History, business, and everyday life repeatedly prove the same truth: progress belongs to those who refuse to quit. Drive, quiet, relentless determination is what separates those who merely participate from those who endure and ultimately prevail.

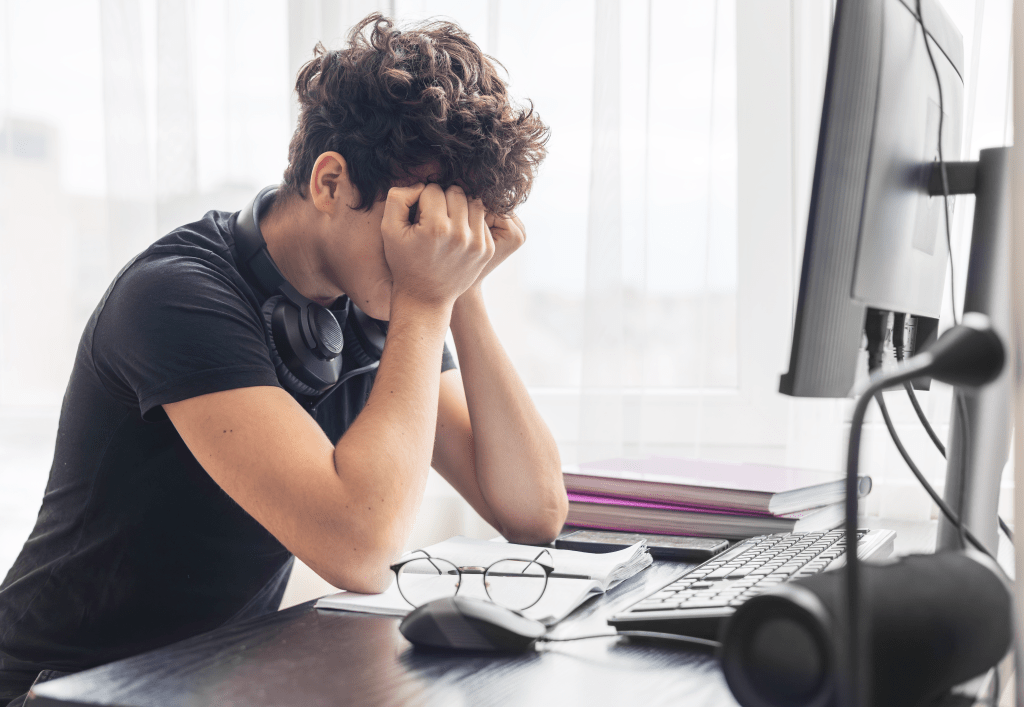

Giving up is often disguised as being “practical.” When obstacles appear, the easier option is to step back, lower expectations, or rationalize retreat. But difficulty is not a signal to stop; it is a signal that the work matters. The presence of resistance confirms that something meaningful is at stake. Without challenge, growth would be unnecessary and excellence impossible.

Drive matters because it compounds. Talent may open a door, but persistence is what keeps it open. Skills can be learned, strategies refined, and mistakes corrected—but only by those willing to stay in the game long enough to learn from failure. The most respected leaders, innovators, and professionals are rarely the most gifted at the start; they are the ones who continued when results were slow and recognition was absent.

There is also a deeper question that exposes the value of perseverance: if everyone could do it, why bother? The answer is simple… because not everyone will. Most people stop when progress becomes uncomfortable. They disengage when the outcome is uncertain. The willingness to push forward when others step aside is precisely what creates distinction. Effort loses its value only when it is common; perseverance remains rare.

Drive is not loud or glamorous. It shows up early, stays late, and keeps moving forward after setbacks. It is choosing consistency over comfort, discipline over excuses, and long-term purpose over short-term relief. It is understanding that success is not a straight line, but a series of recoveries.

The bottom line is clear: never give up. Not because the path is easy, but because quitting guarantees nothing changes. Progress, fulfillment, and meaning all require endurance. Those who keep going, especially when it would be easier not to, are the ones who ultimately shape their outcomes.

In the end, drive is not just about achieving a goal. It is about proving, day after day, that adversity does not get the final word.