Investing in the stock market has long been a cornerstone of personal finance and wealth building. Yet, for many beginners, the world of stocks can seem intimidating and complex. Understanding the fundamentals of how the stock market works is the first step toward making informed, confident investment decisions.

What Is the Stock Market?

The stock market is a platform where investors buy and sell shares of publicly traded companies. These shares represent ownership in a company, and their prices fluctuate based on factors such as company performance, industry trends, and broader economic indicators.

Major stock exchanges, such as the New York Stock Exchange (NYSE) and the Nasdaq, serve as centralized marketplaces where these transactions occur. Investors can participate through brokerage firms or online trading platforms, many of which now offer user-friendly apps and educational tools for beginners.

Why Do People Invest in Stocks?

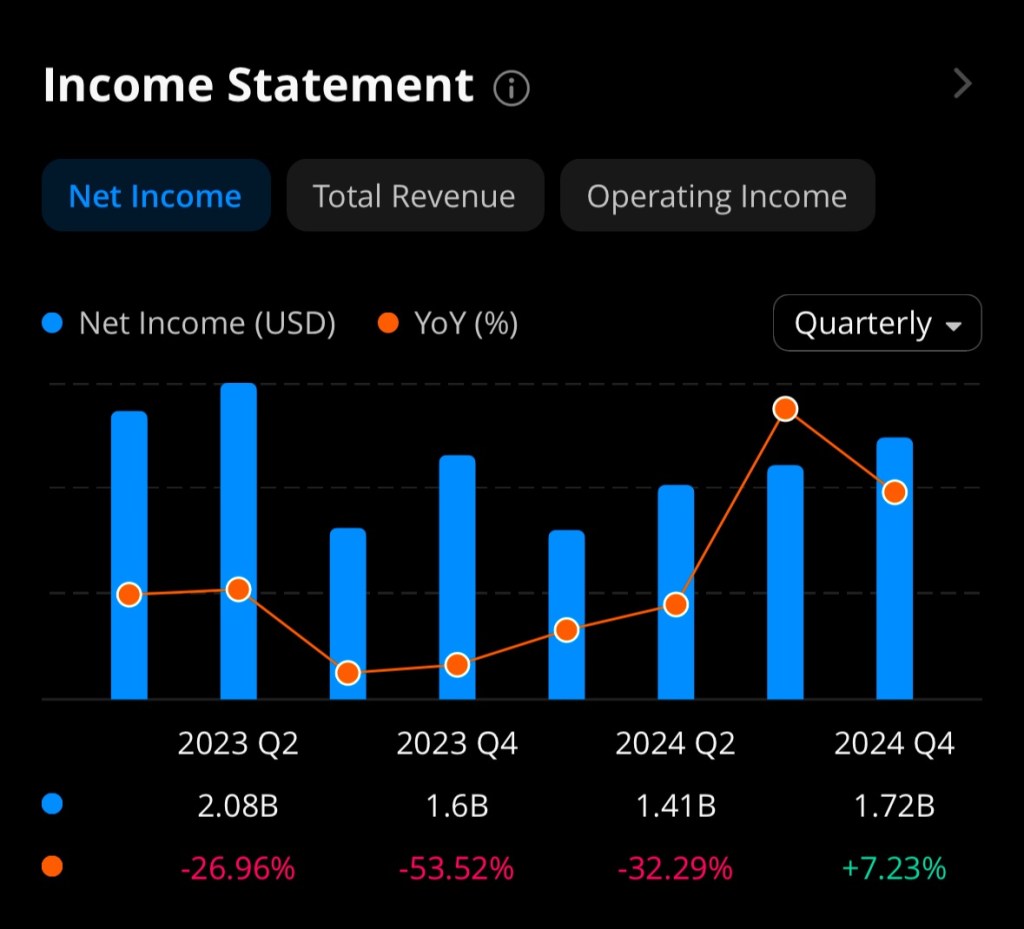

Stocks are a popular investment vehicle because they offer the potential for significant long-term returns. When you invest in a stock, you’re essentially betting on a company’s future success. If the company grows and becomes more profitable, the value of its shares typically increases, allowing investors to sell at a profit. Additionally, some stocks pay dividends—regular cash payments to shareholders—which can be a source of passive income.

Key Concepts for Beginners

To navigate the stock market successfully, new investors should become familiar with several essential concepts:

- Diversification: This strategy involves spreading your investments across different sectors or asset classes to reduce risk. Rather than putting all your money into a single stock, a diversified portfolio can help weather market volatility.

- Risk and Return: All investments carry some degree of risk. Generally, higher potential returns come with higher risk. Understanding your risk tolerance is crucial in shaping your investment strategy.

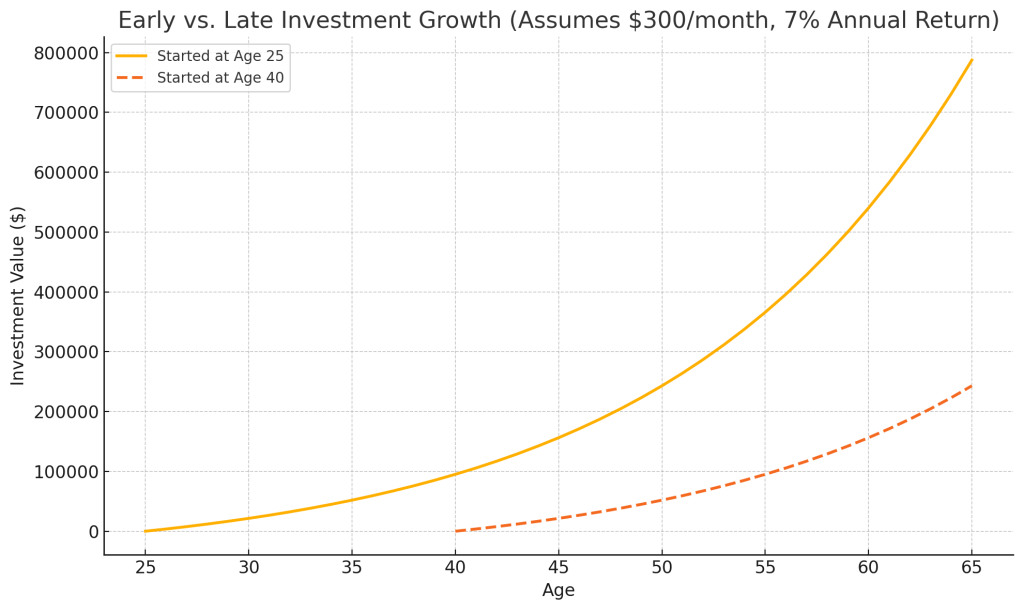

- Time Horizon: The length of time you plan to hold an investment affects your strategy. Long-term investors often ride out short-term market fluctuations in pursuit of steady growth over years or decades.

- Market Orders vs. Limit Orders: A market order buys or sells a stock immediately at the best available price, while a limit order sets a specific price at which you’re willing to buy or sell. Understanding these order types helps manage how you enter or exit investments.

Getting Started

Starting with investing doesn’t require large sums of money. Many platforms allow users to begin with as little as $10, and some offer fractional shares, letting you invest in expensive stocks like Amazon or Tesla with a small budget.

Experts recommend starting with index funds or exchange-traded funds (ETFs) for beginners. These funds track a market index, such as the S&P 500, and offer built-in diversification.

Stock market investing can be a powerful tool for building long-term wealth. While there are risks involved, gaining a solid understanding of the basics, maintaining realistic expectations, and staying informed can help investors make wise decisions. As with any financial decision, it’s also wise to consult a financial advisor to tailor a strategy that fits your personal goals and situation.

Whether you’re saving for retirement, a home, or future education expenses, learning how to invest smartly in the stock market is a valuable skill that pays dividends over time.