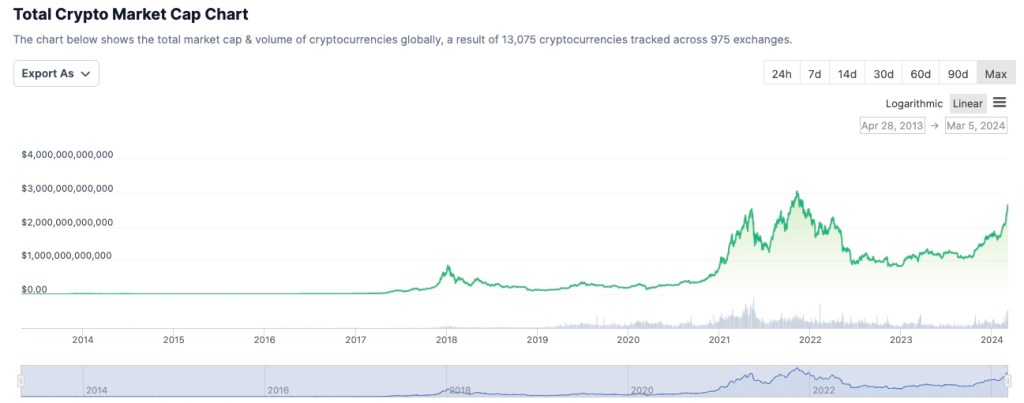

The world of cryptocurrency has captured the attention of investors across the globe, with Bitcoin leading the charge as the pioneer of the digital currency era. Alongside Bitcoin, a multitude of alternative cryptocurrencies, known as altcoins, have emerged, offering unique features and investment opportunities. If you’re considering venturing into this dynamic market, understanding its fundamentals is crucial.

Bitcoin: The Foundation of Cryptocurrency

Bitcoin, created in 2009 by the pseudonymous Satoshi Nakamoto, is the first decentralized digital currency. It operates on blockchain technology, ensuring transparency and security through a distributed ledger system. Bitcoin’s scarcity—it’s capped at 21 million coins—has contributed to its reputation as “digital gold.”

Bitcoin is often viewed as a store of value and a hedge against inflation, with increasing adoption by major corporations and institutional investors. However, its price volatility remains a significant factor, requiring careful consideration before investing.

What Are Altcoins?

Altcoins refer to all cryptocurrencies other than Bitcoin. The term encompasses thousands of digital currencies with diverse purposes, from Ethereum, which facilitates decentralized applications (dApps) and smart contracts, to niche coins like Dogecoin and Cardano.

Each altcoin is designed with a specific use case. For instance:

- Ethereum (ETH): Known for enabling smart contracts and decentralized finance (DeFi).

- Ripple (XRP): Focused on cross-border payments and financial institution adoption.

- Cardano (ADA): Promotes sustainability and scalability in blockchain technology.

While altcoins can offer high returns, they often come with higher risks due to lower liquidity, lesser adoption, and a lack of widespread trust compared to Bitcoin.

Key Considerations for Investing

1) Volatility: Cryptocurrency markets are highly volatile, with prices swinging dramatically in short periods. Bitcoin and altcoins alike are subject to these fluctuations.

2) Research: Before investing in any altcoin, understand its purpose, development team, market trends, and community support. Avoid making decisions based on hype alone.

3) Security: Store your assets in secure wallets. Hardware wallets are preferred for long-term holdings, while software wallets are suitable for frequent transactions.

4) Regulatory Environment: Cryptocurrency regulations vary by country and can impact market prices. Stay informed about government policies and potential restrictions.

5) Diversification: Avoid putting all your funds into a single cryptocurrency. Diversifying between Bitcoin and selected altcoins can mitigate risks.

Risks to Watch

The cryptocurrency market is not without risks:

- Scams: Rug pulls and fraudulent projects are common among altcoins.

- Market Manipulation: Low-liquidity altcoins are susceptible to price manipulation by “whales.”

- Technological Failures: Bugs, hacks, or failed upgrades can render cryptocurrencies worthless.

The Future of Cryptocurrency

Bitcoin remains the anchor of the cryptocurrency market, but altcoins are driving innovation in blockchain technology. Decentralized finance (DeFi), non-fungible tokens (NFTs), and Web3 applications are shaping the next phase of the digital economy, with altcoins playing a vital role.

For those prepared to navigate its complexities, cryptocurrency offers an exciting frontier. However, thorough research, a strong risk appetite, and a long-term perspective are essential for success in this evolving space.

Disclaimer: Cryptocurrency investments are speculative and involve substantial risk. Consult with a financial advisor before making investment decisions.