Quick take: Zeta Global, the AI-driven marketing cloud, has delivered a string of better-than-expected quarters, is guiding to another year of strong revenue growth, and just made a big acquisition to expand its loyalty and enterprise footprint. That combination — accelerating revenue, improving profitability guidance, and strategic M&A — is why some investors are re-rating the stock. Below: the facts, the catalyst, a compact risk view, and a chart/table that show the growth story.

Headlines and the data points you need

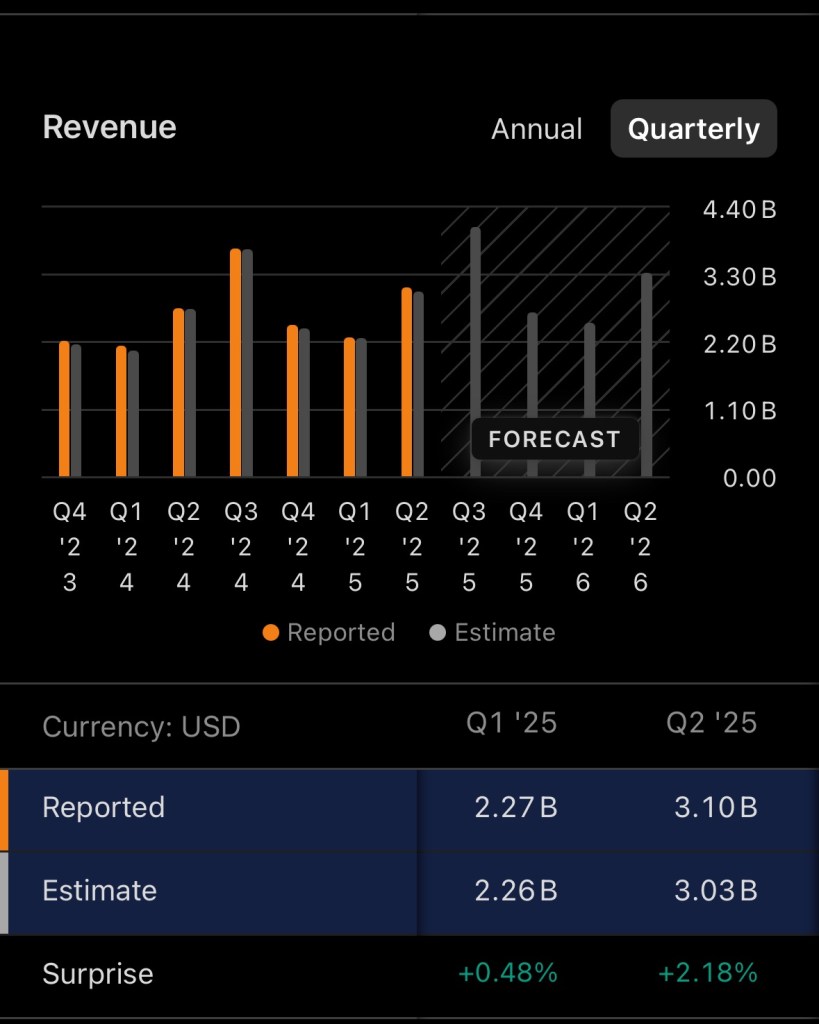

- Zeta reported Q2 2025 revenue of $308.4 million, a ~35% year-over-year increase vs. the prior year quarter. (Nasdaq)

- For full-year 2024 Zeta generated about $1.01 billion in revenue. (Zeta Global)

- Management has repeatedly “beat and raise” — most recently increasing full-year 2025 revenue guidance to $1,258–$1,268 million (midpoint ~$1.263B) and raising Adjusted-EBITDA and free-cash-flow ranges as well. Those revisions reflect faster growth and improving margins. (Zeta Global+1)

- Zeta announced a large acquisition (Marigold’s enterprise business — including Cheetah Digital, Selligent, Sailthru and other assets) to strengthen loyalty and enterprise offerings, a move management says accelerates international reach and cross-sell opportunities. (Zeta Global+1)

- Market snapshot (at time of writing): share price ≈ $20.37 and market cap in the mid-$4 billion range — investors are paying for fast growth but also a path to profitability. (Yahoo Finance)

Why this could be an attractive investment (the bull case)

- High single- to double-digit top-line growth that’s accelerating. Zeta’s recent quarters show consistent revenue acceleration (Q2 ’25 +35% YoY), a key signal for growth investors in the martech/adtech space. Management’s upward guidance for FY-2025 reinforces that it’s not just one quarter of outperformance. (Nasdaq+1)

- Improving operating leverage and cash generation. The company has raised Adjusted-EBITDA and free-cash-flow guidance, pointing to margin expansion. That’s important: investors reward companies that can turn revenue growth into sustainable profits and cash. (Zeta Global)

- Strategic M&A that fills capability gaps and expands addressable market. The Marigold enterprise business deal adds loyalty platforms and prominent enterprise customers (and EMEA coverage), enabling more cross-sell inside an existing customer base and a larger recurring revenue pool. If integration goes smoothly, this can boost both revenue and churn resilience. (Zeta Global+1)

- Compelling unit economics at scale. Zeta reports improving ARPU (average revenue per scaled customer) and strong net revenue retention metrics, which suggest existing customers are spending more — a powerful multiplier for SaaS-like businesses. (Company disclosures highlight rising Scaled and Super-Scaled customer ARPU.) (Zeta Global+1)

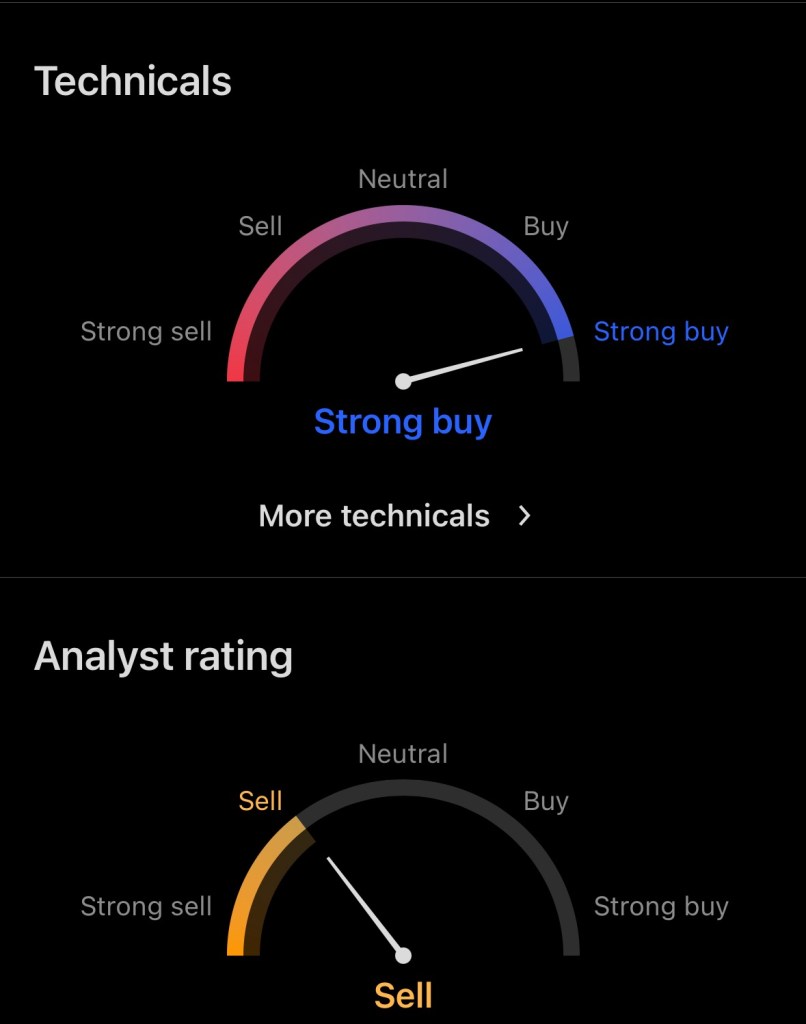

- Positive technical / market interest. Stock research outlets have recently upgraded technical scores (e.g., IBD RS rating rise), indicating renewed investor interest that can amplify returns if fundamentals keep improving.( Investors.com)

Compact table: key metrics (source notes below)

| Metric | Value (most recent / guidance) | Source |

|---|---|---|

| Q2 2025 revenue | $308.4M (+35% YoY) | Company results / press release. (Nasdaq) |

| FY 2024 revenue | $1,006M (≈$1.01B) | FY 2024 report. (Zeta Global) |

| FY 2025 revenue guidance | $1,258–$1,268M (midpoint ≈ $1.263B) | Company guidance (beat & raise). (Zeta Global) |

| Adjusted-EBITDA guidance (FY-25) | ~$263.6–$265.6M | Company guidance. (Zeta Global) |

| Share price (snapshot) | ~$20.37 | Market quote (timestamped). |

| Market cap (approx.) | Mid ~$4B–$4.8B | Market data providers. (Yahoo Finance+1) |

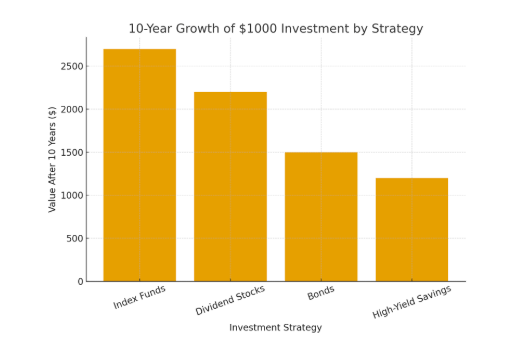

Visual: revenue comparison (Q2 vs prior year, FY 2024 vs FY 2025 guidance)

I created a compact chart and table comparing:

- Q2 2024 (estimate) vs Q2 2025 actual, and

- FY 2024 actual vs FY 2025 guidance midpoint.

(Chart and table were prepared from the company reporting and guidance figures cited above).

Sources for the plotted numbers: Q2 2025 revenue and YoY change, FY 2024 totals, and FY 2025 guidance. (Nasdaq+2Zeta Global+2)

Risks — what could go wrong

- Execution risk on M&A and integration. The Marigold enterprise assets are substantial; integration issues, customer churn, or higher-than-expected costs could blunt the benefits. (Zeta Global)

- Valuation vs. growth tradeoff. The stock price reflects future growth expectations. If revenue growth slows or margin expansion stalls, multiples can compress quickly. (Yahoo Finance)

- Adtech / martech competition and cyclicality. The market is competitive (large incumbents and many specialists). Ad/spend cyclicality could affect revenue. Company performance depends on continued client spend and retention. (Zeta Global)

- Profitability not yet fully GAAP positive. Zeta has narrowed losses but still reports GAAP net losses; investors should watch sustained EBITDA and free-cash-flow conversion. (Zeta Global)

Bottom line (concise)

Zeta Global presents a classic high-growth martech investment case: accelerating revenue, improving profitability guidance, and strategic M&A that extends its product footprint and international reach. That combination can create durable revenue expansion and margin improvement — the ingredients growth investors pay for. But the stock still carries execution and integration risk and depends on preserving high retention and ARPU. If you like fast growth with a clear path to margin expansion and accept the M&A/integration risk, Zeta is a name to research further; if you are risk-averse or need immediate GAAP profitability, it may not fit.

Disclosure:

I do not own any stock or have any financial interest in Zeta Global Holdings (NYSE: $ZETA). This article is for informational purposes only and should not be considered financial or investment advice. Investing in stocks carries risks, and past performance is not indicative of future results. Always conduct your own research and consult with a qualified financial professional before making any investment decisions.

References

Zeta Global Holdings Corp. (2025, August 8). Zeta reports second quarter 2025 financial results; raises full-year 2025 guidance. Zeta Global Investor Relations. Retrieved from https://investors.zetaglobal.com/

Zeta Global Holdings Corp. (2024, February 28). Zeta reports fourth quarter and full-year 2024 results. Zeta Global Investor Relations. Retrieved from https://investors.zetaglobal.com/

Investor’s Business Daily. (2025, September). Zeta Global stock analysis and relative strength update. Investor’s Business Daily. Retrieved from https://www.investors.com/

Reuters. (2025, September). Zeta Global Holdings Corp. company profile and financial summary (ZETA.O). Reuters Markets. Retrieved from https://www.reuters.com/

MarketWatch. (2025, October). Zeta Global Holdings Corp. stock quote & financials (ZETA). MarketWatch. Retrieved from https://www.marketwatch.com/

Business Wire. (2025, July 31). Zeta Global announces acquisition of Marigold’s enterprise business to expand loyalty and EMEA presence. Business Wire. Retrieved from https://www.businesswire.com/

Yahoo Finance. (2025, October 9). Zeta Global Holdings Corp. (ZETA) stock price and market cap data. Yahoo Finance. Retrieved from https://finance.yahoo.com/