Five9, Inc. is a leading provider of cloud-based contact center software, operating within the rapidly expanding Contact Center as a Service (CCaaS) market. As enterprises continue to modernize customer engagement through artificial intelligence and cloud infrastructure, Five9’s platform positions the company at the intersection of digital transformation and customer experience optimization (Five9, Inc., 2025).

Company Overview

Founded in 2001, Five9 delivers cloud-native contact center solutions that integrate voice, digital channels, workforce optimization, and AI-powered automation. The company’s offerings are designed to help enterprises improve customer satisfaction while reducing operational complexity and costs. Five9 primarily serves mid-market and large enterprise customers, with a business model heavily weighted toward recurring subscription revenue (Trefis, 2025).

The CCaaS market continues to benefit from long-term secular tailwinds, including remote work adoption, omnichannel customer engagement, and enterprise investment in AI-driven customer support solutions (Seeking Alpha, 2025).

Financial Performance and Health Snapshot

Revenue and Growth

Five9 reported record full-year revenue exceeding $1 billion, reflecting consistent double-digit growth driven by enterprise adoption and expanding AI-enabled services (Five9, Inc., 2024). Recent quarterly results show revenue growth in the low double-digit range, signaling moderation from prior hypergrowth years but still outperforming many legacy contact center competitors (Investing.com, 2025a).

Profitability and Margins

Operational efficiency has improved as the company scales. Adjusted EBITDA margins have expanded into the low-to-mid 20% range, supported by higher software margins and disciplined cost management (Seeking Alpha, 2025). While GAAP profitability remains pressured by stock-based compensation, non-GAAP earnings and free cash flow generation have shown steady improvement (NASDAQ, 2025).

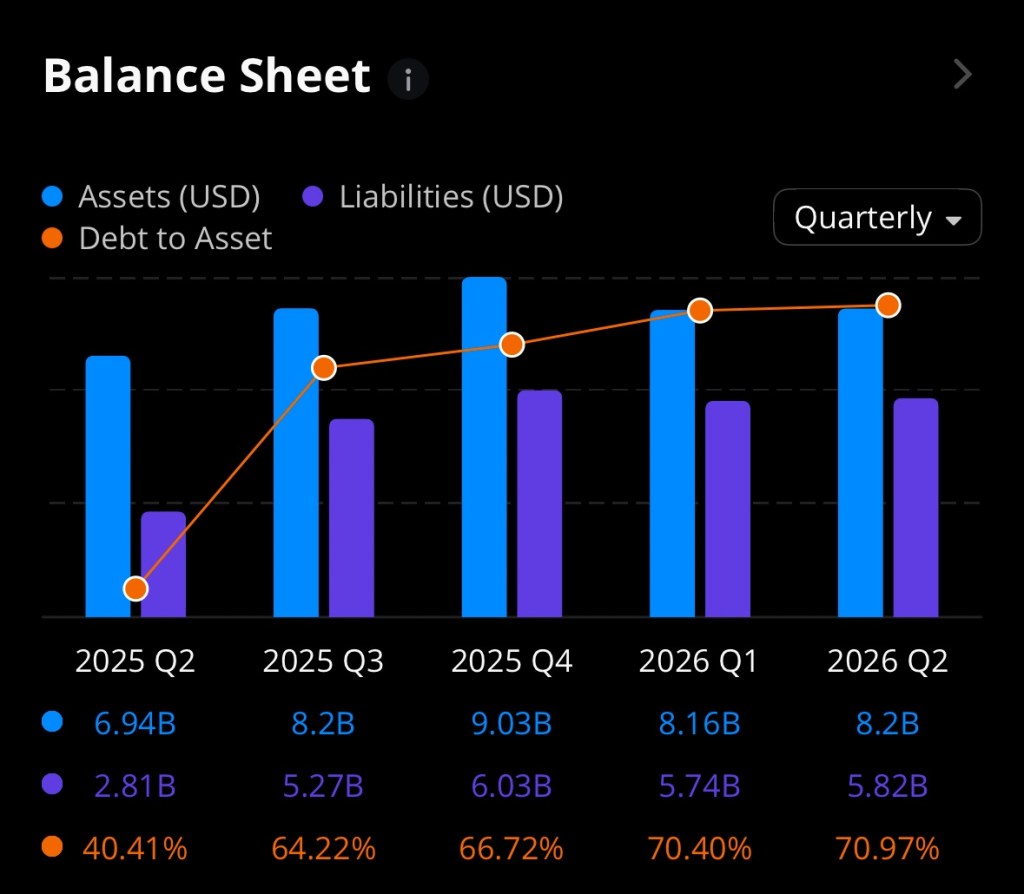

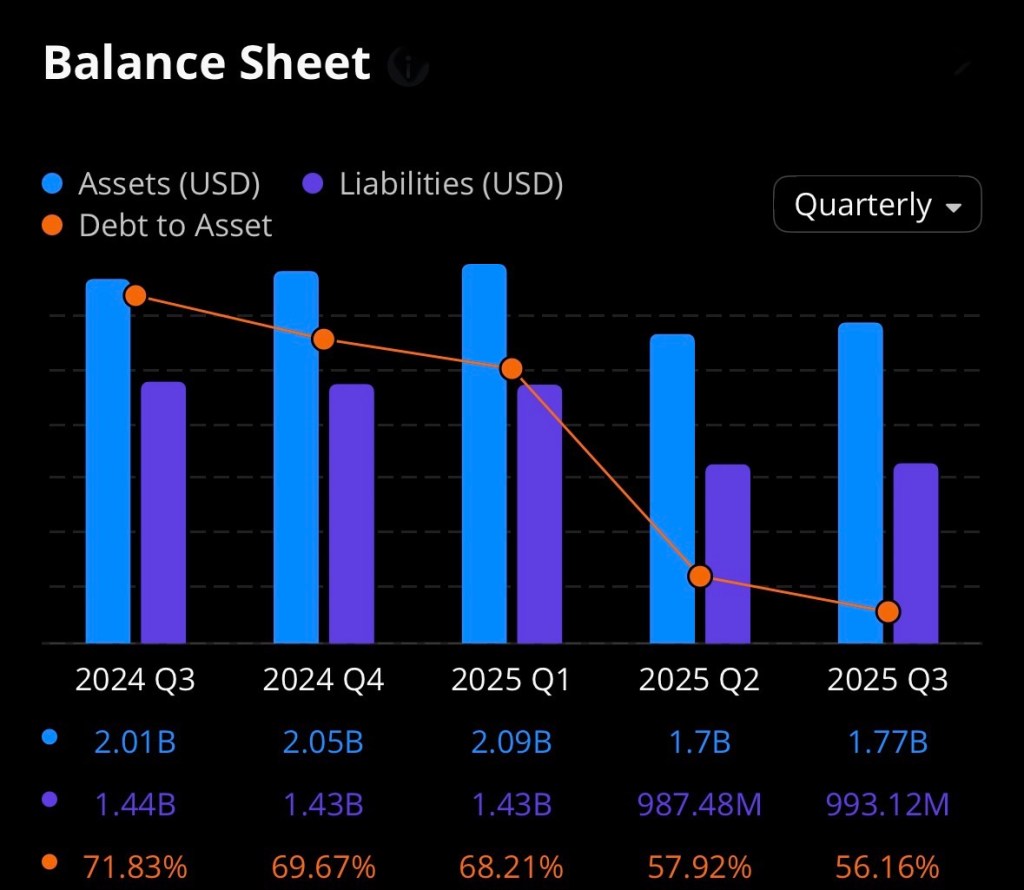

Balance Sheet Strength

Five9 maintains a solid liquidity position, supported by cash reserves and manageable debt levels. The company has also authorized share repurchase activity, signaling management confidence in long-term value creation despite near-term stock volatility (Investing.com, 2025b).

Stock Price and Market Performance

As of late 2025, Five9 shares have experienced significant price compression, trading well below prior cycle highs. The stock recently touched a 52-week low, reflecting broader SaaS sector multiple contraction, investor caution around growth deceleration, and macroeconomic uncertainty (Investing.com, 2025c).

Despite the decline, valuation metrics such as price-to-sales and enterprise-value-to-revenue ratios now sit below historical averages for high-quality SaaS peers, suggesting the market may be discounting future growth more aggressively than current fundamentals justify (NASDAQ, 2025).

Why Five9 May Be an Attractive Investment Heading Into 2026

1. AI-Driven Product Expansion

Five9 continues to embed artificial intelligence across its platform, including intelligent virtual agents, real-time analytics, and automation tools. AI-related revenue has grown faster than the company’s core business, positioning Five9 to benefit from rising enterprise demand for scalable, automated customer engagement (Seeking Alpha, 2025).

2. Recurring Revenue Visibility

A substantial majority of Five9’s revenue is derived from subscriptions, providing predictable cash flows and improved earnings visibility. This recurring model is a key attribute investors seek in mature SaaS companies navigating economic cycles (Trefis, 2025).

3. Margin Expansion Potential

As growth stabilizes and operating leverage improves, Five9 has the potential to further expand margins, particularly if AI-driven products command premium pricing and reduce customer churn (NASDAQ, 2025).

4. Strategic Optionality

Ongoing consolidation within the cloud communications and enterprise software space creates potential upside through partnerships, acquisitions, or strategic interest from larger technology firms seeking to expand their customer experience portfolios (Investing.com, 2025b).

Risks and Considerations

While the long-term outlook remains constructive, investors should remain mindful of several risks. These include intensified competition from well-capitalized rivals, potential delays in enterprise spending, and the possibility that revenue growth continues to decelerate more rapidly than expected (Investing.com, 2025a). Additionally, broader market sentiment toward technology stocks could continue to influence valuation multiples independent of company performance.

Conclusion

Five9 enters 2026 as a financially stable, AI-focused SaaS company operating in a structurally growing market. Although near-term growth has moderated and share price volatility remains elevated, improving margins, recurring revenue strength, and expanding AI capabilities provide a foundation for potential long-term value creation. For investors willing to tolerate short-term uncertainty, Five9 represents a company where fundamentals and market valuation may diverge heading into the next phase of the cloud communications cycle (Five9, Inc., 2025; Seeking Alpha, 2025).

Disclosure:

I do not hold, directly or indirectly, any equity position in Five9, Inc. (NASDAQ: FIVN) at the time of writing. This article is provided for informational and educational purposes only and should not be construed as investment advice, a recommendation to buy or sell securities, or a solicitation of any investment strategy. Readers should conduct their own due diligence and consult a qualified financial professional before making any investment decisions.

References (APA Format)

Five9, Inc. (2024). Five9 reports record full-year revenue exceeding $1 billion. Five9 Investor Relations.

https://investors.five9.com

Five9, Inc. (2025). Quarterly earnings and financial results. Five9 Investor Relations.

https://investors.five9.com/financials

Investing.com. (2025). Five9 stock hits 52-week low amid market volatility.

https://www.investing.com

Investing.com. (2025). Cantor Fitzgerald lowers Five9 price target citing growth moderation.

https://www.investing.com

NASDAQ. (2025). Five9, Inc. (FIVN) stock quote, financials, and performance data.

https://www.nasdaq.com

Seeking Alpha. (2025). Five9: AI-driven contact center growth and margin expansion.

https://www.seekingalpha.com

Trefis. (2025). Five9 business model, revenue mix, and valuation analysis.

https://www.trefis.com