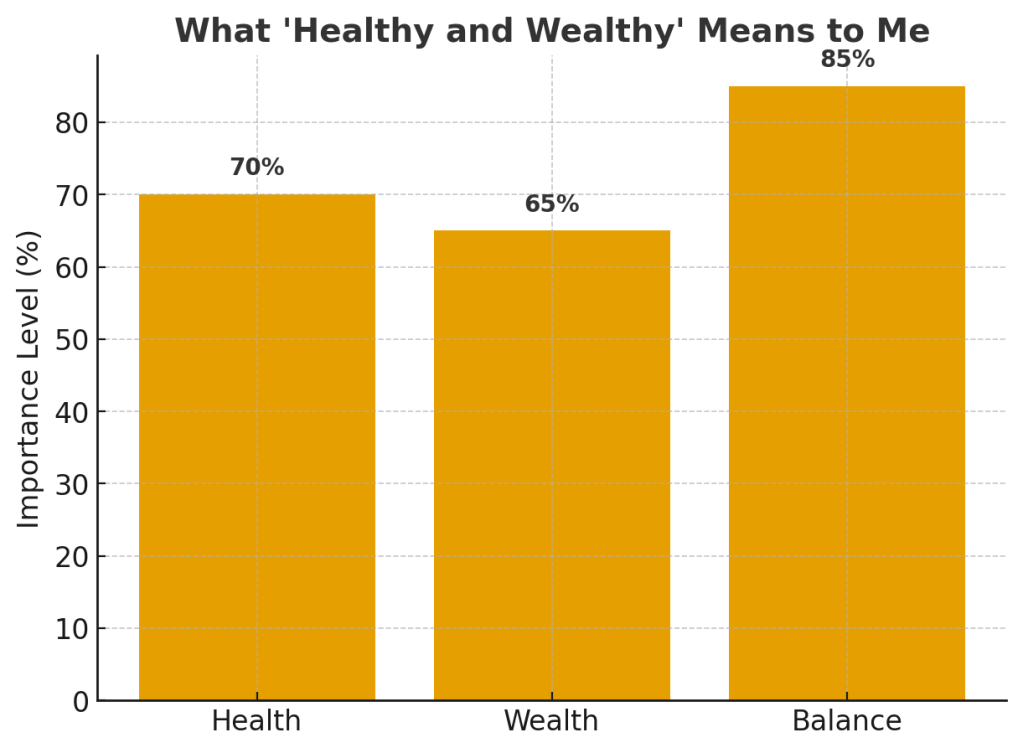

Success is often measured in numbers—bank accounts, investments, or even social media followers—the deeper meaning of being both healthy and wealthy can sometimes get lost. For me, the phrase isn’t about chasing material excess, but about balance, fulfillment, and sustainability in both body and mind.

Health as the Foundation

Health is more than the absence of illness; it’s the daily practice of treating your body and mind with respect. For me, that includes maintaining energy to do the things I love, fueling my body with good food, and taking time to reduce stress. Without health, even the greatest fortune feels empty. Wealth is meaningless if you don’t have the strength or clarity to enjoy it.

Wealth Beyond Money

When I think of being “wealthy,” I don’t immediately picture luxury cars or sprawling mansions. Instead, I see freedom—the freedom to spend time with loved ones, pursue passions, and give back to the community. True wealth, to me, includes financial security, but also peace of mind, strong relationships, and opportunities to grow.

Healthy and Wealthy Together

The two go hand in hand. Being healthy allows me to work toward financial stability with focus and determination. Being financially stable allows me to invest in my health—whether that’s quality healthcare, nutritious food, or the ability to take time off when I need it. Together, they create a cycle that builds not just a lifestyle, but a legacy.

A Personal Vision

Ultimately, “healthy and wealthy” means living in a way that supports long-term happiness. It’s about waking up each day with energy, knowing I have the resources to handle life’s challenges, and feeling grateful for both the small and big wins. To me, that’s real success—being rich in health, rich in love, and rich in purpose.