Nike’s stock has experienced a significant decline over the past year, with shares dropping from a high of $175 to approximately $77, marking a decrease of over 55%.

Factors Contributing to the Decline

- Overvaluation Concerns: In 2021, Nike’s stock reached an all-time peak at over $170 per share, a valuation some experts considered overhyped. The market is now adjusting to more realistic valuations. sneakerfreaker.com

- Increased Competition: Brands like Hoka and On have gained popularity, capturing market share from Nike. sneakerfreaker.com

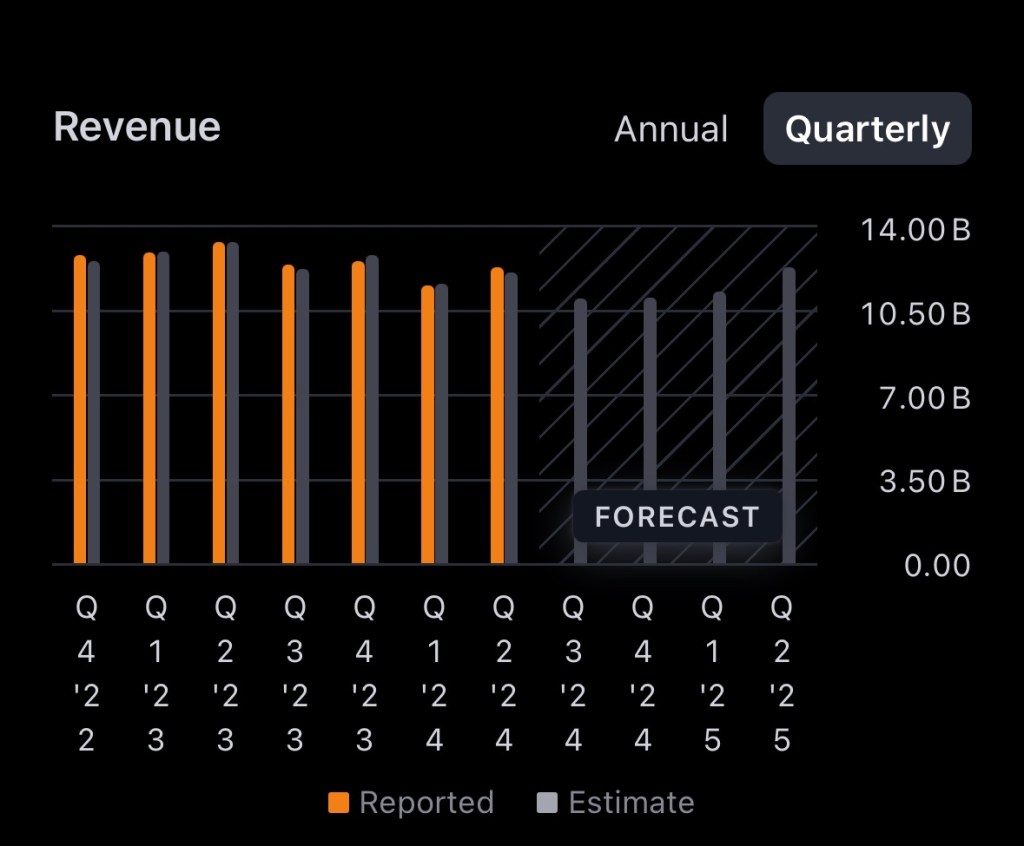

- Sales and Revenue Challenges: In its fiscal Q4 2024, Nike reported a 2% year-over-year revenue decline to $12.6 billion, missing analyst expectations. The company also projected a 10% sales decline for the current quarter, attributing it to aggressive management of classic footwear lines and challenges in digital sales. Fast Company

Strategic Initiatives for Recovery

Under the leadership of new CEO Elliott Hill, Nike is implementing a turnaround plan focusing on:

- Refocusing on Sports: Hill emphasizes a return to Nike’s roots by prioritizing athlete-centered product innovation and storytelling, targeting key categories such as running, basketball, and training. Business Insider

- Reducing Discounting: To protect brand integrity, Nike plans to limit promotional sales and focus on full-price, premium products. Business Insider

- Rebuilding Retail Partnerships: The company aims to strengthen relationships with wholesale partners, recognizing that previous strategies may have strained these collaborations. Business Insider

Investment Considerations

Despite recent challenges, several factors may make Nike an attractive investment opportunity:

- Strong Brand Equity: Nike remains a globally recognized brand with a loyal customer base.

- Strategic Leadership: The new CEO’s initiatives are designed to address current issues and position the company for long-term growth.

- Market Position: Nike’s extensive distribution network and innovative product lines provide a solid foundation for recovery.

While the turnaround strategy may impact short-term results, the focus on core strengths and strategic realignment could enhance long-term shareholder value. Investors should monitor the company’s progress and consider the potential for future growth when evaluating Nike as an investment.

Disclosure: The author of this article may hold a position in Nike, Inc. ($NKE) stock at the time of publication. This article is for informational purposes only and should not be construed as investment advice. Readers are encouraged to conduct their own research or consult with a financial advisor before making any investment decisions.

References

Barrons. (n.d.). Nike unveils its new CEO’s turnaround plan. Can it get its mojo back? Retrieved January 25, 2025, from https://www.barrons.com/articles/nike-earnings-new-ceo-turnaround-plan-0dba83f3

Business Insider. (2024). Nike’s new CEO said the company messed up 3 key areas that he’s trying to fix — and it’s bad news for customers who like cheap stuff. Retrieved January 25, 2025, from https://www.businessinsider.com/nike-new-ceo-elliott-hill-change-sport-sales-wholesalers-turnaround-2024-12

MarketWatch. (n.d.). Nike just laid out an ambitious turnaround plan. But it will come at a cost. Retrieved January 25, 2025, from https://www.marketwatch.com/story/nikes-ceo-touts-immediate-action-to-please-shareholders-shares-are-rallying-after-earnings-e22764a8

Sneaker Freaker. (n.d.). Why is Nike stock down? Revenue loss explained. Retrieved January 25, 2025, from https://www.sneakerfreaker.com/features/why-nike-stock-down-revenue-loss-explainer

Fast Company. (2025). Nike stock price drops after earnings miss and new CEO’s challenges. Retrieved January 25, 2025, from https://www.fastcompany.com/91148691/nike-stock-price-today-shares-decline-reason-2025-outlook