Passing on an inheritance is about far more than money. It’s about clarity, continuity, and care for the people you leave behind. Too often, families are left navigating confusion, legal delays, and emotional stress because preparation was postponed. From my perspective, the most successful inheritances are not the largest, they’re the most organized.

Below are several essential steps you should take now to ensure your assets are transferred smoothly and according to your wishes.

1. Get Your Estate Documents in Order

At the foundation of any inheritance plan are clear, legally valid documents. A will outlines who receives what, while trusts can help manage assets during your lifetime and after your death.

Key documents to consider:

- Last will and testament

- Revocable or irrevocable trusts (if appropriate)

- Durable power of attorney

- Healthcare proxy or living will

These documents should be reviewed periodically, especially after major life events such as marriage, divorce, births, or deaths in the family.

2. Take Inventory of Your Assets

One of the biggest challenges heirs face is simply figuring out what exists. Creating a comprehensive inventory removes uncertainty and saves time.

Your inventory should include:

- Bank and investment accounts

- Retirement plans (401(k), IRA, pensions)

- Real estate and business interests

- Life insurance policies

- Digital assets (online accounts, crypto, subscriptions)

- Personal property of significant value

Include account numbers, institutions, and contact information but store this securely.

3. Review Beneficiaries and Titling

Many assets pass outside of a will through beneficiary designations. If these are outdated, your intentions may not be honored.

Make sure:

- Beneficiary designations align with your current wishes

- Assets are titled correctly (individual, joint, trust-owned)

- Contingent beneficiaries are named

This step alone can prevent costly legal disputes.

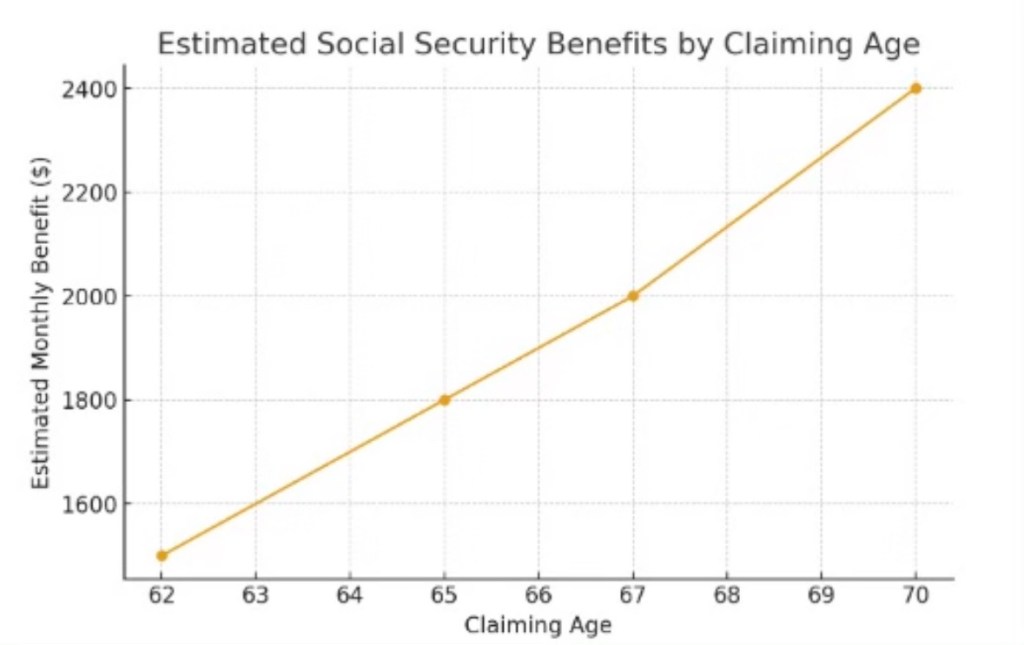

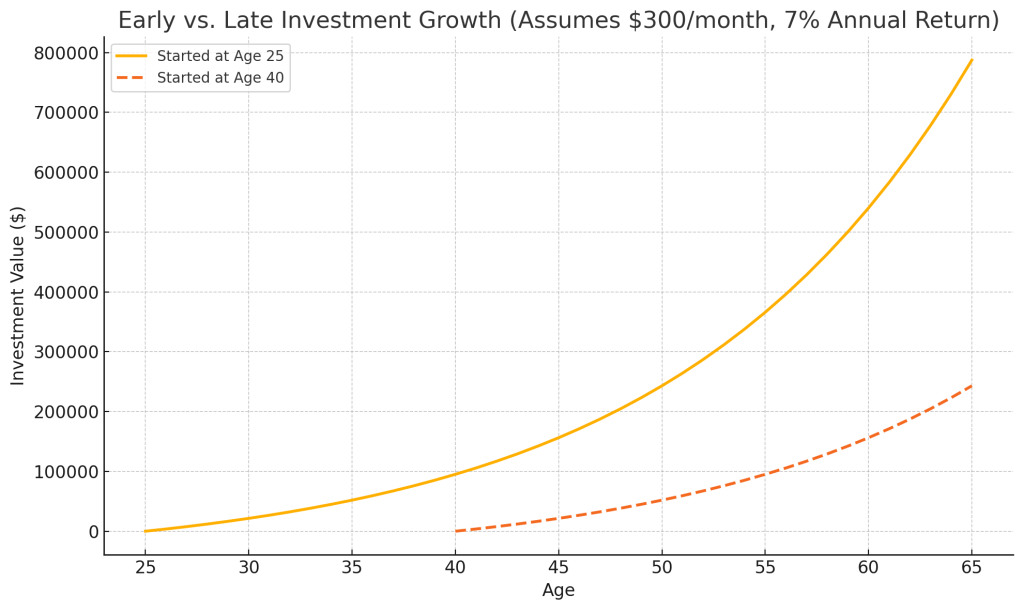

4. Plan for Taxes and Expenses

While not all estates are subject to estate taxes, other costs, such as income taxes, final medical bills, and administrative expenses can reduce what heirs receive.

Consider:

- Consulting a tax or estate professional

- Using trusts or gifting strategies where appropriate

- Ensuring sufficient liquidity to cover short-term expenses

Proactive planning helps preserve more of your legacy.

5. Communicate Your Intentions

One of the most overlooked steps is communication. A thoughtful conversation with heirs can prevent misunderstandings and resentment later.

You don’t need to disclose exact dollar amounts, but explaining:

- Why decisions were made

- Who is responsible for what

- Where documents are stored

can make a meaningful difference.

Inheritance Preparation Checklist

Use this checklist as a quick reference and update it regularly:

- Create or update your will

- Establish trusts if appropriate

- Assign power of attorney and healthcare proxy

- List all financial, physical, and digital assets

- Review and update beneficiaries

- Confirm proper asset titling

- Plan for taxes, debts, and final expenses

- Organize and securely store important documents

- Communicate your plan with key family members

- Review your plan every 2–3 years or after major life changes

Final Thought

Preparing to pass on an inheritance is one of the most responsible financial steps you can take. It’s not just about wealth, it’s about reducing stress, protecting relationships, and ensuring your life’s work continues to serve the people you care about most. A little planning today can make an immeasurable difference tomorrow.