Algorand, the blockchain platform founded by Turing Award-winning cryptographer Silvio Micali, continues to soar in the cryptocurrency realm. The recent trifecta of partnerships with tech giants Microsoft, LimeWire, and Napster has sparked a new wave of enthusiasm, propelling both the platform and its native coin, $ALGO, to unprecedented heights.

Algorand’s Innovative Technology:

At the heart of Algorand’s success is its revolutionary consensus mechanism, which seamlessly integrates Proof of Stake (PoS) with Byzantine Agreement (BA*), ensuring unparalleled scalability, security, and decentralization. This technological innovation has positioned Algorand as a frontrunner in the quest for scalable blockchain solutions.

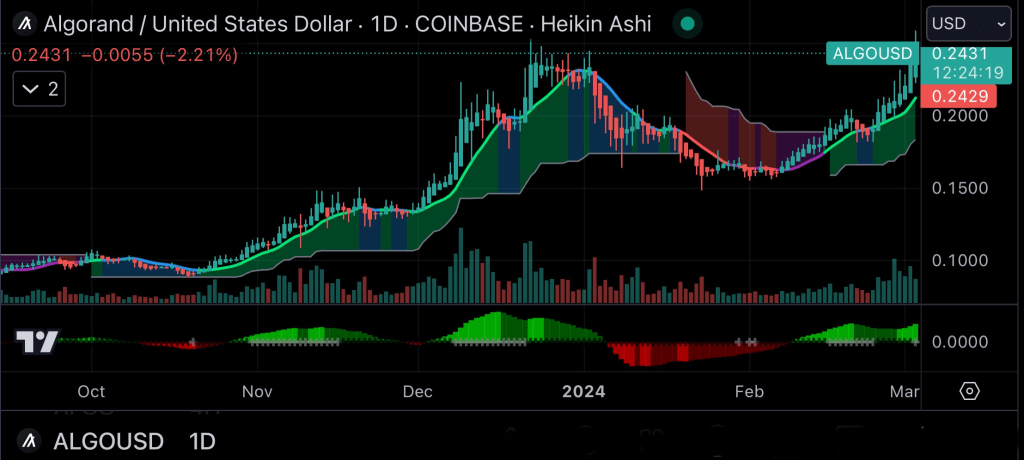

ALGO Coin’s Remarkable Surge:

The native cryptocurrency of the Algorand network, ALGO, has experienced a remarkable surge in value and adoption, fueled by the platform’s technological prowess and strategic partnerships. Currently trading at $0.2431 against the US dollar, ALGO has witnessed an impressive 47% increase in the past month alone.

This surge reflects growing confidence in Algorand’s technology and its potential to disrupt various industries beyond traditional finance, including supply chain management, healthcare, and decentralized finance (DeFi).

Partnerships with Tech Titans:

Algorand’s recent collaborations with Microsoft, LimeWire, and Napster represent significant milestones in its journey towards mainstream adoption and recognition.

- Microsoft Partnership: Algorand’s integration with Microsoft’s Azure cloud platform provides developers with seamless access to Algorand’s powerful tools and resources. This partnership unlocks new possibilities for building scalable and secure decentralized applications (dApps) across various industries.

- LimeWire Collaboration: By partnering with LimeWire, a peer-to-peer file-sharing platform, Algorand aims to explore innovative solutions in digital content distribution and intellectual property rights management. This collaboration opens up new avenues for leveraging blockchain technology in the entertainment industry.

- Napster Alliance: Algorand’s partnership with Napster, a pioneering music streaming service, signals a foray into the realm of decentralized media distribution and royalty payments. Together, Algorand and Napster aim to revolutionize the music industry by introducing transparency and efficiency through blockchain technology.

Community Engagement and Future Prospects:

In addition to its strategic partnerships, Algorand’s vibrant community of developers and enthusiasts continues to drive its growth and evolution. Through initiatives like the Algorand Foundation Grants Program, developers receive support and funding to innovate and build on the platform, fostering a culture of collaboration and creativity.

As Algorand continues to innovate and expand its ecosystem through strategic partnerships and community engagement, the future looks brighter than ever for both the platform and its native cryptocurrency, ALGO.

- Algorand Official Website. (https://www.algorand.com/)

- CoinMarketCap. (https://coinmarketcap.com/)

- Algorand Foundation. (https://algorand.foundation/)

- Microsoft Azure. (https://azure.microsoft.com/)

- LimeWire Official Website. (https://www.limewire.com/)

- Napster Official Website. (https://www.napster.com/)

- Algorand Twitter Account. (https://twitter.com/Algorand)

- Algorand Medium Blog. (https://medium.com/algorand)