February 7, 2026

Conagra Brands, Inc. (NYSE: CAG), one of America’s largest packaged food companies and owner of iconic brands such as Birds Eye, Slim Jim, Healthy Choice, and Marie Callender’s, has emerged as a compelling investment candidate for income-focused investors. Despite recent operational challenges and declining share price performance, the company’s unusually high dividend yield, stable cash flows, and historically low valuation may present an attractive risk-reward profile for long-term investors willing to tolerate near-term volatility.

Current Stock Price and Market Position

As of early February 2026, Conagra Brands shares are trading at approximately $19.55 per share, near the lower end of their 52-week range of $15.96 to $28.52. The company currently carries a market capitalization of roughly $8.8–$8.9 billion and generates annual revenue of approximately $11.23 billion, underscoring its significant presence in the consumer staples sector.

However, the stock has declined more than 26% over the past year, reflecting investor concerns about declining sales volume, rising costs, and shifting consumer preferences.

While these headwinds have weighed on investor sentiment, they have also created a rare combination of depressed valuation and elevated income potential.

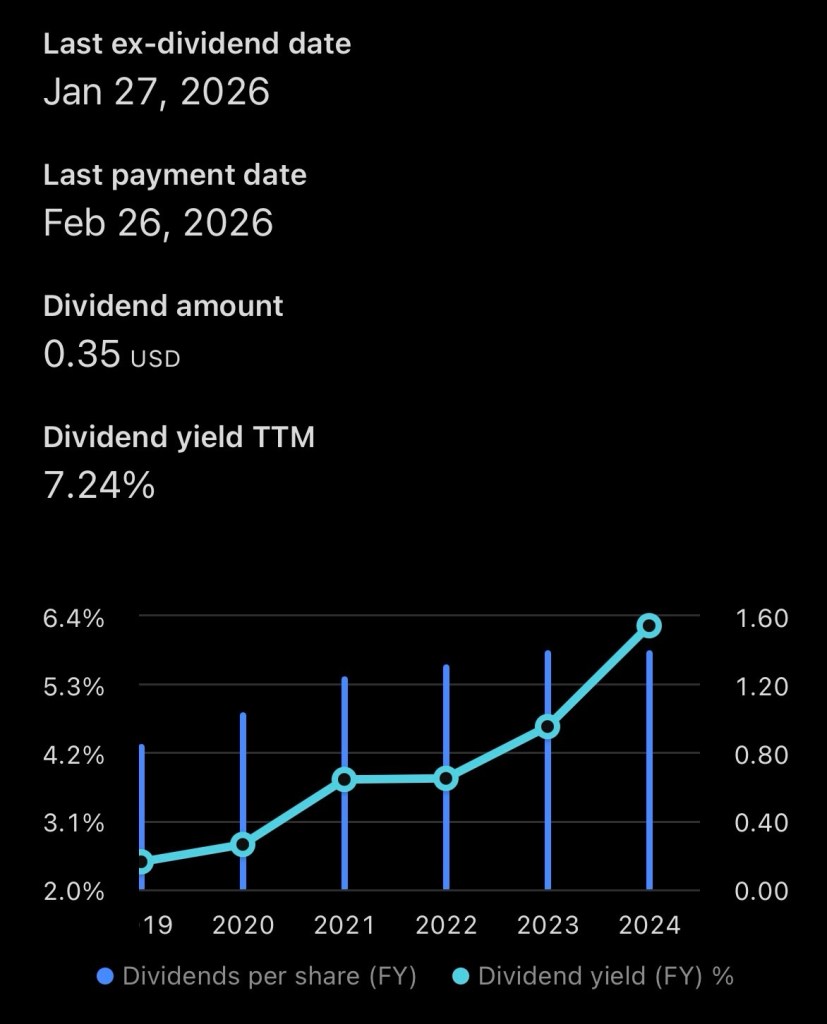

Dividend Yield: A Major Strength for Income Investors

Conagra Brands’ most compelling investment characteristic is its dividend.

- Annual dividend: $1.40 per share

- Dividend yield: Approximately 7.16% to 7.89% depending on price fluctuations

- Dividend payout frequency: Quarterly

- Dividend history: Over 160 dividend payments since 1985

This yield is significantly higher than the broader S&P 500 average, which typically ranges between 1.5% and 2.0%.

Even more importantly, Conagra generates strong free cash flow—approximately $1.14 billion annually—which supports its dividend payments and enhances their sustainability.

The company’s dividend payout ratio based on forward estimates ranges between 45% and 59% of cash flow, indicating the dividend is supported by underlying earnings power rather than excessive borrowing.

For investors seeking income, this dividend alone provides substantial annual returns regardless of stock price appreciation.

Valuation: Historically Low Price Creates Opportunity

One of the most compelling reasons investors may consider Conagra today is its relatively low valuation.

Key valuation metrics include:

- Forward price-to-earnings ratio: Approximately 10.4

- Free cash flow yield: 13.4%

- Book value per share: $18.64 (close to current share price)

These metrics suggest the stock is trading near its intrinsic asset value, with investors effectively paying a modest premium for a business that generates over $1 billion annually in free cash flow.

Historically, consumer staples companies trade at higher multiples due to their predictable cash flows and defensive characteristics. A forward P/E ratio near 10 places Conagra at a meaningful discount compared to many peers.

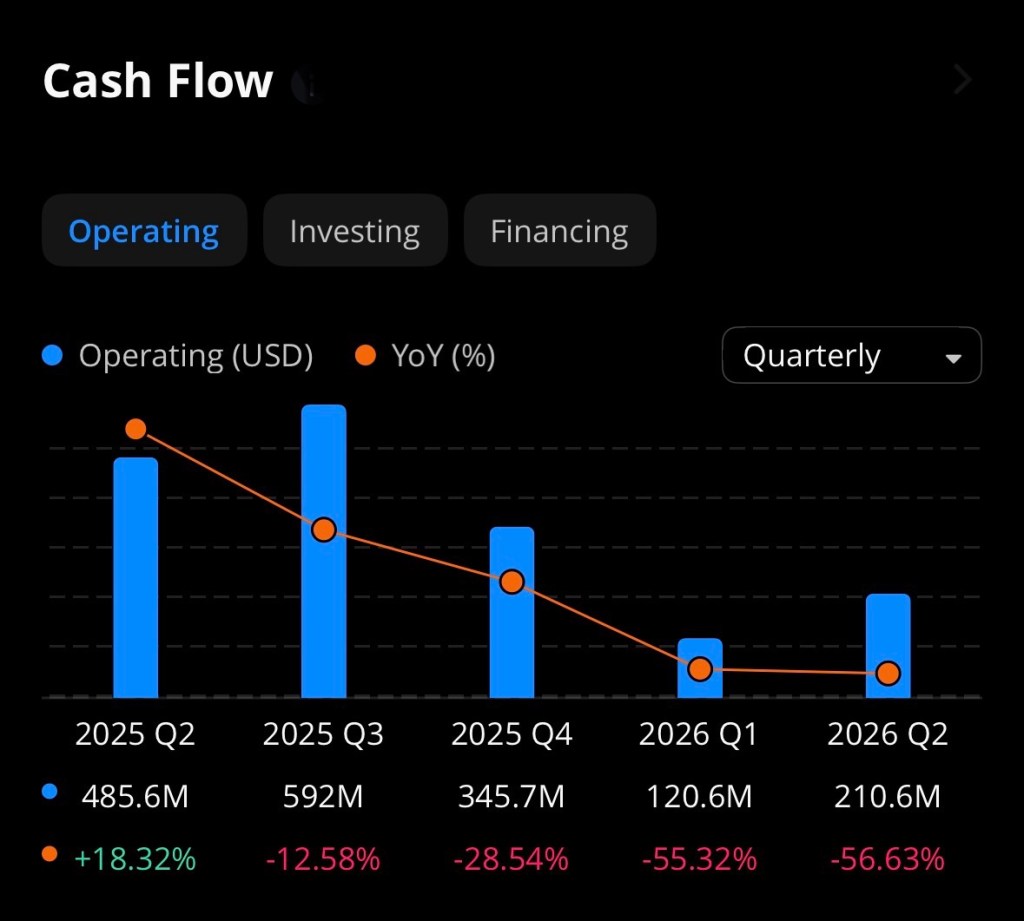

Cash Flow and Financial Strength Support Long-Term Stability

Despite near-term earnings pressures, Conagra remains fundamentally profitable and cash-generating.

Financial highlights include:

- Operating cash flow: $1.54 billion annually

- Free cash flow: $1.14 billion annually

- Gross margin: 25.5%

- Operating margin: 13.83%

These metrics demonstrate that even in a challenging economic environment, Conagra continues to generate meaningful profit margins.

Consumer staples companies like Conagra also tend to be more resilient during economic downturns, as demand for packaged food remains relatively stable regardless of broader economic conditions.

Recent Challenges Have Created Opportunity

Recent operational challenges have contributed to the stock’s decline, including:

- Volume declines due to inflation-sensitive consumers

- Rising raw material costs, particularly meat prices

- Impairment charges and slower growth expectations

However, these challenges appear cyclical rather than structural.

Importantly, Conagra has reaffirmed its long-term outlook and continues investing in efficiency improvements, pricing strategies, and portfolio optimization.

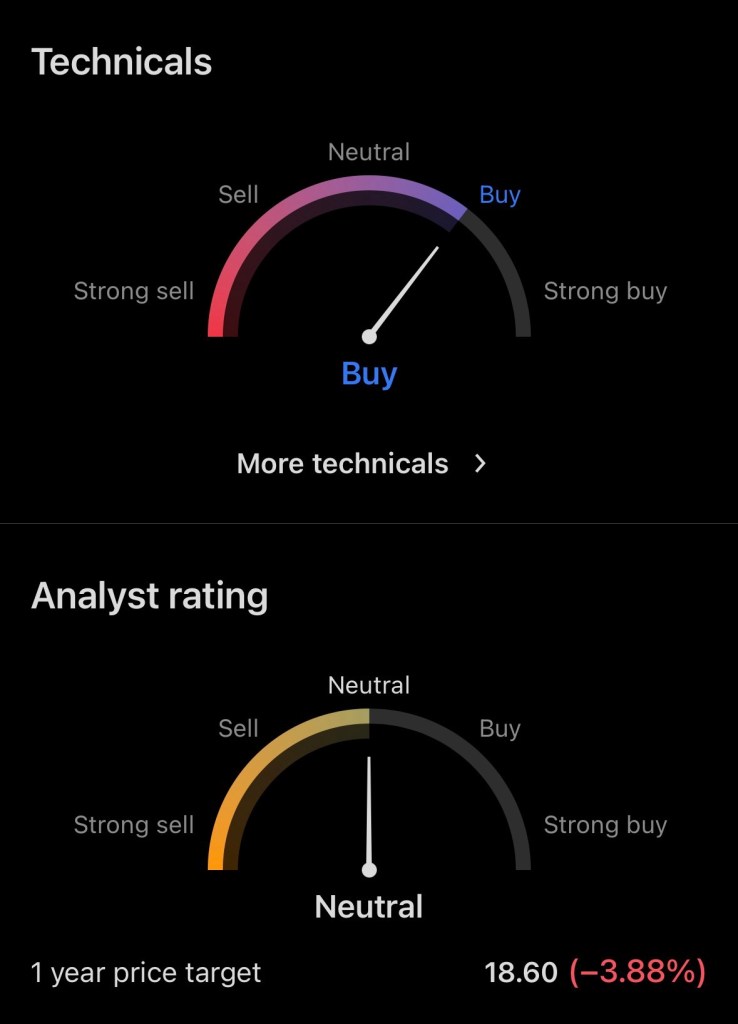

Analyst Price Target and Future Outlook

Wall Street analysts currently maintain an average price target of approximately $20.58, representing potential upside of about 16% from current levels.

Even more conservative targets suggest modest appreciation potential, while income investors collect a substantial dividend while waiting.

Reasonable 12-Month Price Projection

Based on:

- Historical valuation multiples

- Dividend yield normalization

- Improving cost pressures

- Stable consumer demand

A realistic one-year price range for Conagra Brands is:

Base Case: $20–$23

Bull Case: $24–$26

Bear Case: $17–$19

In addition to capital appreciation, investors could receive approximately 7% annual income, significantly enhancing total returns.

Total Return Potential: Combining Dividend and Price Recovery

If shares rise from $19.55 to $22.50 over the next year:

- Capital gain: ~15%

- Dividend yield: ~7%

- Total return potential: ~22%

This level of total return potential is unusually high for a defensive consumer staples company.

Why Conagra Brands May Be a Strong Investment Choice

Key investment strengths include:

1. Exceptionally High Dividend Yield

Nearly 7–8%, far above market averages.

2. Strong Cash Flow Generation

Over $1 billion annually supports dividend sustainability.

3. Low Valuation Relative to Cash Flow and Assets

Forward P/E near 10 suggests undervaluation.

4. Defensive Industry Position

Food companies benefit from consistent consumer demand.

5. Potential Price Recovery as Conditions Improve

Even modest improvement could drive meaningful upside.

Investment Risks

Despite its strengths, investors should consider potential risks:

- High debt levels (~$8.28 billion)

- Slowing revenue growth

- Inflation and commodity cost pressures

- Changing consumer dietary preferences

These risks explain the stock’s depressed valuation but also contribute to its opportunity.

Conclusion: Attractive Income Play with Recovery Potential

Conagra Brands represents a classic high-yield, undervalued income stock. While recent operational challenges have pushed shares lower, the company continues generating strong cash flow and paying a highly attractive dividend.

For income-focused investors and those seeking undervalued defensive stocks, Conagra offers:

- Strong income potential

- Possible capital appreciation

- Defensive consumer staples exposure

If operational performance stabilizes and investor sentiment improves, Conagra Brands could deliver both income and moderate capital gains over the coming year.

Disclosure

The author currently holds a position in Conagra Brands (CAG). This article is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult a financial advisor before making investment decisions.

References

StockAnalysis.com. (2026). Conagra Brands stock statistics and valuation. Retrieved from https://stockanalysis.com/stocks/cag/statistics/

StockAnalysis.com. (2026). Conagra Brands dividend information. Retrieved from https://stockanalysis.com/stocks/cag/dividend/

StockAnalysis.com. (2026). Conagra Brands stock overview. Retrieved from https://stockanalysis.com/stocks/cag/

CompaniesMarketCap.com. (2026). Conagra Brands dividend yield and market cap. Retrieved from https://companiesmarketcap.com/conagra-brands/dividend-yield/

CompaniesMarketCap.com. (2026). Conagra Brands dividend history. Retrieved from https://companiesmarketcap.com/conagra-brands/dividends/

MarketBeat.com. (2026). Conagra Brands dividend payout ratio and yield analysis. Retrieved from https://www.marketbeat.com

Reuters. (2025). Conagra maintains forecasts amid subdued demand. Retrieved from https://www.reuters.com

Barron’s. (2025). Conagra downgraded due to rising meat prices. Retrieved from https://www.barrons.com