Waiting might be one of the few universal human experiences that transcends age, background, income, geography, and even personality. Whether we’re stuck in a doctor’s office long past our appointment time, refreshing a stock chart hoping for a green candle, or watching an insurance claim crawl its way through the system, waiting is a constant companion. And while it can be frustrating, it also reveals a lot about how modern life actually works.

The Doctor Will Be With You… Eventually

Anyone who has ever dealt with healthcare knows that time moves differently in a medical office. You check in early, only to wait 20 minutes to be called, 10 more in the exam room, and maybe another week to get your test results.

Doctors aren’t slow because they want to be; they’re slow because they must be. Every patient brings unpredictability. A quick check-up can instantly turn into a crisis, care requires paperwork, and healthcare systems are overloaded. But as patients, it doesn’t feel like logistics—it feels like we’re just waiting… and waiting.

Many people walk out feeling like they spent more time sitting than being seen. And that’s because they have.

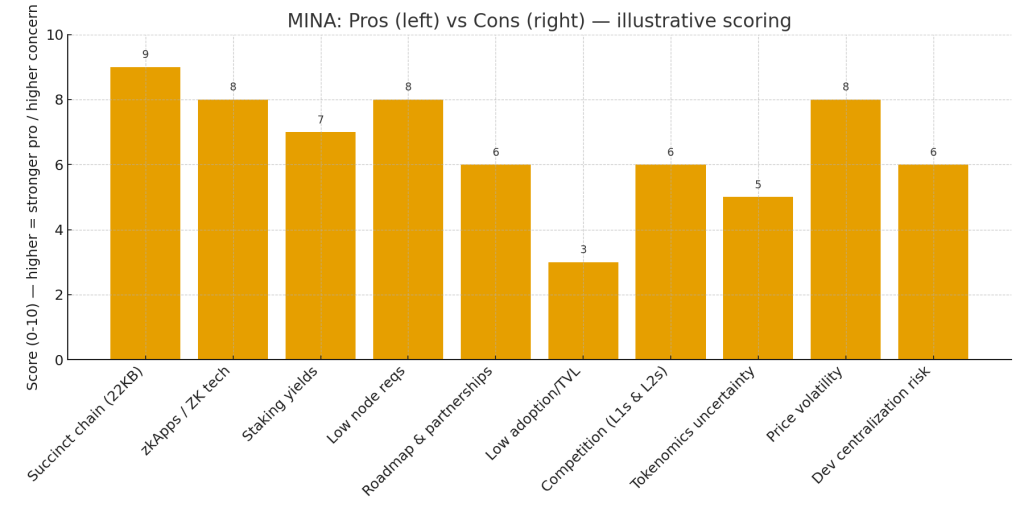

Waiting on the Markets: The Slow Burn of Investing

If there’s any arena that tests patience like a doctor’s office, it’s the stock market. You can research the perfect company, run the numbers, time your entry… and still spend weeks or months waiting for the payoff.

Stocks rarely move on our schedule. Bull markets take time to build, bear markets linger longer than anyone likes, and sideways trading can feel like a cosmic joke designed to test your discipline. You watch your screen, refresh your app, maybe check the news again—just in case something changed in the last 45 seconds.

But over the long run, waiting is the strategy. The real returns historically come not from timing the market, but time in the market. Yet even knowing that, we still find ourselves impatient, hoping our future arrives faster.

Insurance: The Art of Hurry Up and Wait

Insurance is another world where waiting feels baked into the design. You file a claim and expect progress. Instead, you’re asked for more documentation, another photo, a follow-up call, a review, an inspection… and then another review.

Insurance companies aren’t trying to delay—they’re trying to verify. Risk assessment requires accuracy, and accuracy takes time. But when it’s your car, your home, your medical bill, or your livelihood on the line, the process can feel like a slow-motion movie you can’t fast-forward.

Ironically, we pay for insurance to create peace of mind, but the waiting period is often when we feel the least at peace.

Everyday Waiting: The Silent Theme of Modern Life

Outside those big moments, waiting quietly follows us everywhere:

- Waiting for a package that says “Out for delivery” for eight hours

- Waiting for traffic to move

- Waiting for approval, promotion, or a simple call-back

- Waiting for the next phase of life—marriage, career change, retirement

- Waiting for things to “finally calm down” (which never seems to happen)

Humans weren’t built to sit in uncertainty. Psychologically, waiting triggers the same stress response as danger. Our brains want clarity and control—two things waiting rarely provides.

The Hidden Reason We Wait: Progress Takes Time

Whether it’s the doctor, the market, insurance, or our daily errands, waiting is ultimately a byproduct of systems in motion. Progress doesn’t happen in a straight line or on a schedule we set.

In many ways, waiting is proof that something is happening:

- The doctor is giving someone else the attention you’ll soon get

- The stock market is adjusting, recalibrating, and preparing for the next move

- The insurance company is verifying everything you need to protect your future

- Life is unfolding in real time—not rushed, not delayed, simply moving at its own pace

We wait because the world is constantly working behind the scenes, even when we can’t see it.

Turning Waiting Into Something Useful

While we can’t eliminate waiting, we can change what it means to us. Waiting offers a rare chance to pause—a moment to reflect, reset, or simply breathe. It forces us to surrender a little control and trust the process, uncomfortable as that may be.

Because when the moment finally comes—whether it’s the doctor walking in, your stock finally breaking out, or the insurance claim resolving—waiting reminds us that good things often take time.

And maybe, just maybe, learning to wait is one of the most valuable skills we’ll ever develop.