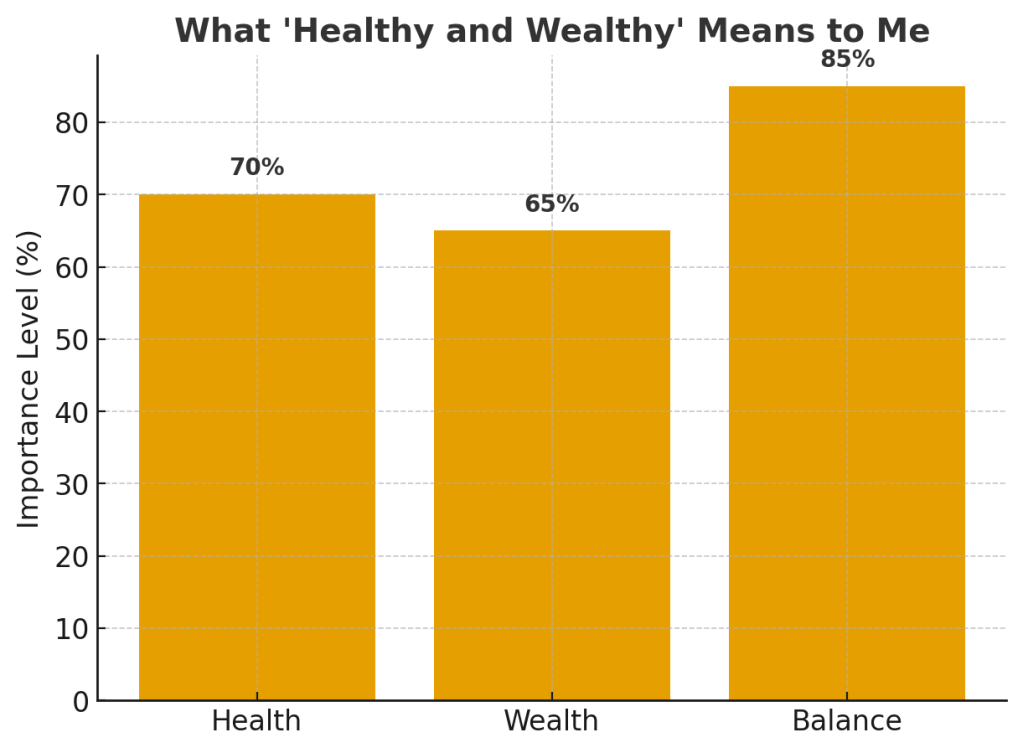

As the Christmas decorations come down and routines begin to normalize, the period between the holidays and the New Year offers a valuable opportunity for reflection and preparation. Rather than rushing into resolutions on January 1, many individuals are using this quieter window to assess their priorities and make intentional plans for the year ahead. With 2026 approaching, two areas stand out as especially important: personal health and financial stability.

The end of the holiday season often brings extra spending, disrupted sleep schedules, and indulgent eating. Resetting now allows people to enter the New Year with clarity, momentum, and realistic goals. Experts across healthcare and financial planning consistently emphasize that small, proactive steps taken early can compound into meaningful long-term benefits.

Health Considerations to Prioritize Going Into 2026

Maintaining health is not about drastic changes, but about sustainable habits that support longevity and quality of life. As the New Year approaches, individuals may want to focus on the following:

- Routine medical checkups: Scheduling annual physicals, dental visits, and vision exams early in the year helps catch issues before they become costly or serious.

- Nutrition reset: Transitioning from holiday eating to balanced, nutrient-dense meals supports energy levels and metabolic health.

- Consistent physical activity: Establishing a realistic exercise routine—whether walking, strength training, or flexibility work—improves both physical and mental well-being.

- Sleep discipline: Returning to regular sleep and wake times can significantly improve focus, immune function, and stress management.

- Stress management: Incorporating practices such as mindfulness, time blocking, or regular downtime can reduce burnout and improve overall resilience.

Wealth Considerations to Strengthen Financial Stability

The New Year is also an ideal time to reassess financial health and prepare for future opportunities and risks. Key areas to consider include:

- Budget review: Evaluating holiday spending and updating monthly budgets helps prevent financial drift early in the year.

- Emergency savings: Ensuring an emergency fund covers at least three to six months of expenses remains a foundational financial safeguard.

- Debt strategy: Creating or refining a plan to reduce high-interest debt can free up cash flow and reduce long-term financial stress.

- Retirement contributions: Reviewing contribution levels to retirement accounts and adjusting for income changes or new limits can significantly impact long-term outcomes.

- Insurance coverage check: Confirming that auto, home, health, and life insurance policies remain appropriate for current circumstances helps protect against unexpected setbacks.

- Investment alignment: Rebalancing portfolios to reflect updated goals, risk tolerance, and time horizons supports disciplined wealth-building.

Entering the New Year With Intention

Getting ready for the New Year does not require sweeping changes or unrealistic resolutions. Instead, it is about thoughtful preparation and alignment. By addressing health and wealth proactively, before January begins, individuals position themselves to move into 2026 with greater confidence, stability, and focus.

The days after Christmas are not just a cooldown from the holidays; they are a strategic pause. How that pause is used can make a measurable difference in the year ahead.