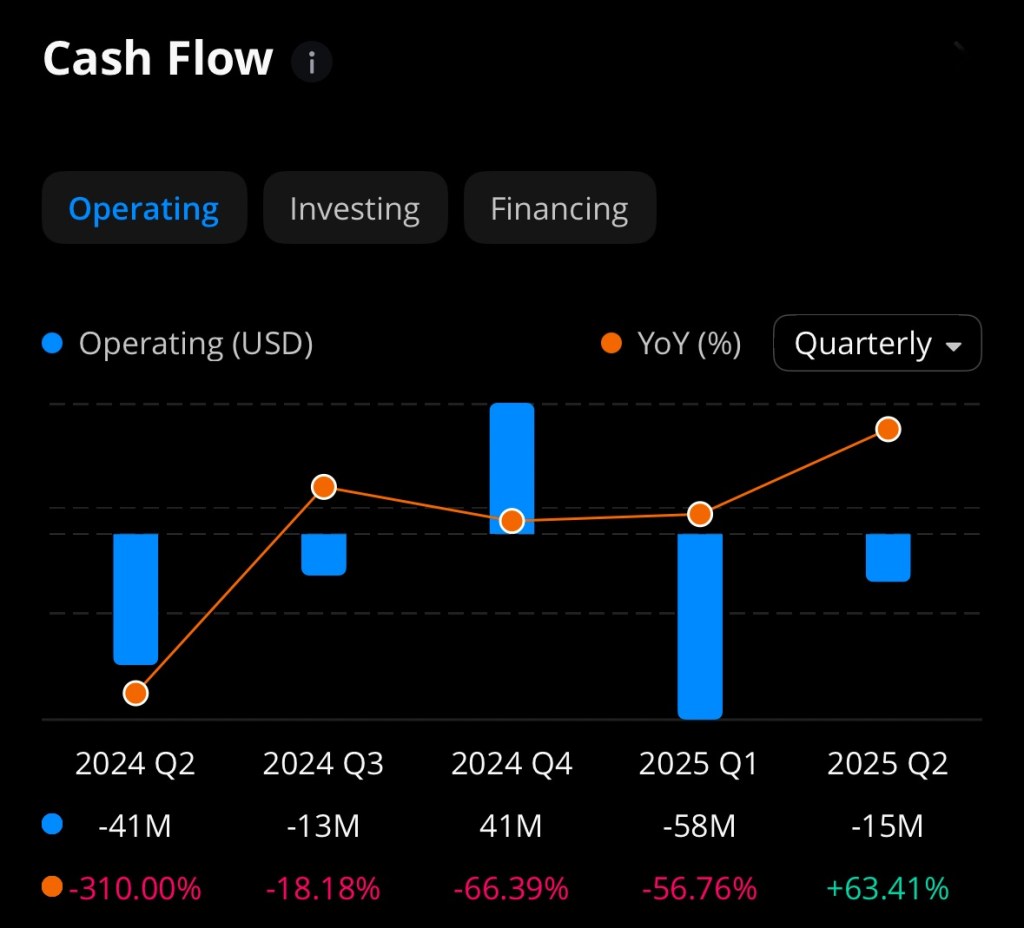

- Cash flow: Free-cash-flow generation has been variable. The company highlights projected cash flow from operations as a pillar of its liquidity, but historical net debt and working-capital swings mean investors should track quarterly cash-flow statements, not just headline operating results. (Conduent Investor+1)

Valuation and risks

- Valuation: On a trailing basis Conduent’s P/E (when positive) and EV multiples are compressed versus stable peers because of the elevated leverage and inconsistent earnings. Market cap (sub-$500M range) compared with enterprise value near ~$1B indicates investors price in significant debt and execution risk. (Yahoo Finance+1)

- Catalysts for upside: sustained adjusted-EBITDA growth, consistent GAAP profitability, meaningful free cash flow, and visible debt reduction would be strong upside catalysts. Contract wins or higher-margin mix (e.g., digital-services expansion) could improve investor sentiment. (Conduent Investor)

- Downside risks: failure to convert adjusted metrics to real cash, large contract losses, macro pressure on customers (public-sector budgets, transportation spending shifts), or refinancing stress on debt.

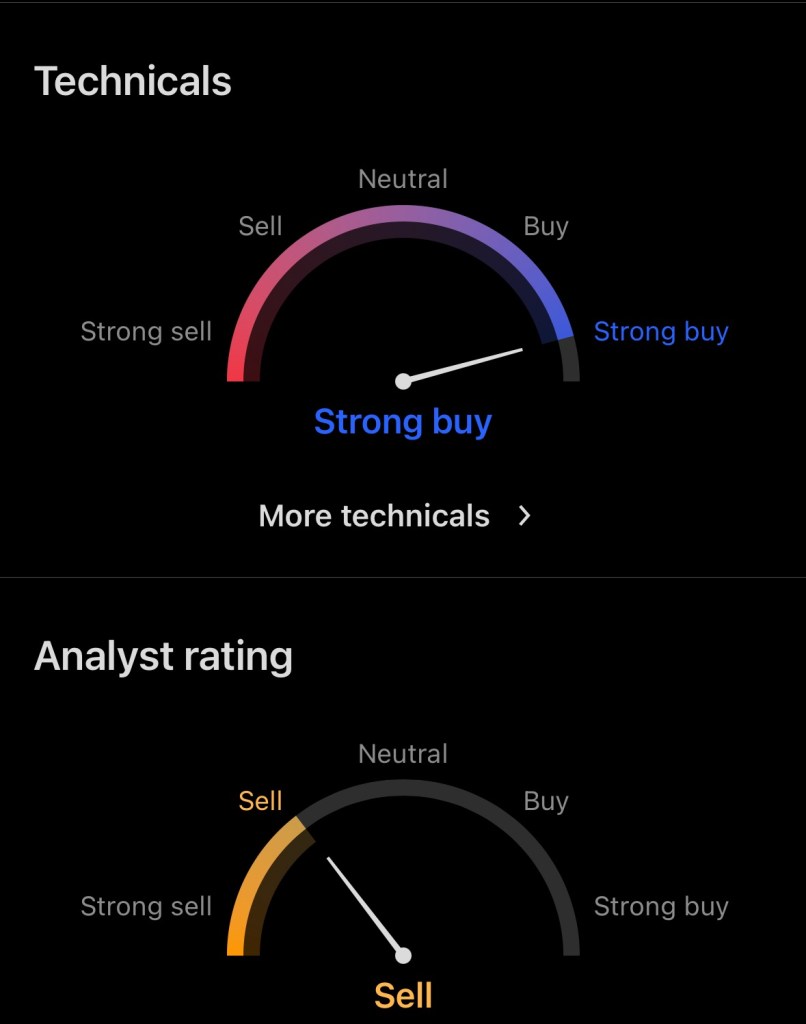

Recommendation (straight answer)

- For conservative investors: Conduent is not suitable. The balance sheet shows leverage and earnings volatility; until management demonstrably converts adjusted profits into recurring GAAP profits and consistent positive free cash flow, the stock is a speculative holding at best. (StockAnalysis+1)

- For risk-tolerant investors / traders seeking gains: Conduent’s low absolute market cap and depressed share price create asymmetric upside if execution improves. That makes it a potential high-risk, event-driven trade — buy only a small allocation, be prepared for high volatility, and plan an exit strategy tied to specific milestones (e.g., two to three consecutive quarters of positive operating cash flow or a material debt-reduction announcement). Use strict position sizing and stop rules. (Conduent Investor)

What to watch next (actionable checklist)

- Quarterly cash-flow from operations (is it consistently positive?). (Conduent Investor)

- Net debt trend — any sustained debt paydown or refinancing on better terms. (StockAnalysis)

- Revenue mix — growth in higher-margin digital services vs. legacy BPO work. (Conduent Investor)

- Management commentary & guidance (next earnings call / 10-Q updates). (Conduent Investor+1)

Sources and Transparency

This article relied on Conduent’s investor relations releases and SEC filings, plus market data aggregators (Yahoo Finance, StockAnalysis, Macrotrends, Nasdaq) for pricing, market cap and historical financial statements. Key sources: Conduent investor releases and 10-Q/10-K filings, Yahoo Finance price & key statistics, and StockAnalysis balance-sheet pages. (StockAnalysis+3Conduent Investor+3Conduent Investor+3)

Bottom line: Conduent is a turnaround story with a leveraged balance sheet. If you believe management will convert improved adjusted margins into recurring cash and pay down debt, the stock offers speculative upside from a depressed base. If you require capital preservation and predictable returns, this is better left alone. Keep position sizing small, watch cash flow and net-debt trends, and tie any buy decision to concrete operational milestones. (Conduent Investor+1)

References

Conduent Incorporated. (2025, August 6). Conduent reports second quarter 2025 results [Press release]. Conduent Investor Relations. https://investor.conduent.com

Conduent Incorporated. (2025). Form 10-Q for the quarterly period ended June 30, 2025. U.S. Securities and Exchange Commission. https://www.sec.gov

Macrotrends LLC. (2025). Conduent balance sheet 2016–2025 (CNDT). Macrotrends. https://www.macrotrends.net

Nasdaq, Inc. (2025). Conduent Incorporated (CNDT) income statement. Nasdaq. https://www.nasdaq.com

StockAnalysis. (2025). Conduent (CNDT) financials, balance sheet & ratios. StockAnalysis. https://stockanalysis.com

Yahoo Finance. (2025). Conduent Incorporated (CNDT) stock price, quote, and news. Yahoo! Finance. https://finance.yahoo.com