In today’s economy, every dollar saved counts — and when it comes to insurance, combining your policies could be one of the easiest ways to keep more money in your pocket.

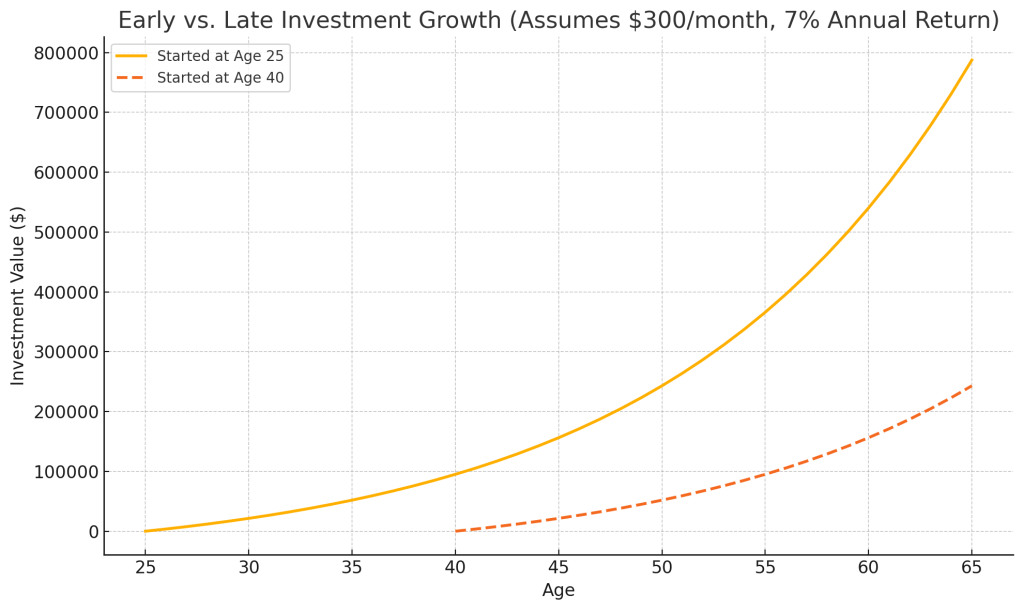

Many Americans carry multiple insurance policies — auto, home, renters, sometimes even umbrella coverage — but fewer realize that bundling these policies with the same provider can unlock significant discounts. According to industry studies, customers who bundle their car and home insurance can often save anywhere from 5% to 25% on their total premium.

Why do insurance companies offer bundling discounts?

Insurance providers like it when customers keep multiple policies under one roof. Bundled customers are more likely to stick around long-term, which reduces the company’s costs to acquire and retain new business. Insurers pass some of those savings on to customers as an incentive to bundle.

How much can you really save?

The exact amount varies by state, provider, and individual circumstances. For example, homeowners generally see larger discounts than renters, and those with good credit and safe driving records may qualify for the biggest savings. In some cases, discounts can total hundreds of dollars a year — money that can be redirected toward other household expenses or savings.

Other perks beyond the discount

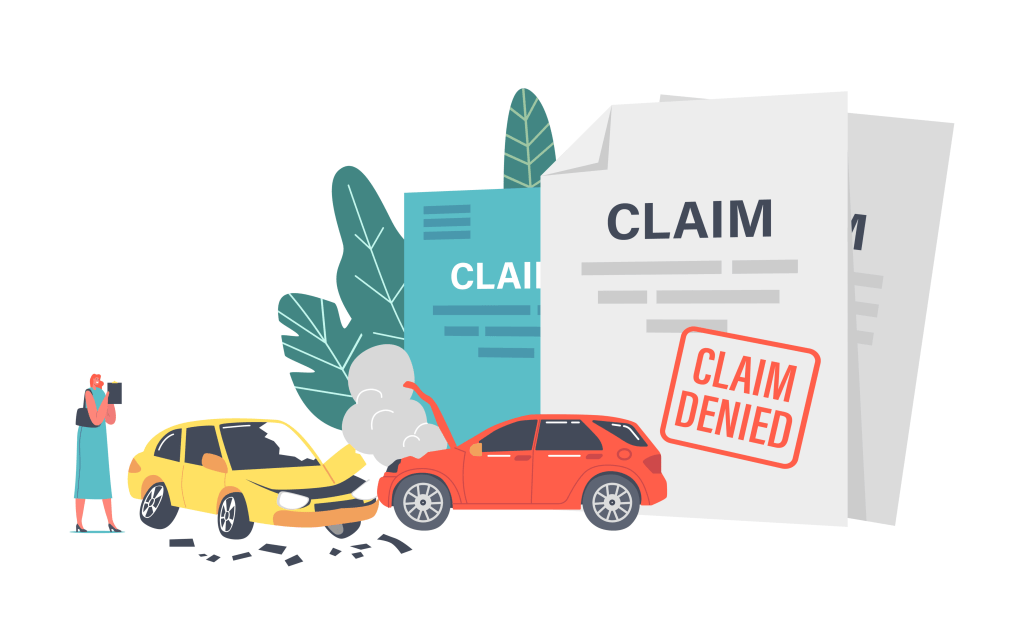

Bundling often makes life simpler, too. Instead of juggling different renewal dates, agents, and billing statements, you can manage your policies through one account. Some companies even offer a single deductible option for claims involving both home and auto — for example, if a storm damages your garage and your car at the same time.

A real-life savings story

I saw the benefits firsthand when I decided to bundle my own home and auto insurance. Before bundling, I was paying separate premiums with two different companies and never really thought much about it. After one quick conversation, I switched both policies to the same provider and ended up saving nearly $4500 a year. Not only did it cut my costs, but it made managing my insurance so much easier — one company, one bill, one renewal date.

Smart coverage, smart savings

Insurance might not be the most exciting thing on your to-do list, but spending a few minutes reviewing your policies could pay off. Ask your insurance agent about bundling options, compare quotes, and see if consolidating your coverage could drive down your costs — without compromising the protection you and your family need.

About the Author:

David Dandaneau is a client relations analyst that covers the insurance and financial services industry. He is known for his insightful analysis and comprehensive coverage of market trends and regulatory developments.