1. Robust Financials & Market Leadership

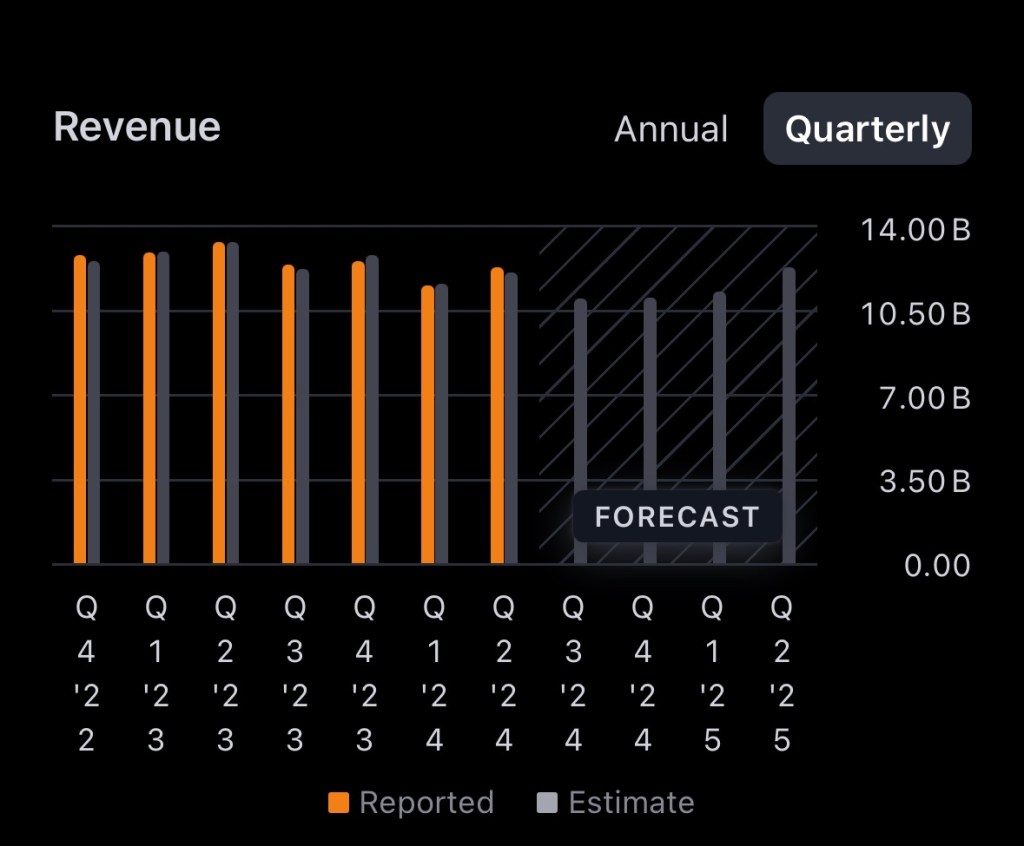

Airbnb delivered $11.1 billion in revenue for 2024, marking a 12% year-over-year increase, driven by higher booking volume and sustained average daily rates. Gross booking value surged to $81.8 billion (+10.6% YoY), while free cash flow hit $458 million in Q4 (18% margin) (AInvest).

Moreover, Airbnb’s global market share in short-term rentals climbed to 44% in 2024, up from 28% in 2019—far ahead of Booking.com (18%) and Expedia/Vrbo (9%) (AInvest).

2. Efficient Asset-Light Business Model

Airbnb’s strategy avoids owning properties, enabling high-margin operations. Their gross margin soared to approximately 83% in early 2024 (The Motley Fool), and their asset utilization metrics demonstrate tightening efficiency. Notably, the net fixed-asset turnover leaped from 12.5 in 2020 to 75.5 in 2024, reflecting strong revenue delivery with minimal asset base (Stock Analysis on Net).

3. Strategic Diversification into Services & Experiences

In recent quarters, Airbnb has repositioned itself beyond homestays into an integrated travel ecosystem-offering localized experiences, services like spa treatments, personal training, and lodging alternatives-all within its revamped app ecosystem (AInvestMarketWatch).

This diversification is not trivial: management projects that the “Services & Experiences” vertical could generate $1 billion in annual revenue within 3–5 years, backed by a $200–250 million investment earmarked for 2025 (AInvestMarketWatch).

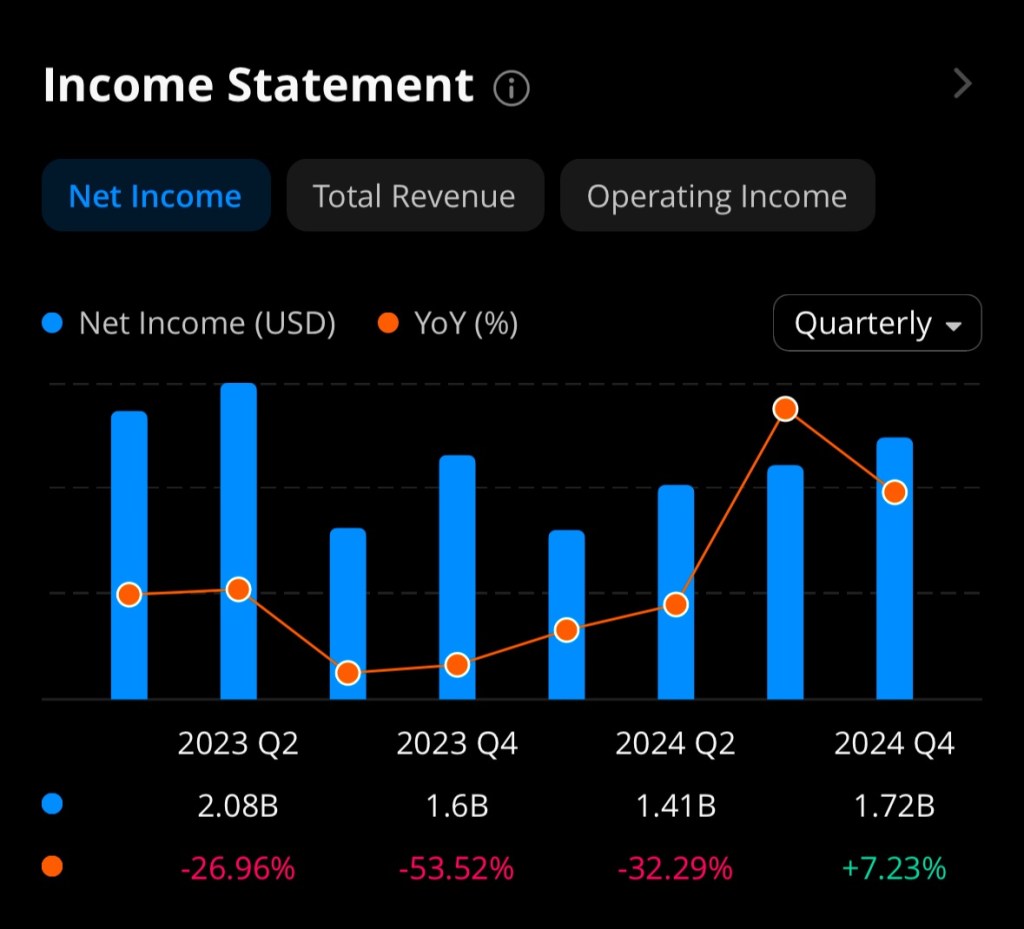

4. Recent Strong Earnings Momentum

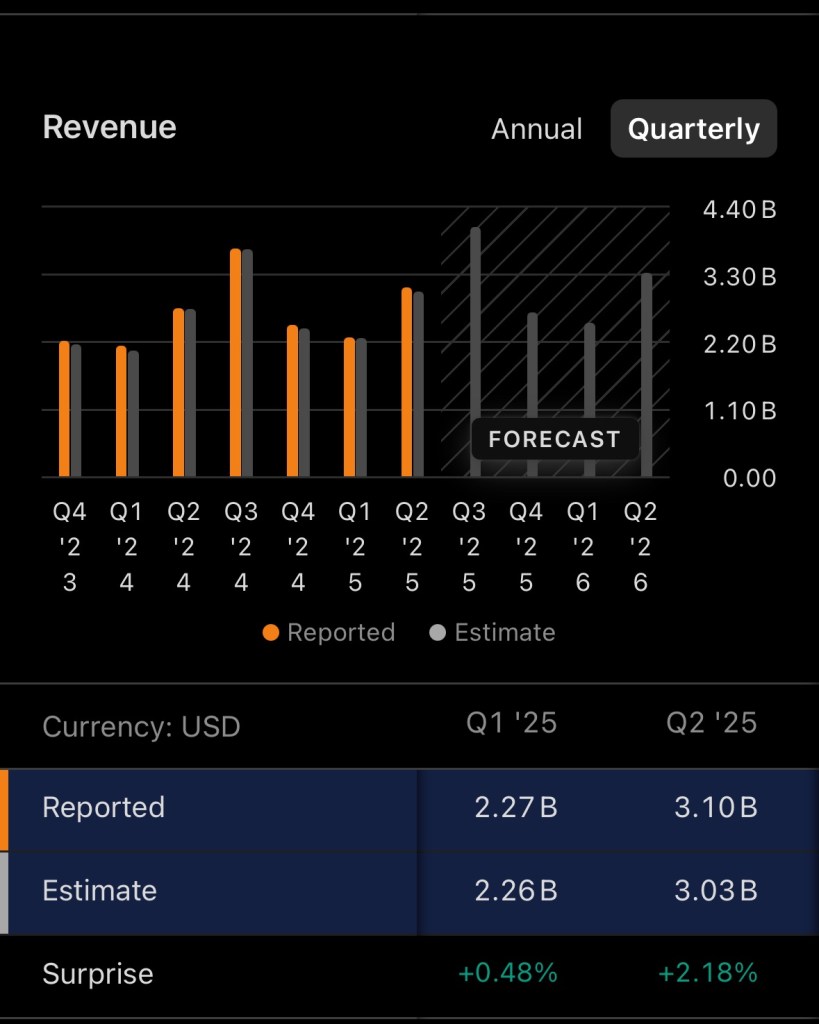

Airbnb outperformed expectations in Q2 2025:

- Earnings per share: $1.03 (+99% YoY vs. $0.94 expected)

- Revenue: $3.1 billion (+13% YoY)

- Gross bookings: $23.5 billion (+11% YoY)

Despite these strong results, caution around margin trajectory and investment pace weighed on sentiment, causing a ~7% dip in premarket trading Investors.

Simultaneously, long-term confidence remains steady-Akre Capital boosted its Airbnb allocation by 10%, signaling belief in the company’s growth trajectory (AInvest).

5. Favorable Industry Trends

In the broader travel space, analysts remain positive. A recent Barron’s feature highlights secular travel growth outpacing GDP and the rising demand for experiences. Although other travel players like hotels and airlines benefit, OTAs and platforms like Airbnb must adapt and diversify to stay competitive-something Airbnb is actively doing (Barron’s).

Industry Positioning: How Airbnb Compares

Here’s a snapshot comparing Airbnb to its main competitors in the travel lodging and experiences sector:

| Company | Market Share (2024) | Business Model | Key Differentiator |

|---|---|---|---|

| Airbnb | 44% | Asset-light platform | Large host network, high margins, diversified services |

| Booking.com | 18% | Hybrid (hotels + rentals) | Strong hotel partnerships, AI integration |

| Expedia/Vrbo | 9% | Hybrid OTA | Bundle offerings, traditional OTA presence |

Airbnb leads clearly in short-term rental share and continues to build stronger differentiation through vertical integration and digital enhancements (AInvest+1MarketWatchBarron’s).

Points of Caution

- Valuation: Forward P/E sits above 30x (e.g., ~34.5x), relatively high compared to peers like Expedia (~10x) or Booking (~18x) (The Motley FooleToro).

- Regulatory Headwinds: Local restrictions (e.g., New York City) and evolving laws could curtail growth in certain markets (eToroMarketWatch).

- Execution Risk: Scaling new offerings and achieving the $1 billion services target will take time—short-term margins may remain under pressure (AInvestInvestorsMarketWatch).

Final Take

Airbnb demonstrates the hallmarks of a high-upside, long-term growth stock:

- Strong financials, efficient operations, and leading share in a growing market.

- Expanding revenue streams beyond traditional listings.

- Strategic execution evidenced by earnings beats and fund manager conviction.

That said, elevated valuation and near-term execution risks suggest that patient investors may benefit from disciplined entry points or staged allocation.

Disclaimer: The author holds a position in $ABNB AIR BNB and this article should not be considered financial advice. Always conduct your own research before making any investment decisions.

References

Ainvest. (2025, February 8). Airbnb resilient growth: Deep dive into profitability, market share, and long-term competitive positioning. Ainvest. https://www.ainvest.com/news/airbnb-resilient-growth-deep-dive-profitability-market-share-long-term-competitive-positioning-2508

Ainvest. (2025, February 8). Airbnb’s strategic shift: Competing with hotels and expanding into services. Ainvest. https://www.ainvest.com/news/airbnb-strategic-shift-competing-hotels-expanding-services-2508

Ainvest. (2025, February 8). Akre Capital’s sudden 53% cut in American Tower: A signal or a slip? Ainvest. https://www.ainvest.com/news/akre-capital-sudden-53-cut-american-tower-signal-slip-2508

Barron’s. (2025, February 10). Travel stocks are surging. United, Delta, Hyatt, and more stand out. Barron’s. https://www.barrons.com/articles/travel-stocks-united-delta-hyatt-cb139268

EToro. (2024, August 12). Analyzing Airbnb’s Q2 2024 earnings report. eToro. https://www.etoro.com/news-and-analysis/market-insights/analyzing-airbnbs-q2-2024

Fool.com. (2025, January 26). I just bought Airbnb stock for the 1st time since the IPO. Here’s why. The Motley Fool. https://www.fool.com/investing/2025/01/26/i-just-bought-airbnb-stock-for-the-1st-time-since

Fool.com. (2025, February 27). 3 must-know reasons to buy Airbnb—and 1 reason to be cautious. The Motley Fool. https://www.fool.com/investing/2025/02/27/3-must-know-reasons-to-buy-airbnb-and-1-reason

Investors.com. (2025, August 13). Airbnb growth accelerates as Q2 earnings beat. Why the stock is falling anyway. Investor’s Business Daily. https://www.investors.com/news/technology/airbnb-stock-abnb-q2-2025-earnings-news

MarketWatch. (2025, February 5). Airbnb wants to be an “anything” app. The debate for investors hinges on these issues. MarketWatch. https://www.marketwatch.com/story/airbnb-wants-to-be-an-anything-app-the-debate-for-investors-hinges-on-these-issues-ca692140

Stock-Analysis-On.net. (2025). Airbnb Inc. long-term investment activity ratios. Stock Analysis On. https://www.stock-analysis-on.net/NASDAQ/Company/Airbnb-Inc/Ratios/Long-term-Investment-Activity