Clover Health Investments Corp. (NASDAQ: $CLOV), a physician enablement company focused on improving healthcare for Medicare beneficiaries, has recently demonstrated significant growth and strategic initiatives that may appeal to investors.

Robust Membership Growth

As of January 2025, Clover Health reported a 27% increase in Medicare Advantage membership, surpassing 100,000 members. Notably, approximately 95% of these members are enrolled in the company’s flagship 4-Star Preferred Provider Organization (PPO) plan, reflecting Clover’s commitment to delivering high-quality care.

Strategic Focus on Profitability

In December 2023, Clover Health announced its decision to exit the Centers for Medicare and Medicaid Services’ (CMS) ACO REACH program. This move allows the company to concentrate resources on its core Medicare Advantage insurance business and the Clover Assistant platform, aiming to achieve profitability on an Adjusted EBITDA basis for the full year 2024.

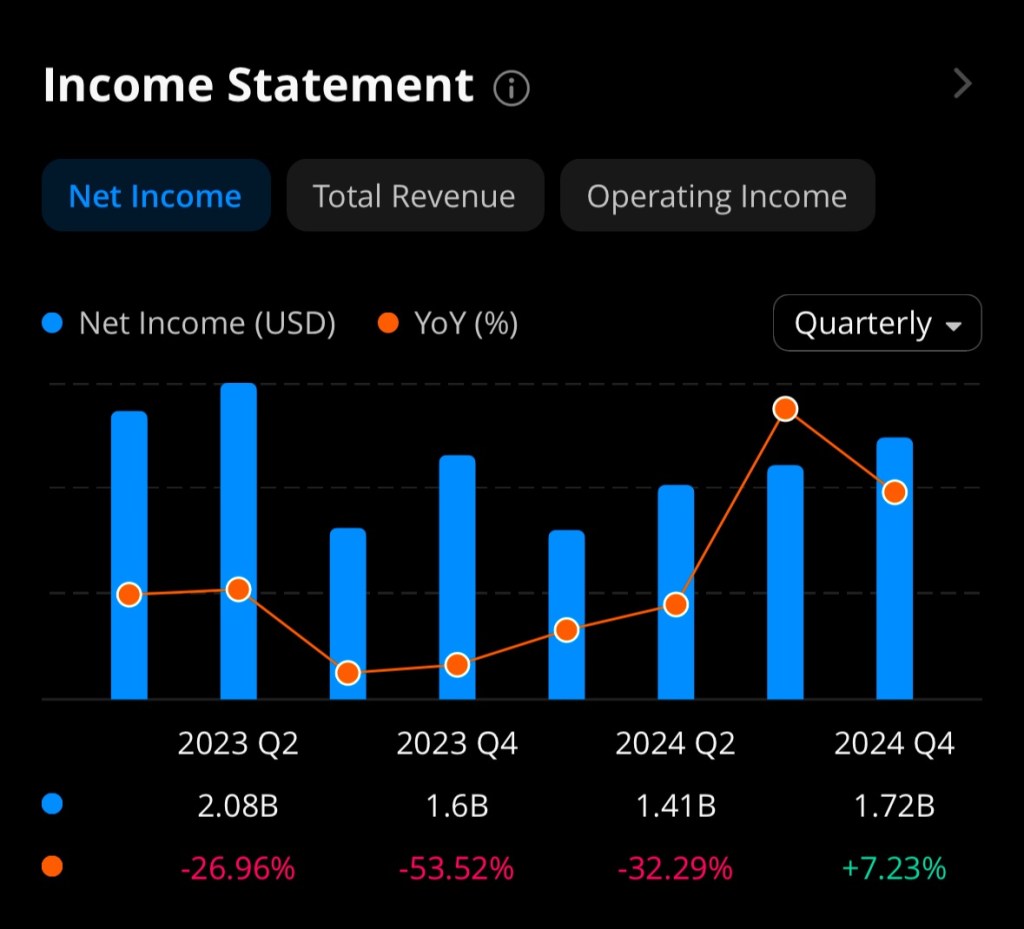

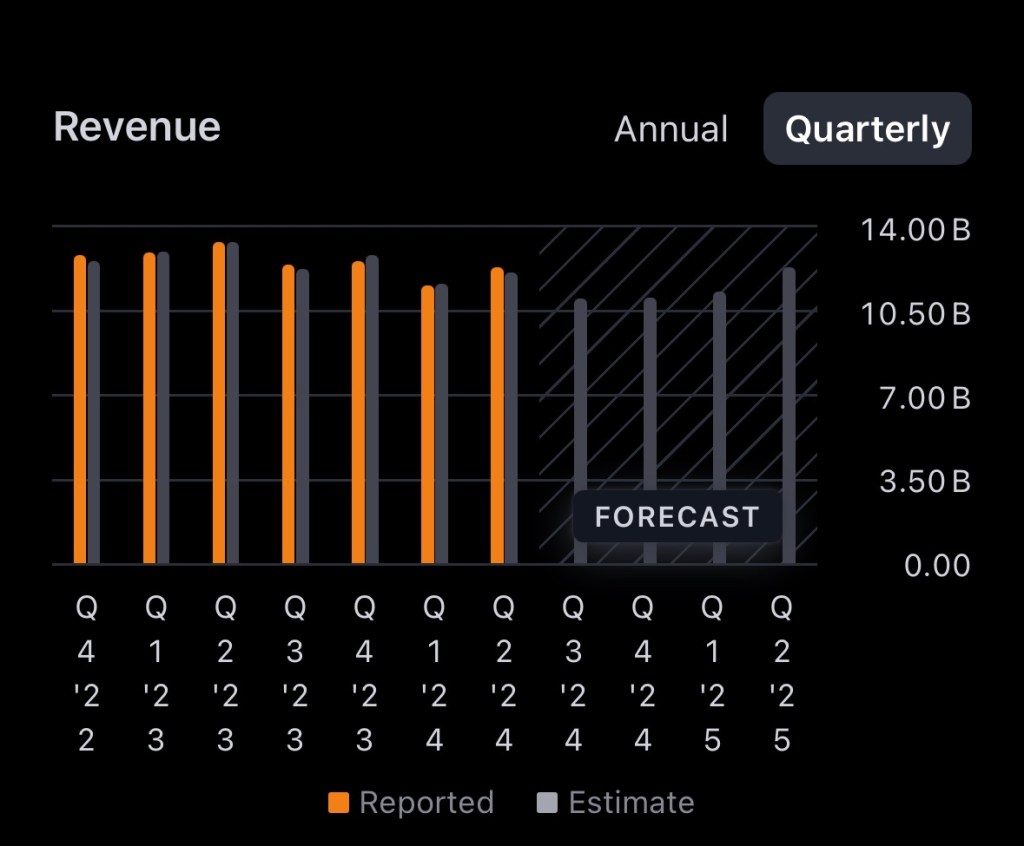

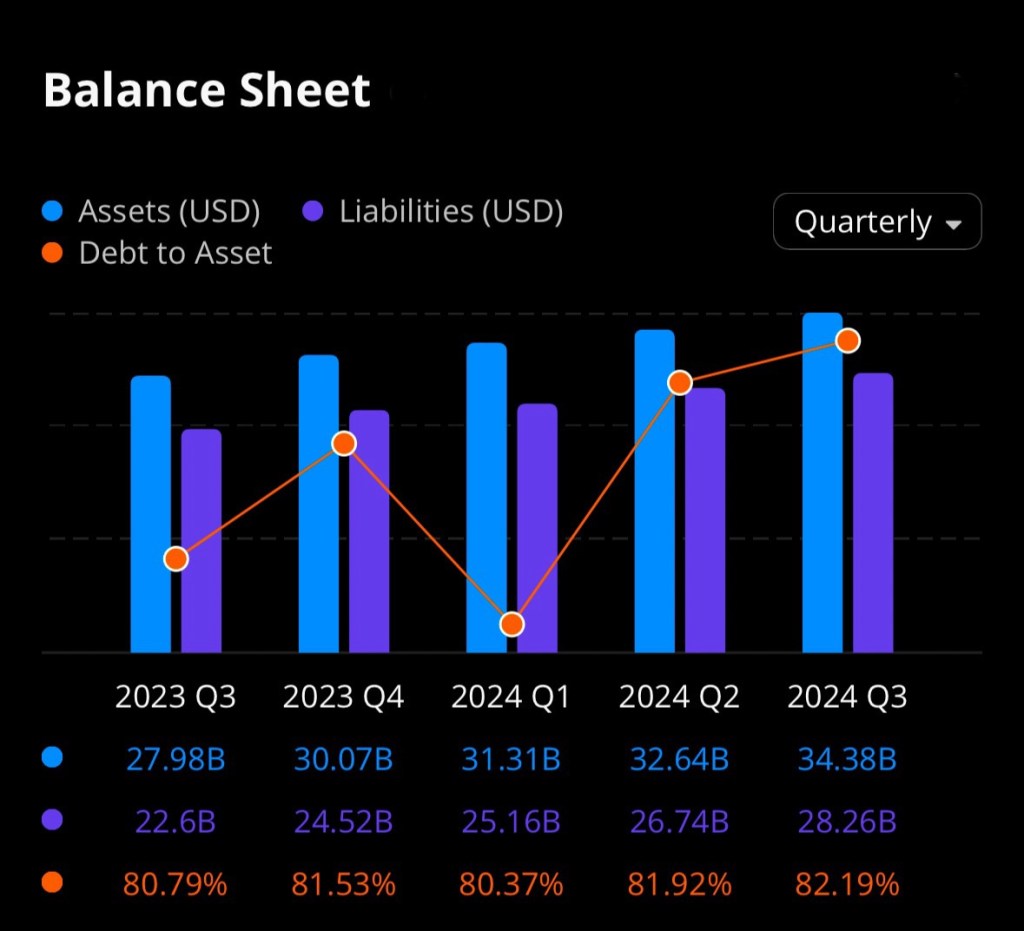

Financial Performance and Outlook

The company’s financial trajectory shows promise, with earnings expected to improve from a loss of $0.12 per share to $0.07 per share in the coming year. Analysts have set a 12-month price target of $5.00 for Clover Health’s stock, suggesting potential upside from its current trading price of $4.46 as of February 16, 2025.

Investment Considerations

While Clover Health’s recent membership growth and strategic refocusing are positive indicators, potential investors should be mindful of market volatility. The stock has experienced fluctuations, and with a significant portion of retail ownership, there is a risk of profit-taking following earnings reports. Therefore, a cautious approach is advisable, possibly awaiting the upcoming Q4 2024 earnings release for more clarity on the company’s financial health.

Clover Health’s strategic initiatives and growth in the Medicare Advantage sector position it as a noteworthy contender in the healthcare market. However, investors should conduct thorough research and consider market dynamics before making investment decisions.

Disclosure: I currently hold a position in Clover Health Investments Corp. (NASDAQ: $CLOV). This article reflects my personal opinions and analysis, and is not intended as financial advice. Please conduct your own research or consult a financial advisor before making any investment decisions.

References

Clover Health. (2023, December 15). Clover Health exits ACO REACH to accelerate path to profitability. Clover Health Investors. https://investors.cloverhealth.com/news-releases/news-release-details/clover-health-exits-aco-reach-accelerate-path-profitability

Finance Yahoo. (2025, January 10). Clover Health reports 27% growth in Medicare Advantage membership. Yahoo Finance. https://finance.yahoo.com/news/clover-health-reports-27-growth-140000713.html

Seeking Alpha. (2025, February 10). Clover Health: Watch out for volatility following Q4 earnings results. Seeking Alpha. https://seekingalpha.com/article/4756994-clover-health-watch-out-for-volatility-following-q4-earnings-results

Stock Analysis. (2025, February 15). Clover Health (CLOV) stock forecast and price target. Stock Analysis. https://stockanalysis.com/stocks/clov/forecast