Snowflake Inc. (NYSE: $SNOW) released its second quarter (fiscal 2026) results, reinforcing its role as a data and AI infrastructure play while navigating challenges in profitability and valuation. The reaction in markets suggests that investors are increasingly viewing Snowflake as more than just a cloud data warehousing provider — but as a core enabler of “AI Data Cloud” strategies. Here’s a breakdown of what’s happening, and the bull vs bear cases moving forward.

What the Numbers Say: Q2 & Recent Financials

Revenue, Margins & Growth

- In Q2 FY2026, Snowflake reported product revenue of $1,090.5 million (i.e. from compute, storage, and data transfer). (Snowflake Investors)

- The company continues to emphasize net revenue retention, which remains elevated (125%) as of July 31, 2025 — indicating that existing customers are expanding usage. (Snowflake Investors)

- In its Q4 FY2025 results (ended January 31, 2025), Snowflake posted total revenue of $986.8 million, with product revenue of $943.3 million — up ~28% year-over-year. (Snowflake)

- The Q4 gross profit margin (GAAP) was ~ 66%, and non-GAAP adjusted gross margin (excluding stock-based comp, amortization, etc.) was ~ 73%. (Snowflake)

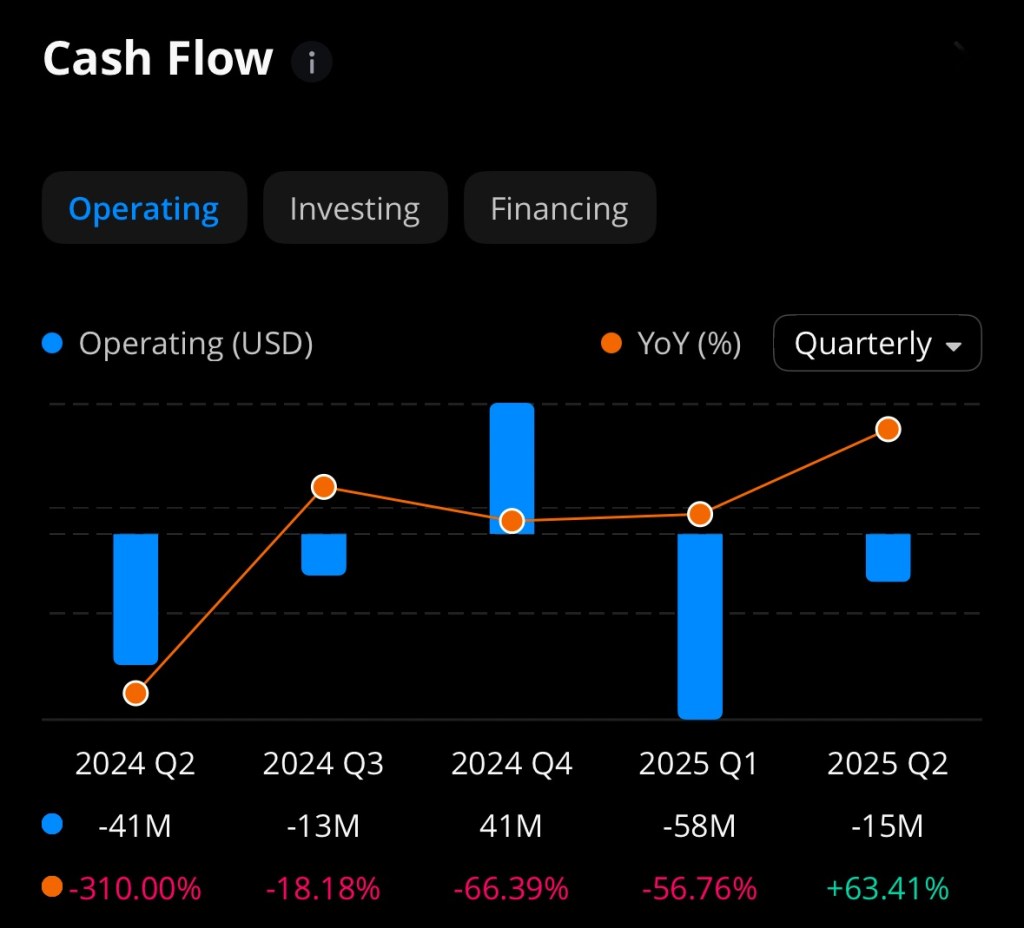

- Snowflake’s Q4 operating loss (GAAP) was about –$386.7 million, but on a non-GAAP basis it posted operating income of $92.8 million (≈ 9% margin). (Snowflake)

- Its free cash flow in that quarter was ~$415.4 million (≈ 42% of revenue) and adjusted free cash flow ~$423.1 million. (Snowflake)

These numbers show both strength and tension: strong top-line growth and healthy non-GAAP profit conversions, but continued GAAP losses driven by sizable investments, stock compensation, and amortization.

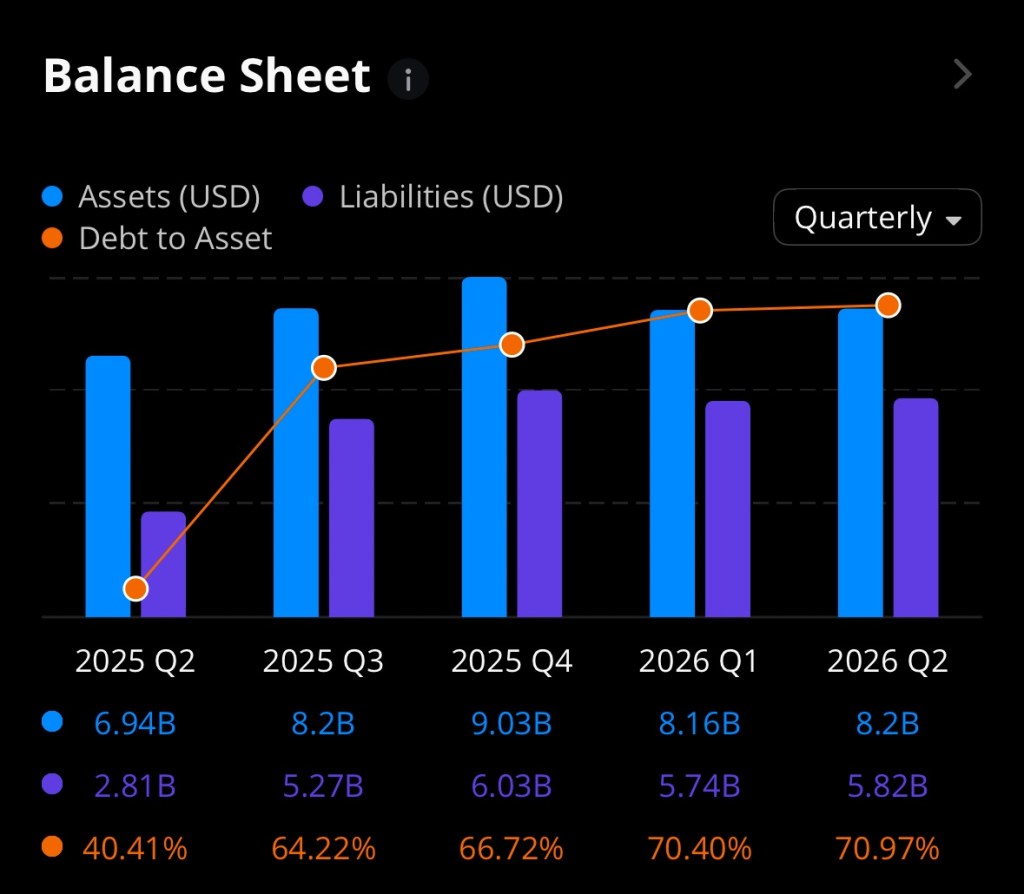

Balance Sheet & Liquidity

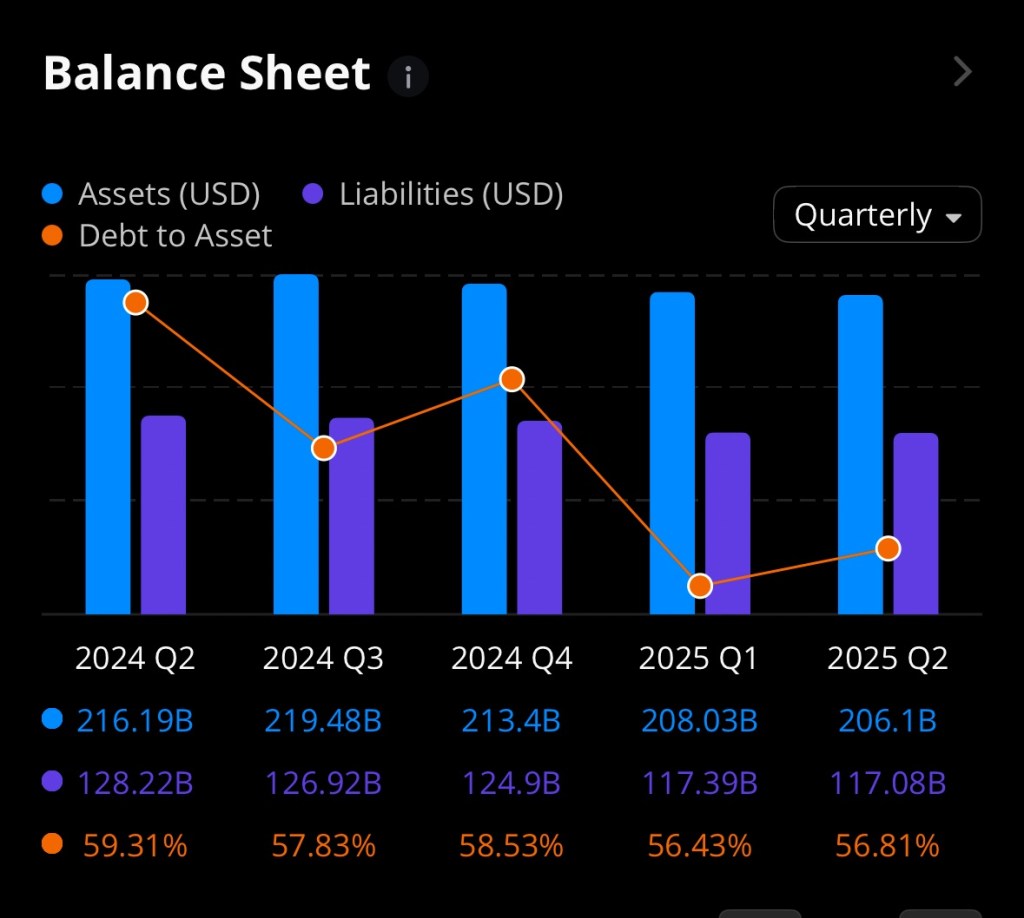

- As of January 31, 2025, Snowflake held ~$2,698.7 million in cash, cash equivalents, and restricted cash. (Snowflake)

- Total debt (short-term + long-term) is more modest — for example, in recent annual balance sheet summaries, SNOW’s short-term and current portion of long-term debt is listed in the range of ~ $36 million. (The Wall Street Journal)

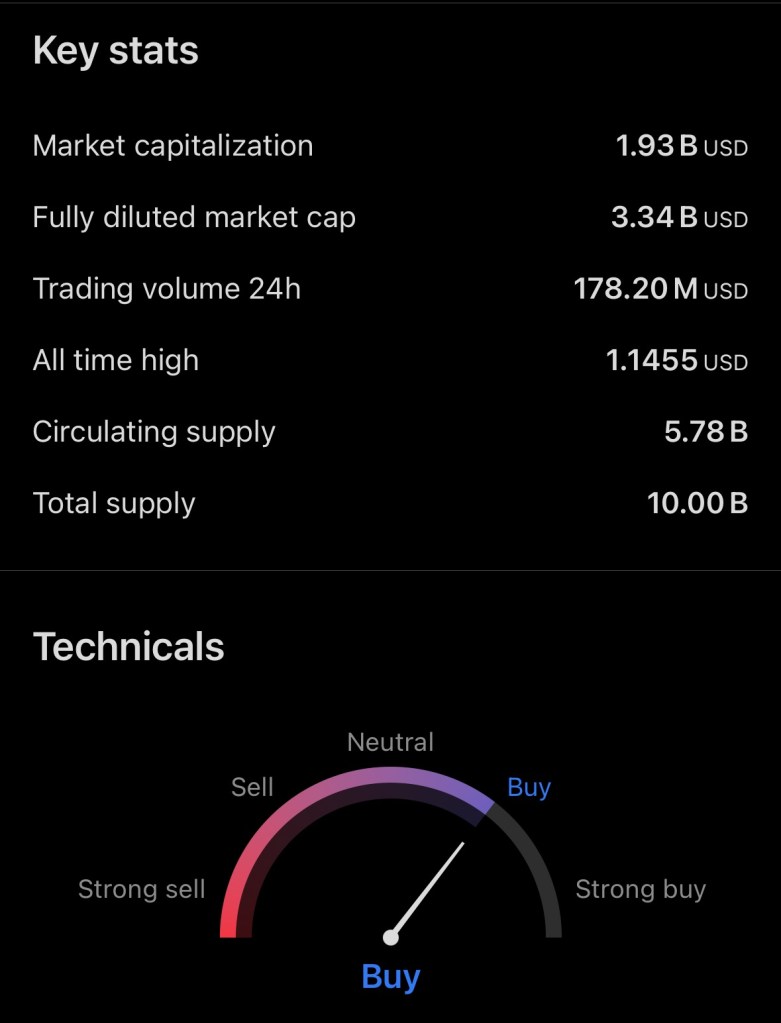

- On the assets side, total assets are in the realm of several billions (over $8B to $9B in some reports) with growth trends consistent among public disclosures. (Investing.com+1)

- The company carries significant liabilities as well (deferred revenue, vendor payables, deferred costs), but its liquidity cushion offers some buffer against short-term shocks. (Investing.com)

Business & Strategic Metrics

- Snowflake’s remaining performance obligations (RPO) — i.e., contracted but not-yet-recognized revenue — stood at $6.9 billion, growing ~33% year-over-year. (Snowflake)

- The company serves 580 customers whose trailing 12-month product revenues exceed $1 million, and 745 Forbes Global 2000 customers as of Q4 FY2025. (Snowflake)

- The 125% dollar-based net revenue retention underlines that Snowflake is often able to upsell or expand within its installed base. (Snowflake Investors)

- More recently, Snowflake announced its acquisition of Crunchy Data (for ~ $250 million) to integrate Postgres capabilities into its ecosystem, enabling developers to more easily build AI agents and manage data workloads. (The Wall Street Journal+1)

- The company is also partnering or aligning more closely with AI/LLM providers (e.g., Anthropic), seeking to embed language model capabilities into its platform. (Reuters+2markets.businessinsider.com+2)

What’s Driving the Recent Move & Market Sentiment

In response to its Q4 FY2025 earnings (released earlier in 2025), Snowflake’s stock jumped ~10.9% after hours, as the company beat on earnings (30 cents per share vs ~18 cents expected) and revenue (nearly $987 million vs $957 million consensus). Barron’s It also raised its forecast for product revenue and delivered upbeat guidance for FY2026, projecting ~24% growth to ~$4.28 billion. (MarketWatch+2Barron’s+2)

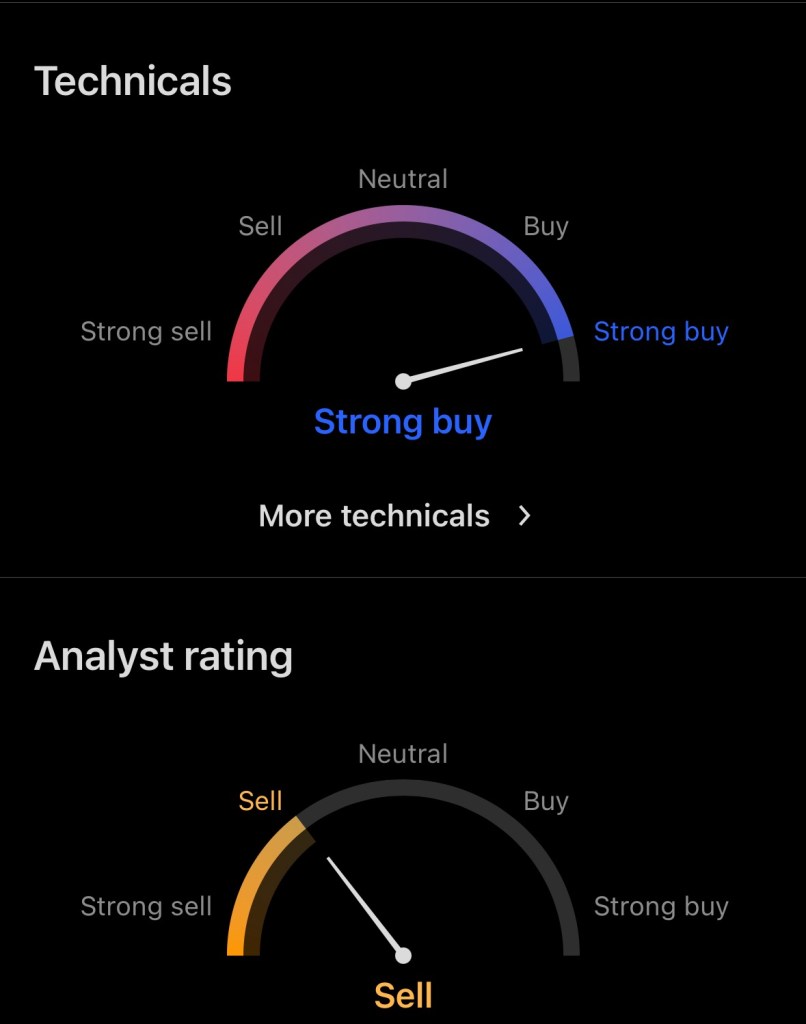

Investors have taken notice of Snowflake’s push into AI, including more sophisticated integrations with large language models, and its efforts to position itself not just as a data platform but an “AI data cloud” enabler. (markets.businessinsider.com+2Reuters+2)

That said, concerns still linger over valuation multiples (Snowflake trades at high forward multiples), GAAP losses, and macro risk to enterprise IT spending.

Why Some Investors Might Find SNOW Attractive (and Its Risks)

Bull Case

- Exposure to Secular Trends in Data + AI

As enterprises shift toward AI, data modeling, real-time analytics, and agent-based applications, Snowflake sits at a nexus: you need scalable, secure data infrastructure. Its existing customer base, product maturity, and retention metrics lend credibility to that positioning. - Upsell & Expansion Potential

Snowflake’s high net revenue retention and expanding average spend per customer suggest that a lot of value lies in selling more compute/storage or ancillary AI features to its installed base. - Strategic Acquisitions & Technology Stack Expansion

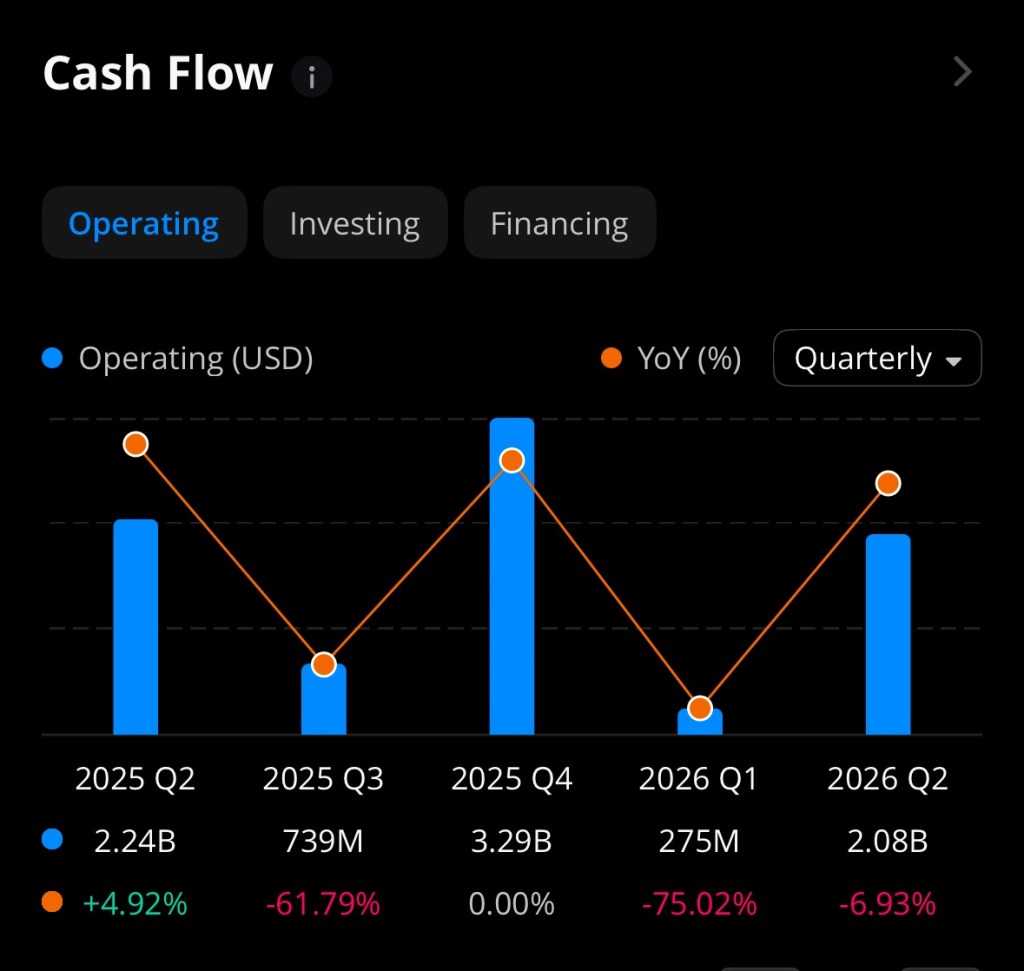

The Crunchy Data deal, combined with its AI platform integrations, may help lock in more workloads (especially developer, data app, and AI agent workloads) and reduce friction for adoption. - Cash Generative Capacity (Non-GAAP / FCF)

Despite GAAP losses, Snowflake has shown strong adjusted free cash flow generation, which gives it flexibility to invest, defend, or expand without complete reliance on external financing. - Backlog / Contracted Revenue Visibility

The RPO metric provides a view into future revenue, giving some predictability to growth expectations and lessening the reliance purely on new deals.

Risks & Challenges

- Profitability & Cost Pressure

Snowflake still runs GAAP losses. Its heavy investment in R&D, sales & marketing, and stock-based compensation make margins sensitive. If growth slows, the pressure on margins will intensify. - Valuation Overhang

At high multiples, the stock’s valuation leaves little room for mistakes. A small slip in guidance or macro softness in enterprise IT spending could cause multiple compression. - Competition & Execution Risk

The competitive landscape is fierce (e.g. Databricks, AWS, Google, Microsoft) and execution (product development, scaling, integrating acquisitions) will matter enormously. - Dependence on Cloud Providers

Snowflake relies on underlying public clouds (AWS, Azure, GCP) for infrastructure. Any changes in pricing, caps, or ecosystem dynamics could affect its cost structure or competitiveness. (Wikipedia+1) - Macro / IT Spend Weakness

In a downturn or with tightening enterprise budgets, large IT and data platform spends may get deferred, impacting growth. - Integration and Engineering Complexity

Adding deeper database, AI, and application layers increases complexity — integrating acquisitions and maintaining stability and performance across features will be demanding.

Outlook & Near-Term Catalysts

- Snowflake’s guidance for Q1 FY2026 product revenue is in the range $955 million to $960 million. (Snowflake)

- For full-year FY2026, the company expects ~ 24% product revenue growth to ~$4.28 billion, with non-GAAP product gross margins reaching ~75%. (Snowflake)

- The success of its Crunchy Data acquisition (Postgres integration), traction of AI integrations (e.g., embedding LLMs for analytics), and customer growth in large enterprises will be closely watched.

If Snowflake can continue delivering above expectations on product revenue, manage its cost base, and ensure that its AI/data additions translate into incremental revenue without diluting execution, it may justify its premium valuation post its recent run.

Verdict & Investor Fit

Snowflake is not a “safe” stock in the sense of predictable earnings or low volatility, but it is a compelling pick for investors with conviction in the data + AI transition and a willingness to ride through lumps. For those looking for asymmetric upside exposure to the AI/data infrastructure stack, SNOW has a profile worth watching — especially if bought during periods of market softness.

Disclosure:

I do not own any stock or have any financial interest in Snowflake Inc. (NYSE: $SNOW). This article is for informational purposes only and should not be considered financial or investment advice. Investing in stocks carries risks, and past performance is not indicative of future results. Always conduct your own research and consult with a qualified financial professional before making any investment decisions.

Barron’s. (2025, August 28). Snowflake stock jumps after earnings beat. Here’s what analysts are saying. Dow Jones & Company. https://www.barrons.com/articles/snowflake-stock-price-earnings-ai-1f2b9a5e

MarketWatch. (2025, August 28). Snowflake’s earnings and revenue beat expectations. Dow Jones & Company. https://www.marketwatch.com/story/snowflakes-earnings-and-revenue-beat-expectations-11695946094

Snowflake Inc. (2025, August 28). Snowflake reports second quarter fiscal 2025 financial results [Press release]. Snowflake Investor Relations. https://investors.snowflake.com/

Yahoo Finance. (2025). Snowflake Inc. (SNOW) financials. Retrieved September 27, 2025, from https://finance.yahoo.com/quote/SNOW/financials