SoFi Technologies Inc. (NASDAQ: $SOFI) has been making waves in the financial services industry with its innovative approach to digital banking and lending. As a disruptor in the fintech space, SoFi is well-positioned to capitalize on the evolving preferences of tech-savvy consumers and investors alike. Here’s why SOFI stock could be a strong addition to your portfolio for the future.

- Expanding Product Ecosystem

SoFi offers a comprehensive range of financial products and services, including student loan refinancing, personal loans, mortgages, investment management, and checking and savings accounts. This diversified product suite not only caters to various customer needs but also promotes cross-selling opportunities within its ecosystem. The company’s “SoFi Relay” and “SoFi Invest” platforms have particularly gained traction among younger consumers who seek a seamless, all-in-one financial solution.

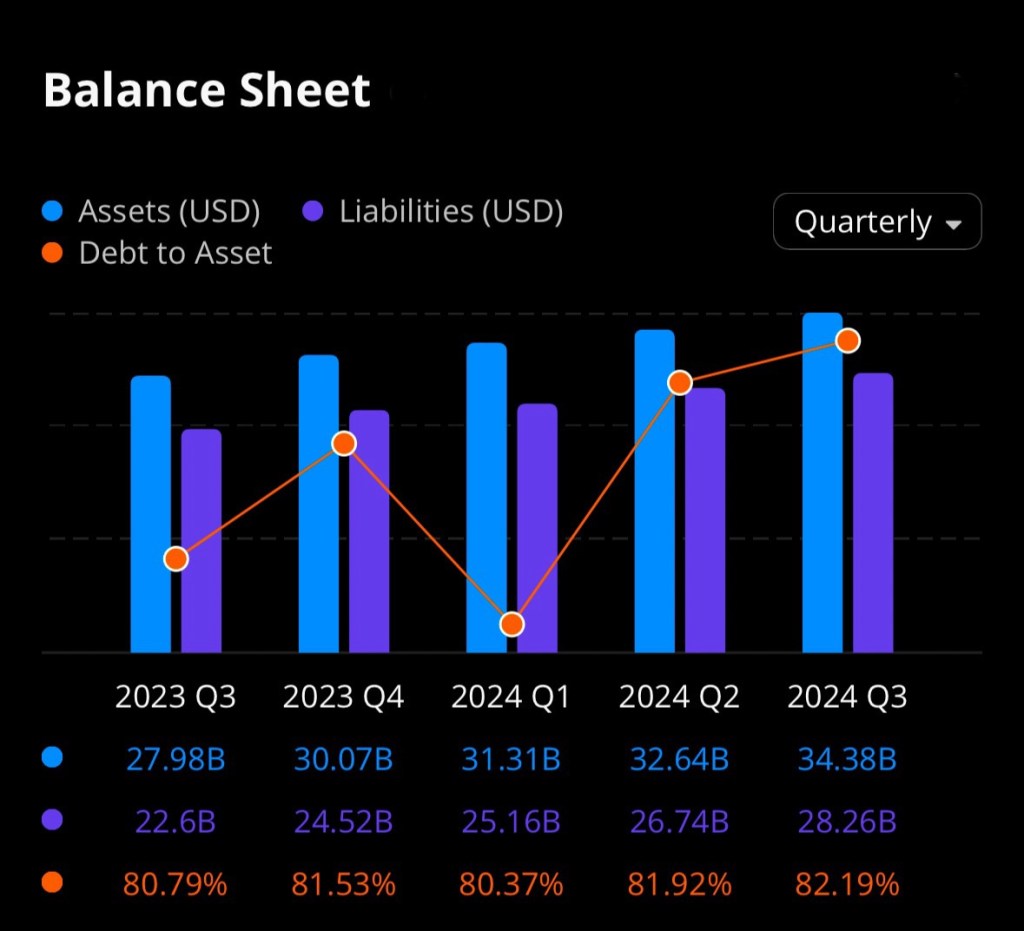

- Strong Growth Metrics

SoFi has reported impressive growth in recent quarters, driven by its increasing customer base and expanding revenue streams. The company’s membership count recently surpassed the 10 million mark, reflecting a year-over-year growth of over 40%. Such robust growth metrics highlight the effectiveness of SoFi’s business strategy and its ability to scale operations efficiently.

- The Digital Banking Revolution

The global banking landscape is undergoing a significant transformation, with digital-first platforms gaining popularity over traditional brick-and-mortar institutions. SoFi’s fully digital infrastructure and user-friendly mobile app place it at the forefront of this revolution. As more consumers shift to digital banking, SoFi’s market share is expected to grow, further solidifying its position in the fintech industry.

- Unique Competitive Advantages

One of SoFi’s standout features is its recently acquired banking charter. This allows the company to offer banking services without relying on third-party partnerships, reducing costs and improving profit margins. Moreover, SoFi’s proprietary technology and data-driven insights give it a competitive edge in delivering personalized financial solutions.

- Tailwinds from Student Loan Refinancing

With the federal student loan moratorium ending, SoFi’s student loan refinancing segment is expected to see a surge in demand. This development could significantly boost the company’s revenue in the near term, adding to its already strong growth trajectory.

- Analyst Optimism

Many analysts remain bullish on SOFI stock, citing its growth potential and strategic initiatives. The company’s focus on profitability, coupled with its expanding market reach, has garnered positive sentiment from Wall Street. Some analysts have even raised their price targets, suggesting substantial upside potential for the stock.

Risks to Consider

While SoFi’s growth story is compelling, investors should be mindful of potential risks, such as regulatory changes, competition from other fintech players, and macroeconomic factors that could impact consumer borrowing trends. Additionally, the company’s path to sustained profitability remains a critical factor to monitor.

SoFi Technologies is revolutionizing the financial services industry with its innovative products and customer-centric approach. Its strong growth metrics, expanding product ecosystem, and strategic advantages make SOFI stock a promising investment for the future. While risks exist, the company’s long-term growth potential and market leadership position offer an attractive opportunity for investors seeking exposure to the burgeoning fintech sector.

Disclosure: I currently hold a position in SoFi Technologies, Inc. ($SOFI). This article reflects my personal opinions and analysis, and is not intended as financial advice. Please conduct your own research or consult a financial advisor before making any investment decisions.