In recent events, the convergence of Artificial Intelligence (AI) and financial markets has ushered in a new era of investment dynamics, propelling both traditional stocks and cryptocurrencies to unprecedented heights. With AI algorithms increasingly driving decision-making processes, investors are witnessing remarkable shifts in market behaviors and opportunities.

Stock Market Surge:

AI’s influence on stock markets has been profound, with algorithms swiftly analyzing vast datasets to predict market trends and identify lucrative investment opportunities. One notable example is the meteoric rise of Quantitative Hedge Funds like Renaissance Technologies, which extensively leverage AI for trading strategies. These funds have consistently outperformed traditional counterparts, showcasing AI’s prowess in navigating complex market landscapes.

Furthermore, AI-powered trading platforms such as Alpaca and Robinhood have democratized access to sophisticated investment tools, empowering retail investors to make data-driven decisions previously reserved for institutional players. These platforms utilize machine learning algorithms to provide personalized investment recommendations and real-time market insights, leveling the playing field for investors of all backgrounds.

Crypto Craze Amplified:

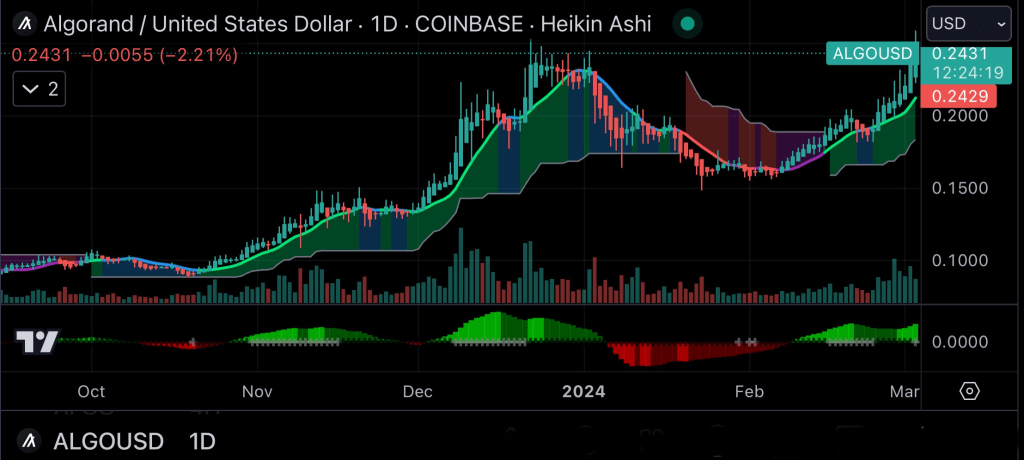

In the realm of cryptocurrencies, AI has emerged as a game-changer, fueling unparalleled growth and innovation. AI-driven trading bots, like those offered by companies such as Cryptohopper and 3commas, autonomously execute trades based on market indicators and user-defined strategies, optimizing trading efficiency and profitability.

Moreover, AI-powered analytics platforms such as IntoTheBlock and Santiment provide comprehensive market intelligence, offering investors invaluable insights into market sentiment, token liquidity, and price volatility. These tools enable investors to make informed decisions in the highly volatile crypto landscape, mitigating risks and maximizing returns.

Real-world Applications:

The integration of AI into financial markets extends beyond trading, with applications ranging from risk management to fraud detection. Banks and financial institutions utilize AI algorithms to assess credit risk, detect fraudulent transactions, and enhance customer service through chatbots and virtual assistants.

Additionally, AI-driven predictive analytics models are revolutionizing investment banking, enabling analysts to forecast market trends, evaluate asset valuations, and optimize portfolio allocations with unparalleled accuracy.

Expert Insights:

Dr. Emily Chen, a leading AI researcher at Stanford University, underscores the transformative potential of AI in financial markets, stating, “AI algorithms possess the ability to process vast amounts of data and identify intricate patterns that elude human analysts. This capability empowers investors to make data-driven decisions and capitalize on emerging opportunities in dynamic market environments.”

Looking Ahead:

As AI continues to evolve and permeate every facet of financial markets, its impact is poised to reshape investment landscapes on a global scale. However, amidst the rapid advancements, regulatory oversight and ethical considerations remain paramount to safeguarding market integrity and investor interests.

The fusion of AI and financial markets heralds a new epoch of innovation and opportunity, where data-driven insights and predictive analytics drive investment strategies, unlocking untapped potentials in both traditional stocks and cryptocurrencies.

About the Author:

David Dandaneau is a insurance agent that covers the insurance and financial services industry. He is known for his insightful analysis and comprehensive coverage of market trends and regulatory developments.

References:

- Investopedia – “Quantitative Trading” – https://www.investopedia.com/terms/q/quantitative-trading.asp

- Forbes – “How AI Is Transforming Cryptocurrency Trading” – https://www.forbes.com/sites/lawrencewintermeyer/2023/09/14/you-cant-spell-blockchain-without-ai-ai-will-dominate-crypto-trading/?sh=78d5c3dd6ede

- Bloomberg – “AI Hedge Funds Trounce Rivals” – https://www.bloomberg.com/news/articles/2024-02-08/quant-hedge-funds-trounce-rivals-amid-china-rout?embedded-checkout=true

- CNBC – “AI in Banking: The Real Benefits of AI & Machine Learning in Finance” – https://www.cnbc.com/2023/12/18/generative-ai-has-landed-on-wall-street-heres-how-it-can-help-propel-massive-revenue-growth-.html

- Santiment Blog – “The Rise of AI in Crypto Trading”