Many people believe you need a large sum of money to start investing, but the truth is you can begin building wealth with as little as $1,000. The key lies in choosing the right strategy that fits your goals, risk tolerance, and timeline.

1. Index Funds

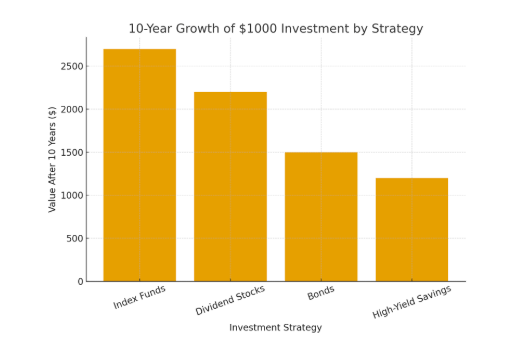

Index funds are one of the simplest and most effective ways to invest. By tracking the performance of a broad market index (like the S&P 500), they offer diversification and steady long-term growth. Historically, index funds have returned around 7–10% annually. With $1,000 invested, the potential compound growth over 10 years could more than double your money.

2. Dividend Stocks

Dividend-paying stocks provide the dual benefit of potential stock price appreciation and regular income through dividend payouts. This strategy appeals to investors who want to generate passive income while also building long-term value. Though returns may vary, reinvesting dividends can accelerate portfolio growth.

3. Bonds

For those seeking stability, bonds remain a trusted option. While the returns are lower compared to stocks, they provide predictable income and are less volatile. A $1,000 bond investment won’t skyrocket in value, but it can help protect capital while earning modest interest.

4. High-Yield Savings Accounts

Technically not an investment in the traditional sense, high-yield savings accounts are a safe place to grow your money while maintaining liquidity. While returns are the smallest of the group, they offer security and immediate access to funds, which is ideal for short-term goals.

Bottom Line

Starting with $1,000 may not make you rich overnight, but it sets the foundation for long-term financial growth. By choosing a strategy that aligns with your needs—whether it’s the steady growth of index funds, the income from dividends, the safety of bonds, or the liquidity of savings—you can begin your journey to building wealth today.