High Dividend Yield & Track Record

Target currently pays $4.56 annually ($1.14 per quarter), translating into a robust ~4.9% yield on today’s ~$93 share price (StockAnalysisTipRanks). The company has increased its dividend for 54 consecutive years, a hallmark Dividend King that inspires investor confidence (NasdaqStockAnalysis). Its most recent raise (1.8%) was declared in June 2025, effective with the $1.14 quarterly payment on Sept 1, 2025 (ex-div Aug 13) (Target Corporation).

Payout Coverage & Sustainability

Target retains a payout ratio of roughly 52%—meaning it distributes just over half of earnings as dividends, leaving room to reinvest and buffer downturns (KoyfinStockAnalysis). It also generated ~$2.9 B in free cash flow over the past 12 months, comfortably above its roughly $2 B annual dividend obligation (Nasdaq).

Valuation Lean vs Peers

At a P/E near 11×, Target trades well below peers like Walmart (~37×), suggesting the market has priced in current headwinds—offering potential upside if operational trends normalize over time (Nasdaq).

🧾 Balance Sheet Overview (as of latest trailing 12 mo / August 2025)

Based on S&P-compiled data (StockAnalysisMarketBeat):

| 📌 Metric | 💰 Value (USD mm) |

|---|---|

| Total Assets | ~$57.9 B |

| Cash & Equivalents | ~$4.34 B |

| Inventories | ~$12.9 B |

| PPE (net) | ~$33.6 B |

| Total Liabilities | ~$42.4 B |

| └ Current Liabilities | ~$19.2 B |

| └ Long-Term Debt | ~$15.4 B |

| Shareholders’ Equity | ~$15.4 B (book value ~ $33.9/share) |

| Net Debt | ~$16.1 B |

Target maintains a healthy asset base, anchored by substantial property, inventory, and cash buffers. Long‐term debt is sizable but manageable given recurring cash flow. Equity has grown steadily (~$14.7 B in FY 2024 to ~$15.4 B TTM), with tangible book value per share near $34—over one-third of share price (StockAnalysis).

🔍 Business Momentum & Outlook

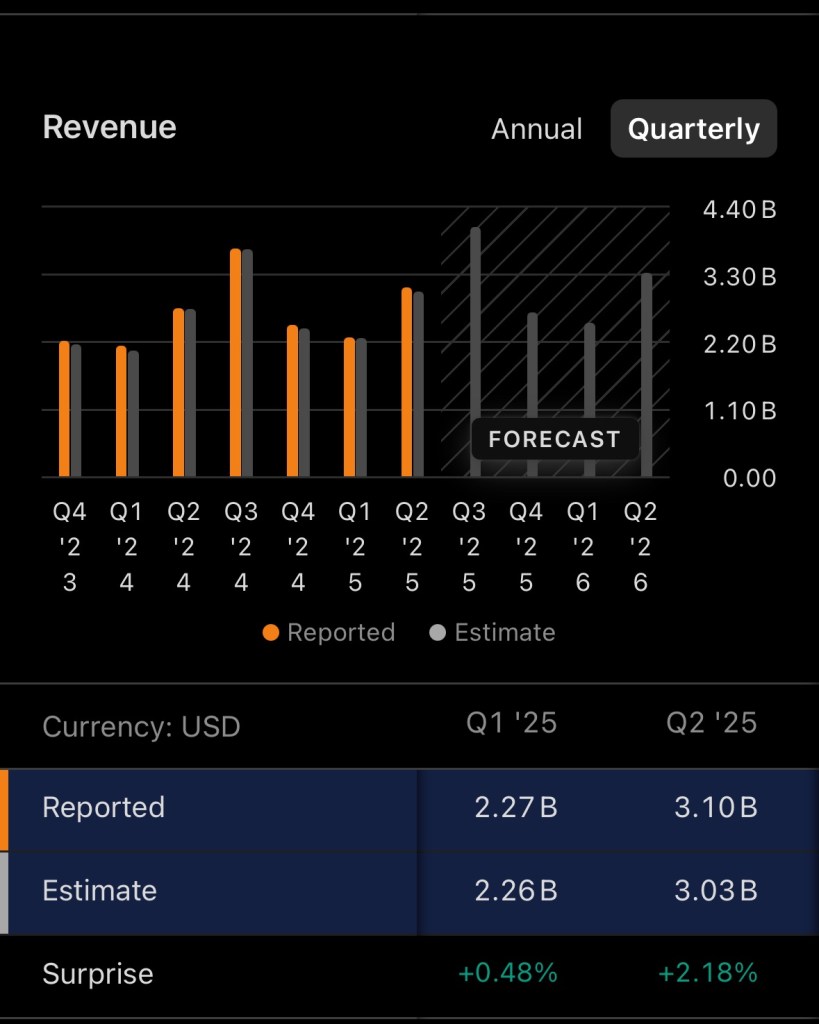

- Recent performance (Q2 FY 2025):

Net sales declined ~0.9% YoY and comp sales fell ~1.9%, though digital sales rose ~4.3%. Operating income slipped ~19% to $1.3 B. Full-year EPS guidance remains at $8.00–$10.00 GAAP (adjusted ~$7–$9) (Target Corporation). - Strategic tailwinds:

Investments in same-day fulfillment via Shipt, modernization of logistics, and omnichannel integration are expected to drive margin recovery (expected to improve toward ~6% by FY 2028) (University of Iowa).

💡 Investment Case: Why Consider TGT

- Reliable, high income: ~4.9–5.0% yield, backed by decades of increases.

- Dividend sustainability: Strong cash flow vs payout; modest payout ratio.

- Undemanding valuation: Trading at low P/E, offering value if business stabilizes.

- Solid balance sheet: Ample liquidity, reasonable leverage, growing equity.

- Long-term turnaround potential: Operational improvements could bolster margins and share price over time.

Risks include macro-sensitive retail environment, margin pressures, inventory mismanagement, and stiff competition. However, the dividend acts as a buffer while strategic moves take root.

📌 Bottom Line

For income-focused investors looking to pair dividend yield with capital appreciation potential, Target (TGT) stands out as a compelling blended opportunity. Its long-standing dividend credibility, backed by solid free cash flow and a durable balance sheet, makes it a defensive anchor in a portfolio. Coupled with low valuation and a clear path to operational recovery, TGT offers both yield today and upside tomorrow.

Disclosure: I currently hold a position in Target Corporation (NASDAQ: $TGT). This article reflects my personal opinions and analysis, and is not intended as financial advice. Please conduct your own research or consult a financial advisor before making any investment decisions.

References

Corporate Target. (2025, June 12). Target Corporation increases quarterly dividend by 1.8 percent. Target Corporate. https://corporate.target.com/press/release/2025/06/target-corporation-increases-quarterly-dividend-by-1-8-percent

Corporate Target. (2025, August 21). Target Corporation reports second quarter 2025 earnings. Target Corporate. https://corporate.target.com/press/release/2025/08/target-corporation-reports-second-quarter-earnings

Koyfin. (2025). Target Corp (TGT) dividend overview. Koyfin. https://www.koyfin.com/company/tgt/dividends/

MarketBeat. (2025). Target financials (NYSE: TGT). MarketBeat. https://www.marketbeat.com/stocks/NYSE/TGT/financials/

Nasdaq. (2025, August 27). 1 green flag for Target stock right now. Nasdaq. https://www.nasdaq.com/articles/1-green-flag-target-stock-right-now-0

Stock Analysis. (2025). Target (TGT) dividend history and growth. Stock Analysis. https://stockanalysis.com/stocks/tgt/dividend/

Stock Analysis. (2025). Target balance sheet (TGT). Stock Analysis. https://stockanalysis.com/stocks/tgt/financials/balance-sheet/

TipRanks. (2025). Target dividend and payout ratio (TGT). TipRanks. https://www.tipranks.com/stocks/tgt/dividends

University of Iowa – Tippie College of Business. (2024). Target Corporation equity research report. https://www.biz.uiowa.edu/henry/download/f24_TGT.pdf