Despite recent volatility and short-term investor hesitation, NVIDIA (NASDAQ: NVDA) remains one of the strongest long-term investment opportunities in the global equity market. While the stock has experienced periods of consolidation and suppressed price action relative to its explosive growth, its financial performance, industry dominance, and forward cash flow trajectory suggest that current levels could represent a compelling entry point for long-term investors.

NVIDIA’s Financial Strength Remains Unmatched

NVIDIA’s growth over the past two years has been historic. The company reported $130.5 billion in fiscal 2025 revenue, up 114% year-over-year, along with net income of $72.9 billion, demonstrating extraordinary profitability.

This growth has accelerated further into fiscal 2026:

- Q3 FY2026 revenue reached $57.0 billion, up 62% year-over-year.

- Quarterly net income surged to $31.9 billion, representing exceptional margin strength.

- NVIDIA expects continued momentum, projecting approximately $54 billion in quarterly revenue, indicating sustained demand.

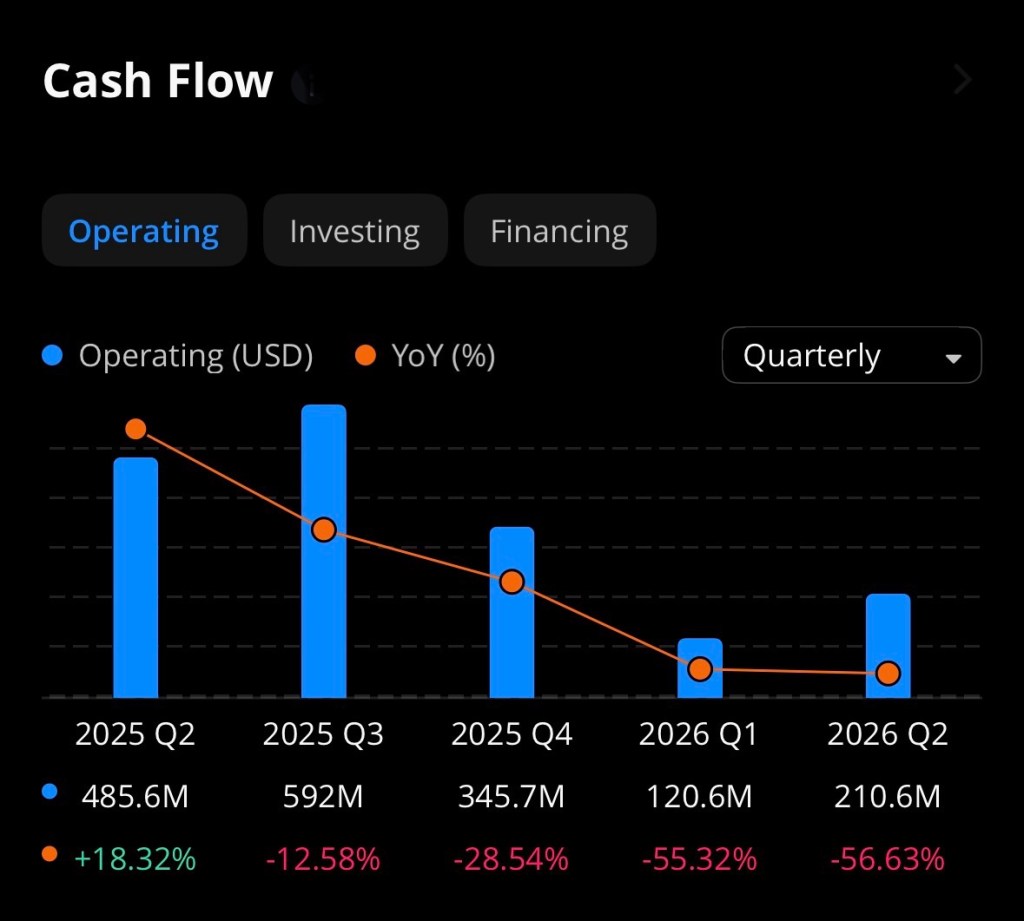

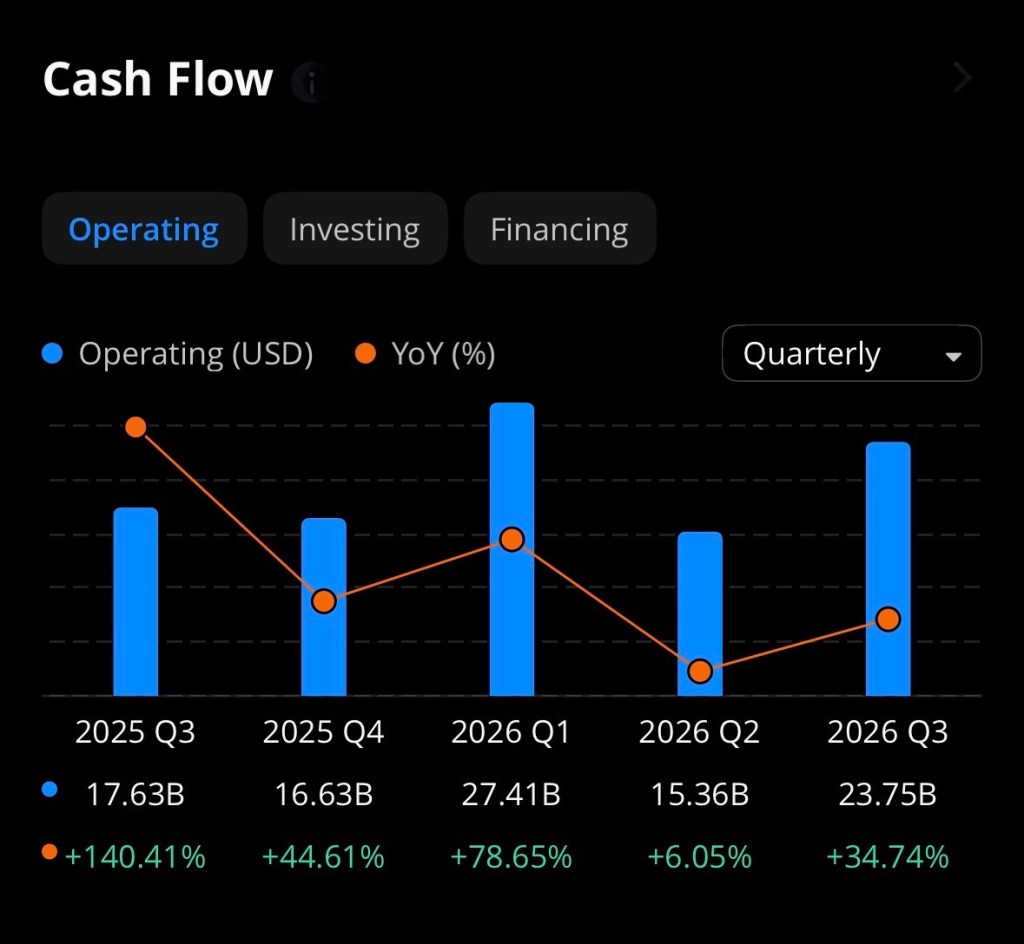

This performance translates directly into massive operating cash flow potential. With operating margins above 60% in recent quarters and explosive AI-related demand, NVIDIA is converting an unusually high percentage of revenue into free cash flow.

AI Demand Is Still in Its Early Stages

The most critical investment thesis for NVIDIA is its central role in powering artificial intelligence infrastructure globally.

Major technology companies are expected to spend over $650 billion on AI infrastructure in 2026, benefiting NVIDIA directly as the primary supplier of advanced GPUs.

Additionally:

- NVIDIA’s data center segment generated over $51 billion in quarterly revenue, driven primarily by AI demand.

- Analysts project NVIDIA’s data center revenue alone could reach $300 billion annually by fiscal 2027, reflecting extraordinary long-term growth potential.

This positions NVIDIA not simply as a semiconductor company, but as the foundational infrastructure provider for the global AI economy.

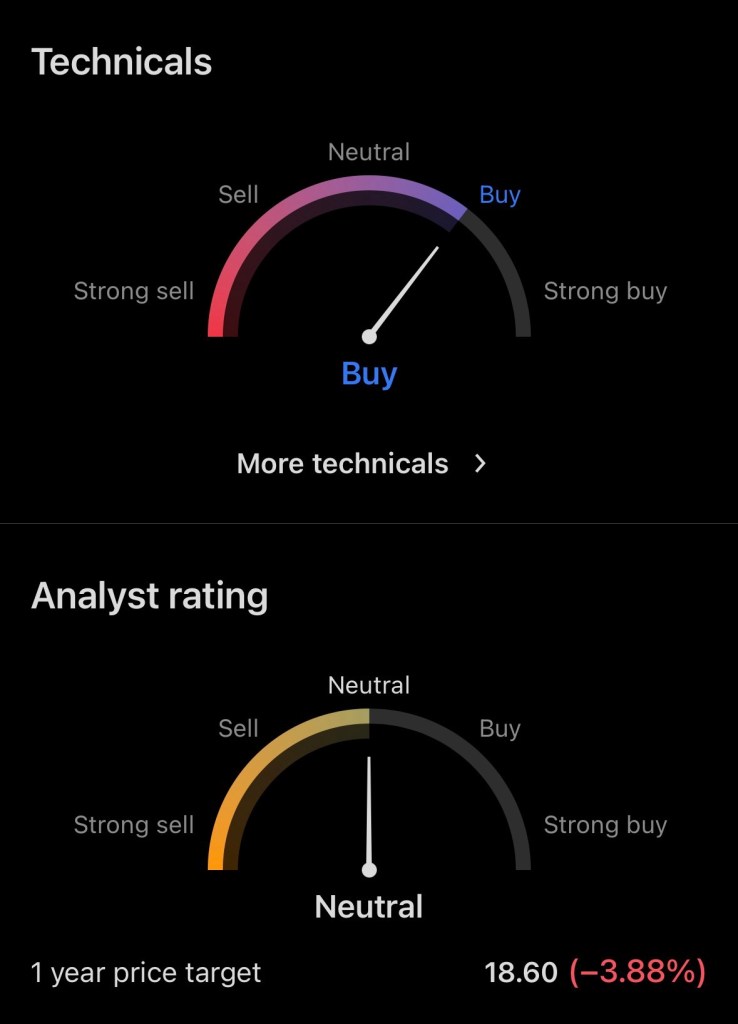

Why the Stock Appears “Suppressed” Despite Strong Fundamentals

NVIDIA’s stock consolidation is primarily driven by macro and investor psychology not deteriorating fundamentals.

Key factors include:

1. Massive Prior Gains Created Consolidation Period

After rising over 1,000% in recent years, periods of sideways movement are normal as valuation multiples normalize.

2. Investor Concerns About AI Spending Sustainability

Some investors worry large capital expenditures from tech giants could reduce near-term cash flow.

However, these investments are directly fueling NVIDIA’s revenue growth.

3. Emerging Competition

Companies like AMD, Broadcom, and custom chips from hyperscalers are increasing competition, but NVIDIA maintains a dominant performance and software ecosystem advantage.

Estimated Cash Flow Comparison: NVIDIA vs Competitors (2026 Projection)

Based on revenue guidance, historical free cash flow margins, and analyst projections, NVIDIA is expected to dramatically outperform competitors in absolute cash flow generation.

| Company | Estimated 2026 Revenue | Estimated FCF Margin | Estimated 2026 Free Cash Flow | AI Market Position |

|---|---|---|---|---|

| NVIDIA | $240B–$280B | 45%–55% | $110B–$150B | Dominant leader |

| AMD | $45B–$60B | 20%–25% | $9B–$15B | Strong competitor |

| Broadcom | $65B–$75B | 35%–40% | $23B–$30B | Growing AI custom chips |

| Intel | $55B–$65B | 10%–20% | $6B–$12B | Recovery phase |

| Qualcomm | $42B–$48B | 25%–30% | $11B–$14B | Mobile AI niche |

Methodology:

Estimates derived from:

- Company financial statements

- Forward guidance

- Historical free cash flow conversion ratios

- AI growth projections

Competitive Advantage: NVIDIA’s True Moat Is Software, Not Just Chips

NVIDIA’s competitive edge extends beyond hardware into software ecosystems such as CUDA, which creates lock-in effects across millions of developers.

Additionally:

- NVIDIA’s GPUs remain superior for training large AI models.

- The company continues rapid innovation with new Blackwell and next-generation AI architectures.

This creates extremely high switching costs for customers.

Valuation Opportunity: Cash Flow Suggests Undervaluation

If NVIDIA generates $130 billion in annual free cash flow within the next 2–3 years, even a conservative valuation multiple of 30x FCF would imply:

Potential future valuation:

$130B × 30 = $3.9 trillion market cap

Compared to today’s lower valuation levels, this represents substantial upside potential.

Long-Term Investment Thesis: Why NVIDIA Remains a Buy

Key bullish factors:

1. AI Demand Is Still in Early Stages

Global AI adoption is accelerating, not slowing.

2. Massive Free Cash Flow Generation

Few companies in history have generated cash flow at NVIDIA’s scale.

3. Dominant Market Position

NVIDIA remains the undisputed leader in AI computing infrastructure.

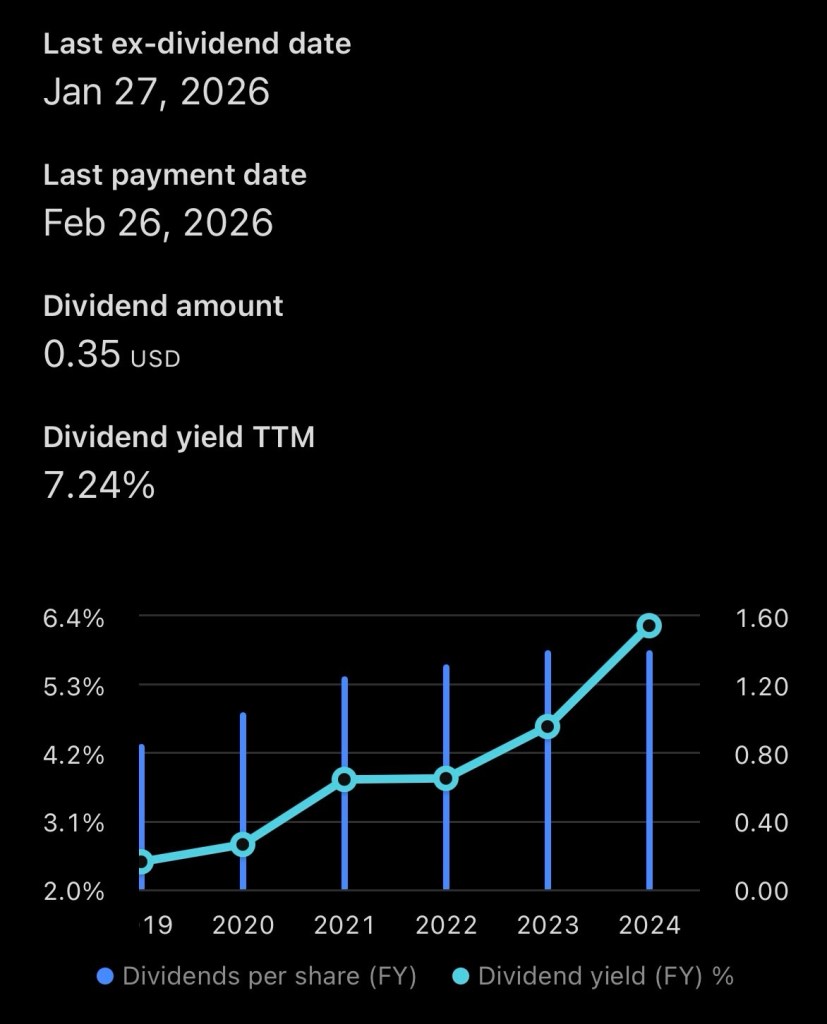

4. Strong Shareholder Returns

The company has already returned $37 billion to shareholders through buybacks and dividends in FY2026 alone.

5. Long-Term Secular Tailwind

AI is expected to reshape every industry over the next decade.

Risks Investors Should Monitor

No investment is risk-free. Key risks include:

- Increased competition from AMD, Broadcom, and hyperscalers

- Government export restrictions

- Potential slowdown in hyperscaler spending

- Valuation volatility due to macroeconomic conditions

However, none of these risks currently undermine NVIDIA’s dominant position.

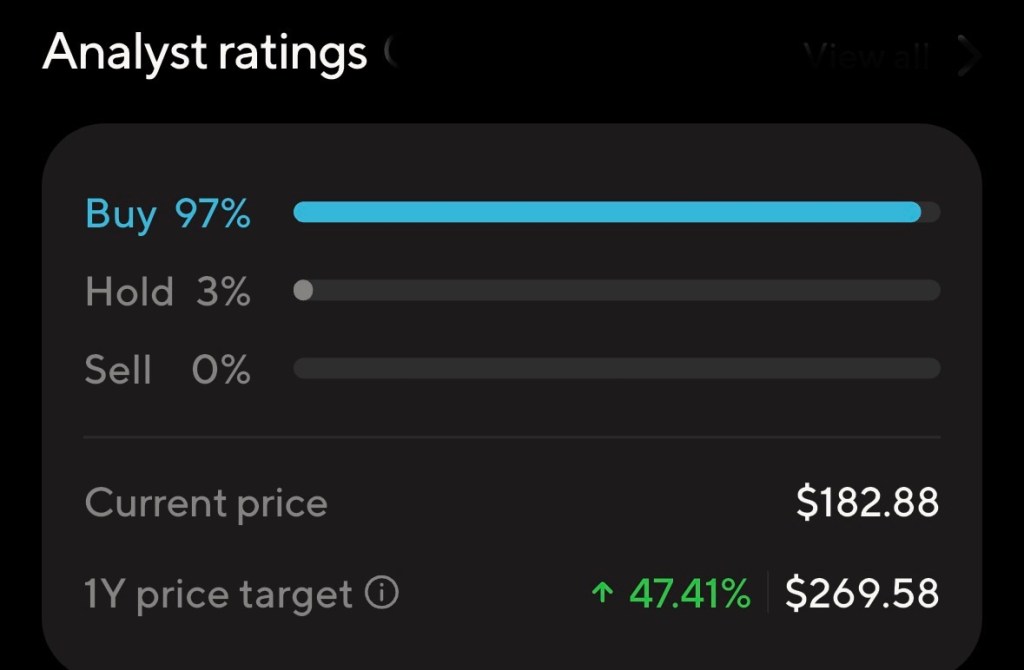

Conclusion: Suppressed Prices May Represent a Rare Opportunity

NVIDIA remains one of the most financially powerful and strategically positioned companies in the world. Despite short-term stock volatility, its explosive revenue growth, dominant AI position, and unprecedented free cash flow generation suggest that current price consolidation may represent one of the most attractive long-term entry opportunities available.

For investors with a multi-year horizon, NVIDIA remains a cornerstone asset in the AI-driven future economy.

Disclosure:

The author does not currently own, directly or indirectly, any shares, options, or other financial interests in NVIDIA Corporation (NASDAQ: NVDA) at the time of publication. This article is provided for informational and educational purposes only and does not constitute financial, investment, or trading advice. Investors should conduct their own research and consult with a licensed financial professional before making any investment decisions.

References

Barron’s. (2026, February). Nvidia stock rises. Broadcom is closing the AI chips gap. Retrieved from https://www.barrons.com

Barron’s. (2026, February). Nvidia stock pops. It should benefit from OpenAI spending. Retrieved from https://www.barrons.com

MarketWatch. (2026, February). Microsoft’s stock is cheaper than IBM’s for the first time in a decade. Retrieved from https://www.marketwatch.com

NVIDIA Corporation. (2025). NVIDIA announces financial results for fourth quarter and fiscal 2025. Retrieved from https://nvidianews.nvidia.com

NVIDIA Corporation. (2025). NVIDIA announces financial results for second quarter fiscal 2026. Retrieved from https://nvidianews.nvidia.com

NVIDIA Corporation. (2025). NVIDIA announces financial results for third quarter fiscal 2026. Retrieved from https://nvidianews.nvidia.com

NVIDIA Corporation. (2025). NVIDIA announces financial results for first quarter fiscal 2026. Retrieved from https://nvidianews.nvidia.com

Tom’s Hardware. (2025, December). Nvidia’s revenue skyrockets to record $57 billion per quarter. Retrieved from https://www.tomshardware.com