Rising Momentum & Market Performance

- Breakouts & Price Rally: SEI recently broke above the pivotal $0.33–$0.34 resistance, delivering a nearly 40% surge in price within a week. A 10% spike over 24 hours further amplifies growing interest in the token. (The Market Periodical)

- Stable Support, Upward Targets: As of August 8, 2025, SEI is holding steady around the key $0.285 support level. Should bullish momentum continue, investors are eyeing Fibonacci resistance targets at $0.48, $0.56, and even $0.67. But a dip below $0.285 could bring a pullback risk. (Blockonomi)

On-Chain Adoption & Ecosystem Growth

- Transaction Volume & User Activity: The network is seeing explosive activity. Daily transactions have topped 1.5 million, while active wallets now exceed 616,000. (The Currency analytics)

- TVL & DeFi Expansion: Total Value Locked (TVL) has climbed dramatically-from $500M to $680M+ in recent updates, and, according to some reports, has soared to as high as $1.13B. This doubles early-2025 levels, underlining robust DeFi growth. (The Market PeriodicalCryptodamusCoinCentral)

- Institutional & Regulatory Recognition: A wave of institutional interest is tied to an ETF filing; SEI’s user base has ballooned to over 8.1 million addresses, placing it as the #2 EVM-compatible chain by user count. TVL jumped 24% to above $535M. (Cryptonews)

Technical and Sentiment Indicators

- Technical tools are flashing bullish signals: RSI and MACD suggest further upside potential, particularly if SEI maintains position above its 200-day EMA. (OneSafe)

- Analysts highlight a possible higher-low formation, reminiscent of past wave patterns, potentially marking the start of a broader “Wave C” rally. (Blockonomi)

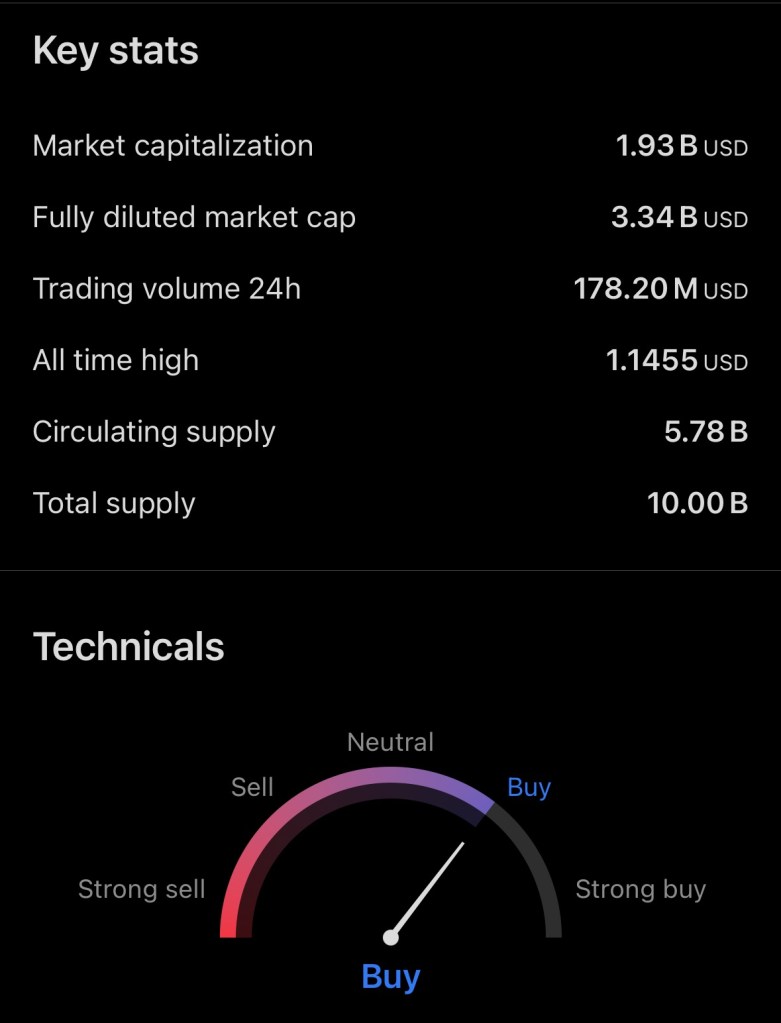

SEI’s Token Supply & Volume Overview

| Metric | Key Data (as of August 2025) |

|---|---|

| Circulating Supply | Approximately 5.78 billion SEI (CryptoMarketCapCoinStatsTokenomist) |

| Maximum / Total Supply | 10 billion SEI (CryptoMarketCapCoinStatsBinance) |

| Supply Unlocks | Linear vesting underway; upcoming unlocks scheduled around mid-August 2025 (Tokenomist) |

| 24-Hour Trading Volume | Between $143M and $160M depending on data source (CryptoMarketCapCryptoRankBlockonomi) |

Investment Summary: Short- vs. Long-Term Outlook

Short-Term:

SEI is in a critical zone-holding support at ~$0.285 could drive a breakout toward $0.48 or beyond. High trading volume and technical momentum support this scenario. However, watch for potential pullbacks if the support fails.

Long-Term:

Strong ecosystem fundamentals, increasing TVL, active users, and institutional interest (ETF-based momentum) give SEI solid traction. Continued infrastructure development and adoption could support sustained growth, especially as token unlocks are phased in without sudden floods of supply.

Risks to Note:

- Supply unlocks (e.g., mid-August) may generate selling pressure.

- Over-reliance on DeFi and gaming applications may limit ecosystem diversification. (Gate.com)

Final Take

Sei Network is gaining serious traction, backed by strong on-chain growth, technical momentum, and institutional recognition. For short-term traders, current support zones and bullish setups offer attractive opportunities, so long as key levels hold. For long-term investors, SEI’s expanding ecosystem, increasing utility, and vesting transparency suggest meaningful upside as the chain matures. Always balance optimism with awareness of unlocking events and ecosystem concentration risks.

Disclaimer: The author holds a position in $SEI Network and this article should not be considered financial advice. Always conduct your own research before making any investment decisions.

References

Blockonomi. (2025, July 28). Sei price holds $0.28 support, targets $0.48 and beyond. Blockonomi. https://blockonomi.com/sei-price-holds-0-28-support-targets-0-48-and-beyond

Blockonomi. (2025, August 3). Sei crypto signals reversal with price surge and on-chain momentum. Blockonomi. https://blockonomi.com/sei-crypto-signals-reversal-with-price-surge-and-on-chain-momentum

CoinCentral. (2025, July 21). SEI price surges 33% as DeFi ecosystem explodes to new heights. CoinCentral. https://coincentral.com/sei-sei-price-surges-33-as-defi-ecosystem-explodes-to-new-heights

CoinStats. (2025). Sei Network price and market data. CoinStats. https://coinstats.app/coins/sei-network

CryptoMarketCap. (2025). Sei Network price, supply, and market capitalization. CryptoMarketCap. https://cryptomarketcap.com/coins/sei

CryptoNews. (2025, July 19). Sei ETF filing sparks 40% rally as it becomes #2 EVM chain—$0.30 next? CryptoNews. https://cryptonews.com/news/sei-etf-filing-sparks-40-rally-as-it-becomes-2-evm-chain-0-30-next

CryptoRank. (2025). Sei Network trading volume and market data. CryptoRank. https://cryptorank.io/price/sei-network

Cryptodamus. (2025, July 25). Sei Network explodes: Downtrend broken—see key metrics and institutional DeFi surge. Cryptodamus. https://cryptodamus.io/en/articles/news/sei-network-explodes-downtrend-broken-see-key-metrics-institutional-defi-surge

Gate.com. (2025, July 29). Sei hits a 6-month high: What’s driving the ecosystem’s momentum? Gate.com. https://www.gate.com/learn/articles/sei-hits-a-6-month-high-whats-driving-the-ecosystems-momentum/10401

OneSafe.io. (2025, July 27). Sei price surge: Driving momentum in crypto payments. OneSafe.io. https://www.onesafe.io/blog/sei-price-surge-driving-momentum-crypto-payments

The Currency Analytics. (2025, July 22). Sei Network hits 1.5M transactions: Is a sharp price surge next? The Currency Analytics. https://thecurrencyanalytics.com/altcoins/sei-network-hits-1-5m-transactions-is-a-sharp-price-surge-next-181371

The Market Periodical. (2025, July 16). Sei price breaks out: What’s fueling the 10% rally? The Market Periodical. https://themarketperiodical.com/2025/07/16/sei-price-breaks-out-whats-fueling-the-10-rally

Tokenomist.ai. (2025). Sei Network token supply and unlock schedule. Tokenomist.ai. https://tokenomist.ai/sei-network