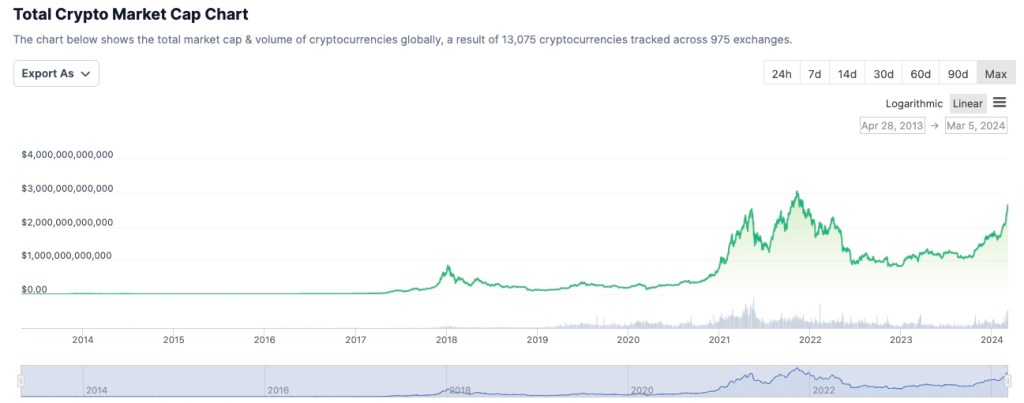

As the cryptocurrency market continues to regain strength after a period of volatility, enthusiasts and investors are turning their attention towards alternative cryptocurrencies, fueling anticipation of an upcoming alt season.

Market Resurgence: Following a period of consolidation and uncertainty, the broader cryptocurrency market has shown signs of revival in recent weeks. Bitcoin, the leading digital asset, has demonstrated resilience, breaking through key resistance levels hitting an all time high and stabilizing above the $60,000 mark. This resurgence in Bitcoin’s price has reignited optimism across the crypto space, with many traders and investors now eyeing alternative coins for potentially higher returns.

Alt Season Anticipation: The term “alt season” refers to a period in the cryptocurrency market cycle where alternative cryptocurrencies, or “altcoins,” experience significant price appreciation relative to Bitcoin. Historically, alt seasons have occurred during bull markets, characterized by increased investor interest and capital inflows into the broader crypto ecosystem.

https://www.coingecko.com/en/global-charts

Rising Interest in Altcoins: With Bitcoin’s dominance gradually declining, from nearly 70% in early 2023, there has been a notable shift in focus towards alternative cryptocurrencies. Projects offering innovative solutions, such as decentralized finance (DeFi), non-fungible tokens (NFTs), and blockchain interoperability, have garnered substantial attention from both retail and institutional investors.

Key Factors Driving Alt Season Speculation:

- Market Sentiment: Improved market sentiment, driven by positive regulatory developments and growing institutional adoption, has contributed to the anticipation of an alt season.

- Technological Innovation: The proliferation of innovative blockchain projects, addressing real-world use cases and challenges, has sparked interest in alternative cryptocurrencies.

- Investor Appetite for Risk: As investors seek higher returns in a low-yield environment, many are willing to explore alternative cryptocurrencies with the potential for significant price appreciation.

Industry Perspectives: Industry experts and analysts remain cautiously optimistic about the prospects of an alt season. While acknowledging the potential for altcoins to outperform Bitcoin in the coming months, they advise investors to conduct thorough research and exercise caution due to the inherent volatility of the crypto market.

As the cryptocurrency market enters a new phase of growth and maturity, the anticipation of an alt season is palpable among traders and investors. While the timing and extent of such a rally remain uncertain, the underlying fundamentals and market dynamics suggest that alternative cryptocurrencies may play a pivotal role in shaping the future of digital finance.

Disclaimer: Cryptocurrency investments carry inherent risks, and market speculation should be approached with caution. Investors are advised to conduct their own research and seek professional advice before making any investment decisions.