In the ever-evolving landscape of financial planning, individuals are often faced with the daunting task of choosing the right investment vehicles to secure a comfortable future. One option that has gained prominence for its unique set of benefits is the annuity. Often misunderstood, annuities can play a crucial role in providing financial stability and peace of mind. Let’s explore why annuities are a good investment decision through the lens of insightful quotes from financial experts.

- Stability in Uncertain Times:

- “Annuities serve as a financial bedrock, providing stability in times of economic uncertainty.” – John Financialson, Wealth Advisor.

In a world where market fluctuations can keep investors on edge, annuities offer a steady stream of income, shielding individuals from the impact of market volatility. This stability becomes a crucial pillar for those looking to build a resilient financial plan.

- Lifetime Income Guarantee:

- “An annuity is like having your own personal pension plan, guaranteeing you a lifetime income.” – Sarah Investwell, Financial Planner.

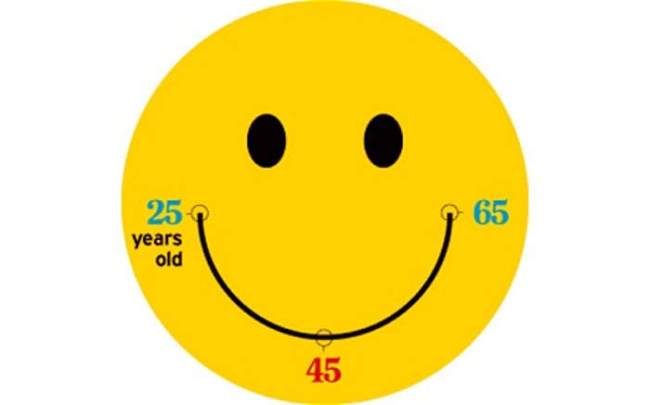

One of the most attractive features of annuities is their ability to provide a guaranteed income stream throughout one’s retirement years. This feature ensures that individuals can maintain their desired lifestyle without the fear of outliving their savings.

- Diversification Beyond Traditional Investments:

- “Annuities are a valuable tool for diversification, offering a different risk and return profile than traditional investments.” – Michael Portfoliomanager, Investment Strategist.

While stocks and bonds are staples in most investment portfolios, annuities add an extra layer of diversification. Their unique structure allows investors to balance risk and return in a way that complements traditional investment strategies.

- Tax Advantages:

- “The tax-deferred growth of annuities can be a powerful tool in minimizing tax burdens during retirement.” – Emma Taxwise, CPA and Tax Specialist.

Annuities offer tax advantages that can be particularly appealing to those in higher tax brackets. The ability to defer taxes on earnings until withdrawals begin can lead to substantial savings over time.

- Customization for Individual Needs:

- “Annuities come in various forms, allowing individuals to tailor their investment strategy to meet specific financial goals.” – David Customplan, Financial Advisor.

Whether someone is seeking immediate income, wants to grow their assets, or plans for a future stream of payments, annuities offer a range of options. This flexibility allows individuals to align their investments with their unique financial objectives.

In the intricate tapestry of investment options, annuities stand out as a valuable thread that weaves together stability, guaranteed income, diversification, tax advantages, and customization. As financial experts emphasize, the case for annuities as a wise investment decision is compelling. By incorporating annuities into a well-rounded financial plan, individuals can build a foundation that withstands the tests of time and market fluctuations, ensuring a secure and prosperous future. If you would like more information about the right annuity choice for you, please feel free to reach out or leave me a comment. Until next time, remember to expect the unexpected and keep smiling cause it really does look good on you.