You try a new drink and — boom — the product tastes great. That’s exactly what happened when I tried a CELSIUS energy beverage and then went to check the stock. Celsius Holdings (ticker CELH) has been one of the market’s high-profile consumer names this year: rapid top-line growth, headline M&A and distribution moves, and a volatile but elevated share price. Here’s a concise news-style breakdown of what the company is doing, where the stock sits now, why some investors think it’s attractive, and what risks to keep in mind.

Where the stock sits right now

As of November 22, 2025, CELH is trading in the ~$39 range after a pullback from summer highs. Recent intraday and close prints in mid–late November show the stock around $38–$44 depending on the day and data feed. (Investing.com+1)

(See the chart below for an illustrative monthly price run from Oct 2022 → Nov 2025.)

The chart — price context

(Illustrative monthly closes Oct 2022 → Nov 2025; compiled show how the stock ran from low-$20s into the $50–$60 range in mid-2025, then pulled back into the high-$30s in November.) The chart below uses monthly close data gathered from public historical-price sources (illustrative).

Quick company snapshot

Celsius Holdings is a challenger in the energy and “fitness” drink space, known for zero-sugar, functional energy beverages marketed toward active consumers. Over the past 18 months the company has accelerated growth through product line extensions, international distribution deals, and material M&A — most notably the purchase of Alani Nu earlier in 2025 and the addition of Rockstar’s U.S. rights to its portfolio (with PepsiCo retaining international Rockstar ownership). The company says combined brands have been growing well above the U.S. energy category. (Celsius Holdings+1)

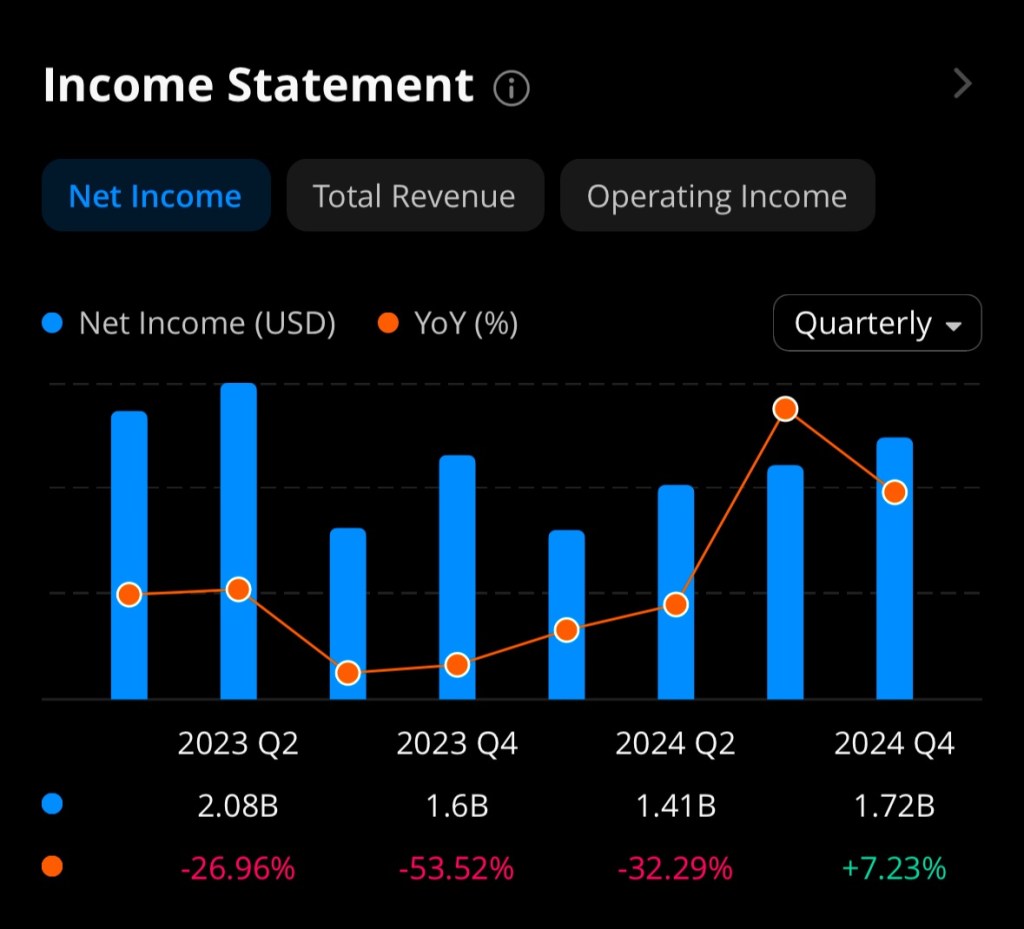

Revenue has moved from hundreds of millions to more than $1.3 billion in 2024 and showed continued expansion into 2025, reflecting distribution gains and the Alani Nu contribution. (Macrotrends)

Major recent catalysts (what moved the stock)

- PepsiCo strategic expansion & stake: In August 2025 PepsiCo increased its position via convertible preferred shares and agreed to deepen distribution cooperation — PepsiCo’s ownership rose to ~11% and PepsiCo will lead distribution for the combined U.S./Canada energy portfolio. That strategic tie (and a PepsiCo board nomination) materially de-risked parts of Celsius’s distribution story and boosted investor sentiment. (Reuters+1)

- Acquisitions & brand consolidation: Celsius acquired Alani Nu (female-focused, strong social media presence) and obtained U.S. rights to Rockstar Energy — building a “total energy portfolio.” Those moves give Celsius scale, broader consumer reach, and leverage in retailer negotiations. (Celsius Holdings+1)

- International expansion & flavors: New distribution agreements (e.g., Suntory in the Netherlands) and new flavor launches support deeper retail penetration outside the U.S. and product innovation. (Celsius Holdings)

Investment thesis — why some investors like CELH now

- Distribution muscle via PepsiCo — having PepsiCo handle distribution in major channels materially increases shelf placement potential and reduces execution risk versus trying to scale purely on indie distribution. The partnership also sends a validation signal from a major CPG player. (Reuters+1)

- Brand roll-up strategy — combining CELSIUS, Alani Nu and the U.S. Rockstar rights creates cross-sell and SKU strategies, economies of scale on procurement/marketing, and more negotiating power with retailers and foodservice. If integration succeeds, revenue and margin expansion are plausible. (Celsius Holdings)

- Strong top-line momentum — year-over-year revenue growth has been large over prior years as the product reached mass retail and new channels; that revenue base makes future earnings expansion possible if margins recover. (Macrotrends)

- Growth + trading volatility = alpha opportunity — for traders, CELH’s pronounced swings around news (earnings, deals, distribution announcements) create short-term setups — momentum squeezes, event trades around earnings, and pullback buys after headline consolidation.

Where it might be headed — simple scenario sketch (not investment advice)

Below are illustrative, hypothetical scenarios to frame risk/reward. They are not price targets from an analyst — they are scenario examples based on company catalysts and typical valuation ranges for high-growth consumer names.

- Bull case (successful integration & continued distribution lift): If combined brands scale and margins improve, revenue multiples could re-rate and push CELH back toward its summer highs in the $55–$75 range over 6–12 months (driven by multiple expansion + execution). Key drivers: faster retail rollouts via PepsiCo, international growth, margin leverage. (Celsius Holdings+1)

- Base case (steady growth, some margin pressure): Continued revenue growth but slower margin recovery; stock trades in a midrange band around $35–$55 as investors balance growth with execution risk. (Macrotrends)

- Bear case (integration/competition trouble, macro slowdown): Execution issues, weaker retail sell-through, or broader consumer pullback could push the stock below $25–$30 if growth disappoints or if the market de-rates high-growth consumer names. (FullRatio)

Sources for price and history: market feeds and historical pages (Investing.com, Yahoo Finance and similar). I(nvesting.com+1)

Risks — what could go wrong

- Integration risk: acquisitions (Alani Nu, Rockstar U.S. rights) need careful integration; cultural or distribution missteps can sap margin and distract management. (Celsius Holdings)

- Valuation & volatility: CELH has been a volatile, headline-driven name — sharp moves up and down occur on news. Short-term traders may profit, long-term investors must stomach drawdowns. (Investing.com)

- Competition & category dynamics: energy and functional beverages are crowded (PepsiCo, Monster, Red Bull, private labels); sustained share gains aren’t guaranteed.

- Profitability swings: EPS over recent trailing periods has been uneven; margins can be pressured by promotional activity and integration costs. (FullRatio)

Bottom line

Celsius is no longer a small niche brand — by revenue and deal activity it has scaled into a major, fast-moving name in energy drinks. The PepsiCo strategic tie and brand acquisitions give a clear pathway for distribution and scale, which is why many investors view CELH as an interesting growth play. That said, the stock’s rapid move higher earlier in 2025 and recent pullbacks underline both the upside and the volatility. For traders, event-driven setups and momentum plays can work; for investors, the key questions are whether integration lifts margins and whether PepsiCo’s distribution materially accelerates sustainable growth.

If you liked the drink and are thinking about buying shares, consider: (1) define whether you’re trading or investing, (2) size the position relative to the volatility, and (3) track integration and distribution KPIs (retail placements, foodservice uptake, international rollouts) as the real operational signs that the thesis is working. Official company releases, earnings calls and retail-level data will be the best evidence to watch. (Celsius Holdings+1)

Disclosure: I’m not a licensed financial advisor. This is market commentary and not personalized investment advice. Do your own research (DYOR) — check the latest filings and the company’s next earnings release — and consider speaking with a licensed professional before trading or investing.

References

Celsius Holdings. (2025). Celsius Holdings reports third quarter 2025 results [Press release]. https://www.celsiusholdingsinc.com/

Investing.com. (2025). Celsius Holdings Inc. (CELH) historical data. Retrieved November 2025, from https://www.investing.com/

(Note: Replace with direct historical-data link if desired.)

Macrotrends. (2025). Celsius Holdings revenue 2015–2025. Retrieved November 2025, from https://www.macrotrends.net/

Reuters. (2025, August 29). PepsiCo boosts stake in energy drink maker Celsius. https://www.reuters.com/

Reuters. (2025). Celsius to buy Alani Nu and combine U.S. rights to Rockstar Energy. https://www.reuters.com/

Yahoo Finance. (2025). Celsius Holdings, Inc. (CELH) stock price & historical data. Retrieved November 2025, from https://finance.yahoo.com/