January 15, 2026 – Tampa, FL — The Baldwin Group (NASDAQ: BWIN), a leading independent insurance brokerage and advisory firm, is making notable strides in expanding its national footprint through a series of strategic acquisitions and corporate actions, moves that have attracted investor interest and helped support recent gains in its stock price.

In the last several months, Baldwin has completed multiple significant transactions. The company finalized its acquisition of Obie, a Chicago-based embedded landlord insurance distribution platform that has delivered extraordinary revenue growth since 2021. Obie’s insurance technology and nationwide distribution capabilities are expected to strengthen Baldwin’s real estate investor solutions and support broader adoption of embedded insurance offerings. (Stock Titan)

Shortly after the Obie announcement in mid-January 2026, Baldwin’s stock experienced a noticeable uptick, with shares rising over 3.6% on acquisition news a clear sign of investor confidence in Baldwin’s growth strategy. (IndexBox)

In early 2026, Baldwin also completed the acquisition of Capstone Group, a full-service Philadelphia-area insurance brokerage firm. Capstone expands Baldwin’s regional reach and adds new capabilities in risk management, group health, and ancillary benefit lines further diversifying Baldwin’s portfolio of services. (Investing.com)

Perhaps most transformational is the company’s $1.026 billion merger with CAC Group, a specialty and middle-market insurance brokerage transaction completed in early January 2026. This strategic combination positions Baldwin among the largest independent insurance advisory platforms in the U.S., adding unparalleled specialty expertise in sectors like cyber, financial lines, construction, natural resources, and private equity. (Stock Titan+1)

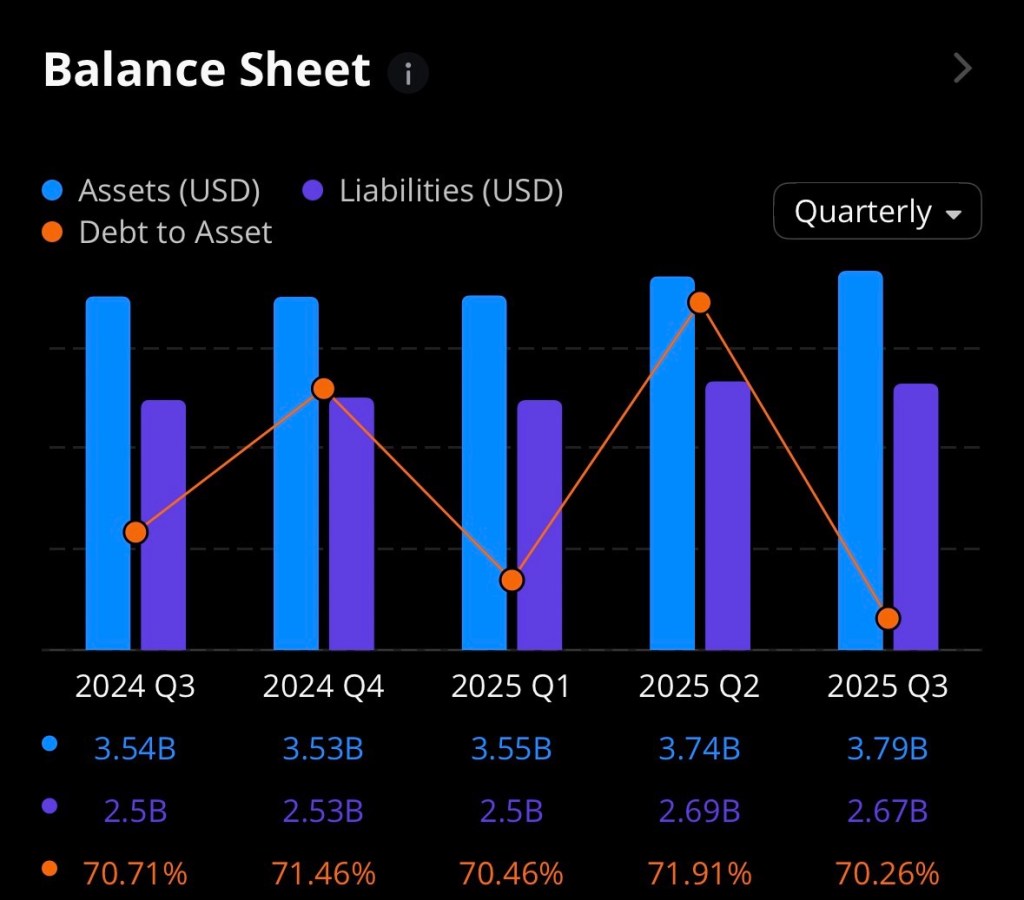

Financially, Baldwin has shown consistent growth in revenue and organic expansion across reporting periods in 2025. Third-quarter results reported revenue growth of 8% and continued adjusted earnings momentum, even as the company navigates through net losses on a GAAP basis. (Business Wire)

According to recent stock data, BWIN’s share price has reflected both volatility and opportunity. As of mid-January 2026, BWIN shares traded near $25.48, with a 52-week range of approximately $21.26 to $47.15. Analysts maintain a mixed outlook, with a consensus price target higher than current levels but tempered by risks related to integration and profitability challenges. (StockAnalysis)

Capital and Debt Strategy

Alongside these strategic acquisitions, The Baldwin Group has successfully priced an incremental $600 million Term Loan B, which upsizes its existing credit facility and provides flexibility to fund acquisitions and refinance existing borrowings. This capital strategy supports Baldwin’s expansion while managing leverage levels that accompany rapid growth. (Stock Titan)

Investment Considerations and Risks

Investors considering exposure to BWIN should be aware that, while the company is scaling rapidly, it continues to report net losses on a GAAP basis and carries a significant debt load tied to its acquisition strategy. Meanwhile, adjusted performance metrics demonstrate improving profitability trends that could support future valuation performance if realized. (Baldwin+1)

Disclosure: I hold a position in The Baldwin Group (BWIN), and the views expressed above reflect only general observations of recent developments and publicly available data.

References

IndexBox. (2026, January 15). Baldwin Insurance Group stock rises on Obie acquisition news.

Stockanalysis.com. (2026). The Baldwin Insurance Group (BWIN) Stock Price & Overview.

Business Wire. (2025). The Baldwin Group announces fourth quarter and full year 2024 results.

Business Wire. (2025, November 4). The Baldwin Group announces third quarter 2025 results.

StockTitan. (2026, January). The Baldwin Group completes acquisition of Obie and Capstone Group.

BeyondSPX. (2026, January). Baldwin Group completes $1.026 billion merger with CAC Group.

StockTitan. (2024). The Baldwin Group announces successful pricing of $600 million incremental Term Loan B.