1. Highly Bullish Long-Term Forecasts

Some quantitative models project a steep upward trajectory. One forecasting service estimates an average December 2025 price of $34.67, with a low of $32.18 and a high of $35.72—implying over 100% upside from current levels (StockScan). If investor sentiment catches up with this model, the stock could indeed flirt with $40 before year-end.

2. Financing Strength and Cash Position

As of March 31, 2025, Oscar Health reported a fortified balance sheet: $4.86 billion in cash, equivalents, and investments, up from $3.97 billion at the end of 2024. Total assets rose 21% YoY, while operating cash flow increased 38% (Michael Burry’s Insights). This cash cushion gives Oscar flexibility to invest in growth, navigate regulatory headwinds, and drive further value.

3. Strategic Expansion Through New Partnerships

Oscar’s deal with Hy-Vee to launch “Hy-Vee Health with Oscar” in Des Moines, covering about 400,000 employees in the individual marketplace starting Jan 1, 2026, signals a bold move into employer-backed coverage. The ICHRA model aims to save businesses 20–30% and deliver substantial cost-savings to employees-this could create significant scale and margin tailwinds (Benzinga).

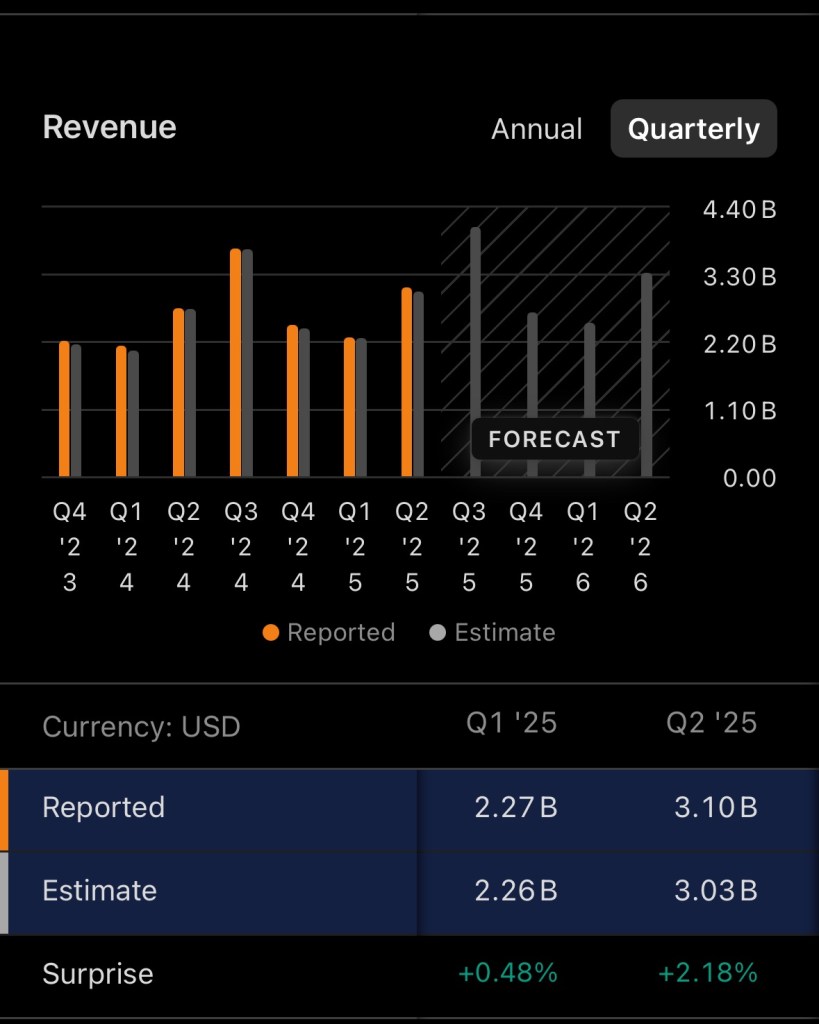

4. Accelerating Revenue Growth

While Q2 revenue of $2.86 billion fell slightly short of the $2.91 billion estimate, it still marked a 29% increase YoY. The company reaffirmed its full-year 2025 revenue guidance at $12–12.2 billion (versus Wall Street’s $11.32 billion estimate), underscoring underlying growth momentum (BenzingaYahoo FinanceStockAnalysis).

5. Valuation Appears Undervalued for Growth Potential

Oscar trades at over 101x forward EV/EBITDA, a lofty multiple—but some analysts argue this valuation is justified by its “quality characteristics” and disruptive business model (StockStory). Others see it as deeply undervalued despite near-term uncertainty tied to ACA policy risks (Seeking Alpha+1).

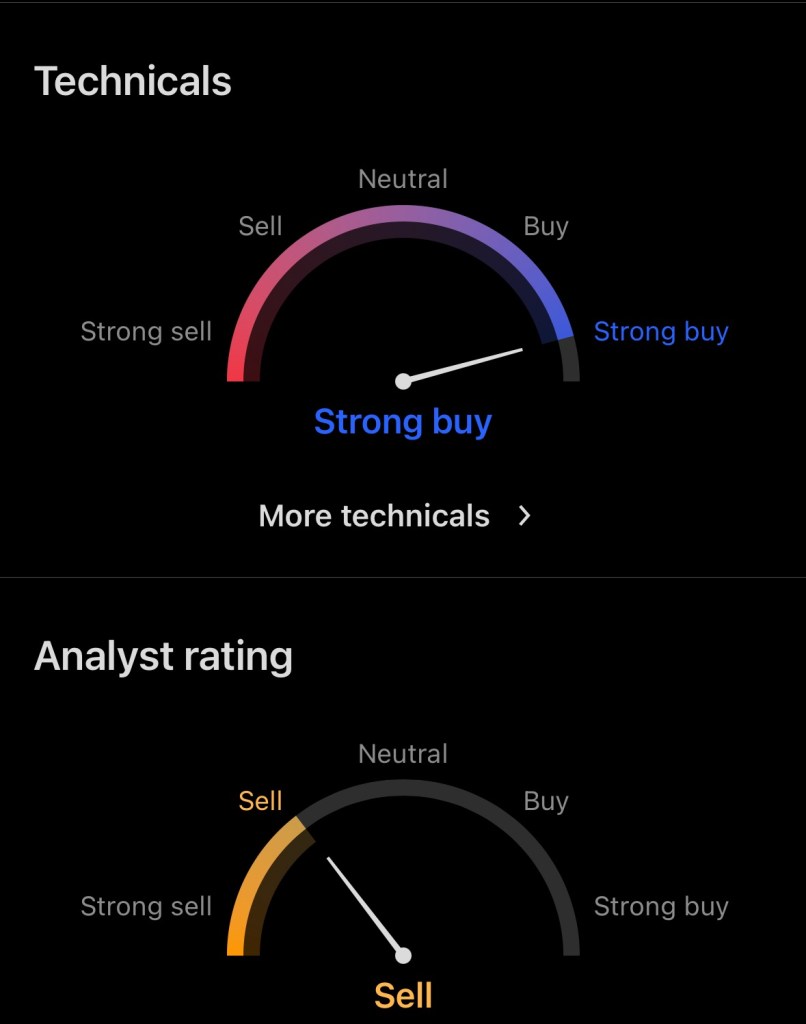

Why Analysts Are Still Cautious

- Low Analyst Price Targets: Consensus 12-month forecasts range between $8 and $14, with averages clustered around $11–$12—well below the $40 mark (ZacksThe Wall Street JournalPriceTargetsInvesting.com).

- Skeptical Market Sentiment: Many brokerages hold “Sell,” “Hold,” or “Neutral” ratings. Notably, Piper Sandler cut its target from $14 to $13, citing uncertainties around risk adjustments and path to profitability (Benzinga). MarketBeat’s consensus is “Strong Sell,” and TipRanks flags a “Downside potential” of ~30% (MarketBeat).

- Profitability Still Out of Reach in 2025: OSCR is expected to operate at a loss—losses projected around $200–300 million for the year (Yahoo Finance). Its Q2 GAAP loss was $0.89/share, and medical loss ratio (MLR) swelled from 79% in 2024 to 91.1% in Q2 2025 (BenzingaStockAnalysis). These factors dampen bullish expectations.

Headlines-Style Article: “Oscar Health: Can It Make the Leap to $40 by Christmas 2025?”

New York, August 23, 2025 – Oscar Health Inc. (NYSE: OSCR) currently trades near $16.98, buoyed by stellar revenue growth, robust liquidity, and a landmark new partnership but Wall Street’s confidence remains tepid.

Why $40 isn’t implausible:

- Long-term algorithmic forecasts place December 2025 prices in the low-$30s, including a possible high of $35.72 (StockScan).

- Strengthened cash position of $4.86 billion, coupled with rising operating cash flows, enhances the company’s financial flexibility (Michael Burry’s Insights).

- Innovative ventures like the Hy-Vee collaboration, targeting 400,000 employees, position Oscar to disrupt cost structures and tap new revenue streams (Benzinga).

- A confirmed revenue guidance of $12–12.2 billion highlights strong underlying demand despite macro-healthcare headwinds (Yahoo FinanceStockAnalysis).

But hurdles remain:

- Analyst targets remain pessimistic, ranging mostly between $8 and $14, with an average nearer $11–12 (ZacksThe Wall Street JournalPriceTargetsInvesting.com).

- Profitability is still elusive: projected operational losses of up to $300 million in 2025, and increased medical loss ratios (MLR) eroding margins (BenzingaYahoo FinanceStockAnalysis).

- Sentiment skews negative, with ratings from “Hold” to “Strong Sell” prevailing, reflecting elevated policy-related and insurance-market risks (MarketBeat).

Final Thoughts: While consensus targets place Oscar Health under $15, a confluence of strong cash reserves, growth initiatives, and bullish long-term models could propel the stock into the low $30s by Christmas-though doing so would require sustained execution and favorable market sentiment in the face of continued near-term challenges.

Disclaimer: The author holds a position in $OSCR Oscar Healthcare and this article should not be considered financial advice. Always conduct your own research before making any investment decisions.

References

Benzinga. (2025, August 20). Oscar Health faces analyst questions on path to profitability. Benzinga. https://www.benzinga.com/analyst-stock-ratings/analyst-color/25/08/47133490/oscar-health-faces-analyst-questions-on-path-to-profitability

Benzinga. (2025, August 21). What’s going on with Oscar Health stock on Wednesday? Benzinga. https://www.benzinga.com/news/health-care/25/08/47240234/whats-going-on-with-oscar-health-stock-on-wednesday

Finance Yahoo. (2025, August 19). Oscar Health (OSCR) updates 2025 revenue guidance. Yahoo! Finance. https://finance.yahoo.com/news/oscar-health-oscr-updates-2025-174216635.html

MarketBeat. (2025). Oscar Health analyst ratings and price targets. MarketBeat. https://www.marketbeat.com/stocks/NYSE/OSCR/

Michael-Burry.com. (2025, August). Oscar Health stock analysis. Michael-Burry.com. https://www.michael-burry.com/oscr-stock-analysis/

Seeking Alpha. (2025, July 30). Oscar Health stock: Undervalued, but not without risk. Seeking Alpha. https://seekingalpha.com/article/4814520-oscar-health-stock-undervalued-but-not-without-risk

Stockanalysis.com. (2025). Oscar Health (OSCR) financials and stock data. Stock Analysis. https://stockanalysis.com/stocks/oscr/

Stockscan.io. (2025). Oscar Health stock forecast. StockScan. https://stockscan.io/stocks/OSCR/forecast

StockStory.org. (2025). Oscar Health stock insights. StockStory. https://stockstory.org/us/stocks/nyse/oscr

The Wall Street Journal. (2025). Oscar Health Inc. research ratings & reports. WSJ. https://www.wsj.com/market-data/quotes/OSCR/research-ratings

Zacks Investment Research. (2025). Oscar Health (OSCR) price targets & forecasts. Zacks. https://www.zacks.com/stock/research/OSCR/price-target-stock-forecast