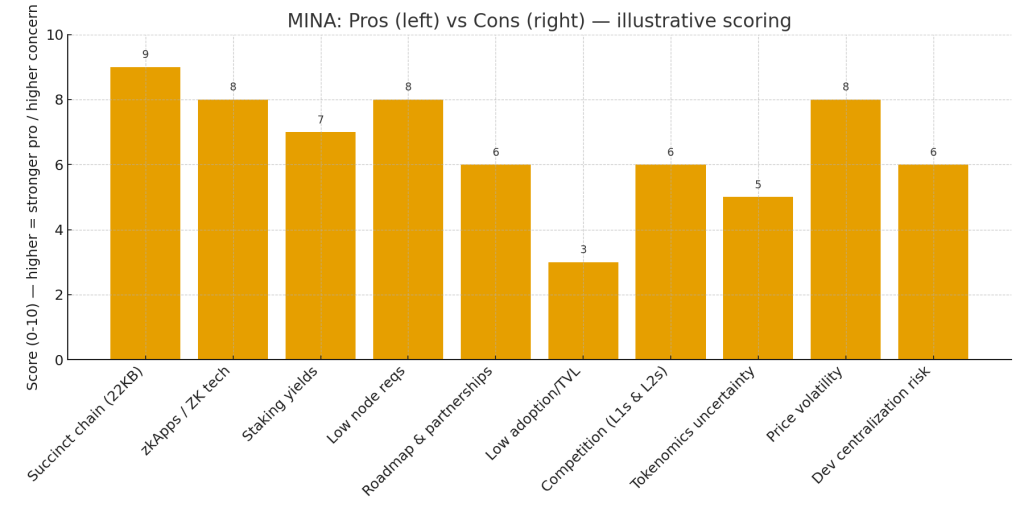

Mina Protocol markets itself as the “lightest blockchain” — a layer-1 that stays tiny by using recursive zero-knowledge proofs (zk-SNARKs) so the entire chain remains a succinct ~22KB snapshot instead of a growing ledger. That design promises a blockchain any device can verify, lowering node requirements and enabling on-device privacy-aware dApps (zkApps). Those technical foundations are Mina’s headline differentiator and the core reason some investors treat MINA as a long-term hold. (Mina Protocol+1)

Where MINA stands right now

As of early November 2025, MINA trades in the low-to-mid $0.17–$0.19 range with a market cap in the low hundreds of millions of dollars and roughly 1.26 billion MINA circulating. Price and ranking vary by source and exchange, but major market trackers show MINA as a mid-to-low market-cap altcoin. (CoinMarketCap+1)

Why investors like MINA — the bullish case

- Truly lightweight chain: Mina’s constant-sized blockchain (~22KB) lowers the hardware and bandwidth needed to run a full node, which could help decentralize participation and boost mobile/edge use cases. This is fundamental to Mina’s pitch as a “blockchain for everyone.” (Nansen Research+1)

- Zero-knowledge programmability (zkApps): Mina’s zkApp framework enables privacy-preserving smart contracts and verifiable off-chain computation. If ZK tech becomes central to mainstream Web3 privacy and scaling, Mina could capture unique developer interest. (Mina Protocol)

- Staking yields / network rewards: MINA supports staking and many exchanges and platforms offer competitive staking APRs (examples reporting 6–12% or higher on various platforms), which attracts yield-seeking holders who prefer passive income while they wait for price appreciation. (Kraken+1)

- Active roadmap and ecosystem work: Core development groups and community initiatives continue evolving Mina (roadmaps and upgrades in 2024–25 aim at tooling, zk developer onboarding, and greater interoperability). Continued protocol development can improve utility and adoption. (Mina Protocol+1)

- Relatively small market cap = upside if narrative wins: Compared with top L1s, Mina’s market cap is modest, so positive adoption or a crypto risk-on rotation could produce outsized percentage gains (classic “small-cap upside” dynamic).

Risks and why caution is warranted

- Adoption & TVL remain low vs major L1s: For MINA to move materially higher, it needs more apps, users, and locked value. Today it’s still a niche stack versus giants like Ethereum, Solana, or new ZK-focused rivals. Low TVL limits organic utility demand for the token. (CoinGecko+1)

- Strong competition: Other projects are pursuing ZK tech, rollups, and lightweight verification. If larger ecosystems integrate similar ZK capabilities (or if Ethereum rollups dominate the ZK narrative), Mina’s unique edge could shrink. (o1Labs)

- Tokenomics & supply dynamics: A large circulating supply (~1.26B MINA) and ongoing issuance/staking rewards can dilute price upside unless demand grows to absorb supply. Coin trackers list circulating supply but no fixed “max” supply, so inflation mechanics matter to holders. (CoinMarketCap)

- Price volatility & market risk: As a mid/low-cap crypto, MINA is susceptible to broad market moves, liquidity shocks, and volatility — factors that can erase gains quickly. Historical price charts show sharp swings that should caution risk-sensitive investors. (Yahoo Finance)

- Technology / centralization risk: While Mina’s research teams (o1 Labs, Mina Foundation, community contributors) are active, concentrated development or coordination risks exist — and any delays or setbacks to roadmap items could temper market enthusiasm. (o1Labs)

Potential upside in an “altcoin season”

Altcoin seasons reward narratives — smaller caps with clear, differentiated value propositions often run hardest. Mina’s narrative (real ZK programmability + tiny chain size) fits a neat theme: privacy, edge verification, and on-device dApps. If the ZK narrative accelerates — through developer tool improvements, interoperability wins (projects like Aligned working on ZK verification integrations), or a wave of zkApps adoption — MINA could outpace larger, less nimble chains. Several mid-2024–25 developments and roadmap items indicate the team remains focused on ZK tooling and ecosystem funding, which would be the necessary fuel for such a move. (o1Labs+1)

How an investor might position (not financial advice)

- Long-term speculative hold: If you believe ZK tech and ultra-light clients matter, a small allocation to MINA (size depending on risk tolerance) could be reasonable — especially if you stake to capture yield while waiting for adoption. (Kraken)

- Event-driven trade: Watch roadmap milestones, zkApp launches, partnerships (e.g., Aligned/Ecosystem announcements), and listings/staking product rollouts. Positive, repeated dev activity and growing on-chain usage are bullish triggers. (Mina Protocol+1)

- Risk management: Given volatility and competition, position sizing, stop levels, and a clear thesis (what adoption metric would make you add more vs cut losses) are essential.

End Result

Mina’s technology is interesting and differentiated: a truly succinct chain with ZK programmability that theoretically lowers barriers to running full nodes and enables privacy-preserving dApps. That technical moat gives MINA a plausible role in a future Web3 where ZK proofs are central. However, adoption, TVL, competition, tokenomics, and market volatility remain the main hurdles. For investors, MINA looks like a classic higher-risk, higher-optional-upside altcoin: attractive to those who believe in ZK-native dApps and willing to stomach swings; less attractive to conservative crypto investors who prefer larger, more established L1 ecosystems. (Mina Protocol+2CoinMarketCap+2)

Disclaimer

I currently hold a position in MINA. The views and opinions expressed in this article are my own and are provided for informational purposes only. This content should not be construed as financial, investment, or trading advice. Always conduct your own research or consult with a licensed financial advisor before making investment decisions.

References

CoinMarketCap. (2025, November 8). Mina (MINA) price, charts, and market cap. Retrieved from https://coinmarketcap.com/currencies/mina-protocol/

Mina Foundation. (2025). Mina Protocol documentation and roadmap. Retrieved from https://docs.minaprotocol.com/

o(1) Labs. (2024). Mina Protocol: The world’s lightest blockchain powered by zero knowledge. Retrieved from https://o1labs.org/

Messari. (2024, December). Mina Protocol research profile. Retrieved from https://messari.io/asset/mina

CoinGecko. (2025, November 8). Mina (MINA) price and market data. Retrieved from https://www.coingecko.com/en/coins/mina-protocol

Binance Research. (2024). Understanding Mina Protocol: Lightweight blockchain and zkApps. Retrieved from https://research.binance.com/en/projects/mina

Aligned Layer. (2025). Mina zkApp integrations and ecosystem collaborations. Retrieved from https://www.alignedlayer.com/blog/mina-zkapps-integration

Decrypt. (2024, July 14). What is Mina Protocol and how does it use zero-knowledge proofs? Retrieved from https://decrypt.co/resources/what-is-mina-protocol

Staking Rewards. (2025). Mina staking overview and yields. Retrieved from https://stakingrewards.com/crypto-assets/mina/